4562 Form 2006

What is the 4562 Form

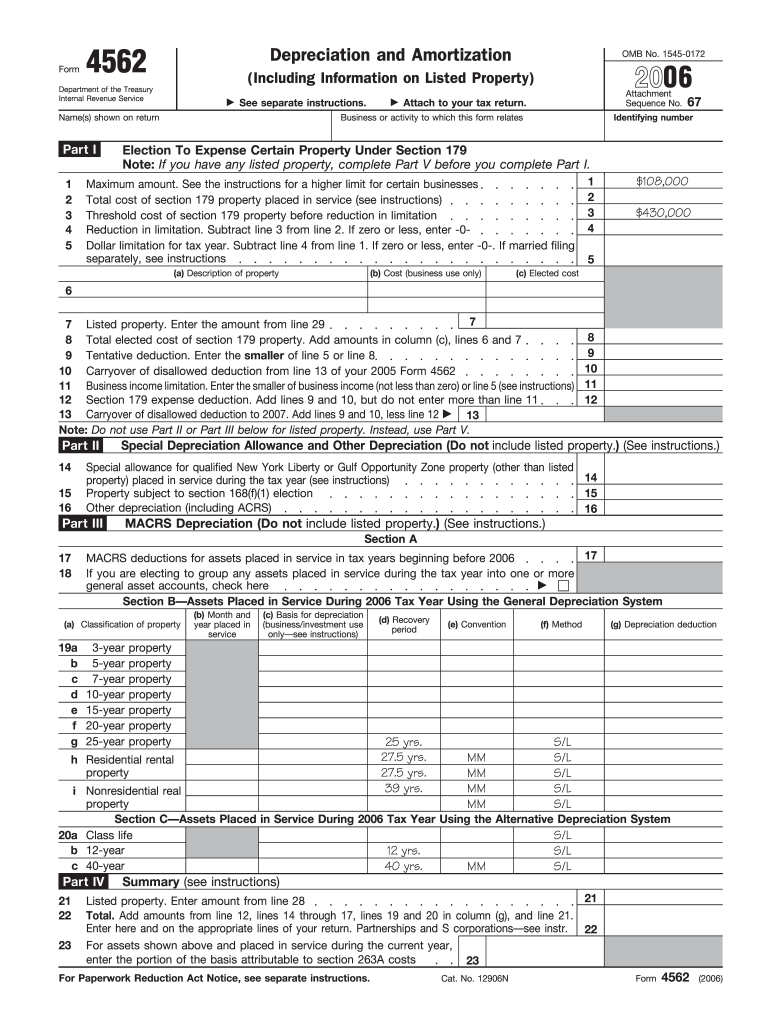

The 4562 Form, officially known as the Depreciation and Amortization form, is used by businesses and individuals to report depreciation and amortization deductions for tax purposes. This form allows taxpayers to claim deductions for the wear and tear of property, equipment, and other assets over time. It is essential for accurately calculating taxable income and ensuring compliance with IRS regulations.

How to use the 4562 Form

Using the 4562 Form involves several steps to ensure accurate reporting of depreciation and amortization. Taxpayers must first gather all relevant information regarding the assets they wish to depreciate. This includes the purchase date, cost, and the method of depreciation chosen. Once the necessary data is compiled, the form can be filled out, detailing each asset and its corresponding depreciation expense. It is crucial to follow IRS guidelines to avoid errors that could lead to penalties.

Steps to complete the 4562 Form

Completing the 4562 Form requires careful attention to detail. Here are the steps involved:

- Gather all necessary documentation related to the assets.

- Determine the depreciation method to be used, such as straight-line or declining balance.

- Fill out Part I for listed property, if applicable, and Part II for depreciation and amortization.

- Calculate the total depreciation for each asset and enter the amounts in the designated sections.

- Review the form for accuracy before submission.

Legal use of the 4562 Form

The legal use of the 4562 Form is governed by IRS regulations. Taxpayers must ensure that they comply with the rules regarding depreciation and amortization deductions. This includes maintaining accurate records of asset purchases and ensuring that the chosen depreciation methods align with IRS guidelines. Failure to comply with these regulations can result in penalties or disallowance of deductions.

Filing Deadlines / Important Dates

Filing deadlines for the 4562 Form are typically aligned with the overall tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following tax year. However, if an extension is filed, the deadline may be extended to October 15. It is important to be aware of these dates to avoid late penalties and ensure timely processing of tax returns.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 4562 Form. These guidelines cover various aspects, including eligible assets, depreciation methods, and record-keeping requirements. Taxpayers should refer to the IRS instructions for Form 4562 to ensure compliance and to understand the implications of their depreciation choices. Adhering to these guidelines is crucial for accurate tax reporting.

Quick guide on how to complete 2006 4562 form

Prepare 4562 Form effortlessly on any device

Digital document management has gained traction with businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage 4562 Form on any device using airSlate SignNow's Android or iOS applications and upgrade any document-related process today.

The easiest way to modify and eSign 4562 Form effortlessly

- Locate 4562 Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign 4562 Form and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2006 4562 form

Create this form in 5 minutes!

How to create an eSignature for the 2006 4562 form

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the 4562 Form and why do I need it?

The 4562 Form, also known as the Depreciation and Amortization form, is essential for businesses to report depreciation on assets. By using airSlate SignNow, you can easily eSign and send the 4562 Form, ensuring you stay compliant with tax regulations while streamlining your documentation process.

-

How does airSlate SignNow simplify the process of completing the 4562 Form?

airSlate SignNow simplifies the completion of the 4562 Form by providing an intuitive interface that allows users to fill, sign, and send documents electronically. With our platform, you can quickly gather necessary signatures and share the 4562 Form with stakeholders, enhancing efficiency and reducing turnaround time.

-

Is there a cost associated with using airSlate SignNow for the 4562 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solutions provide access to features that streamline the signing and management of documents like the 4562 Form, ensuring you get great value for your investment.

-

Can I integrate airSlate SignNow with other software to manage the 4562 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM and accounting tools, to enhance your workflow. This means you can manage the 4562 Form alongside your other essential business documents, keeping everything organized and accessible.

-

What features does airSlate SignNow offer for managing the 4562 Form?

airSlate SignNow offers a range of features specifically designed to manage documents like the 4562 Form, including customizable templates, automated workflows, and secure cloud storage. These features help you streamline the signing process and ensure your documents are securely stored and easily retrievable.

-

How secure is my data when using airSlate SignNow for the 4562 Form?

Data security is a top priority at airSlate SignNow. When handling the 4562 Form or any document, your information is protected with advanced encryption and compliance with industry standards, ensuring that your sensitive data remains confidential and secure.

-

Can I access the 4562 Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access the 4562 Form anytime, anywhere. This mobile accessibility ensures you can manage your documents on the go, making it convenient to eSign and send the 4562 Form without being tied to a desktop.

Get more for 4562 Form

- University of california agriculture ampampamp natural resources form

- Permanent 4 h horse identification form

- Student agreement and medical walnut ca 91789 1399 form

- Phone 706 446 1430 form

- Application verificationtroy university form

- Ordering an official transcript andor diploma in person form

- International travel policydocx form

- Njxxxxxxxxxxx form fill out and sign printable pdf

Find out other 4562 Form

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement