Form 4562 Depreciation and Amortization Including Information on Listed Property 2022

What is the Form 4562 Depreciation and Amortization Including Information on Listed Property

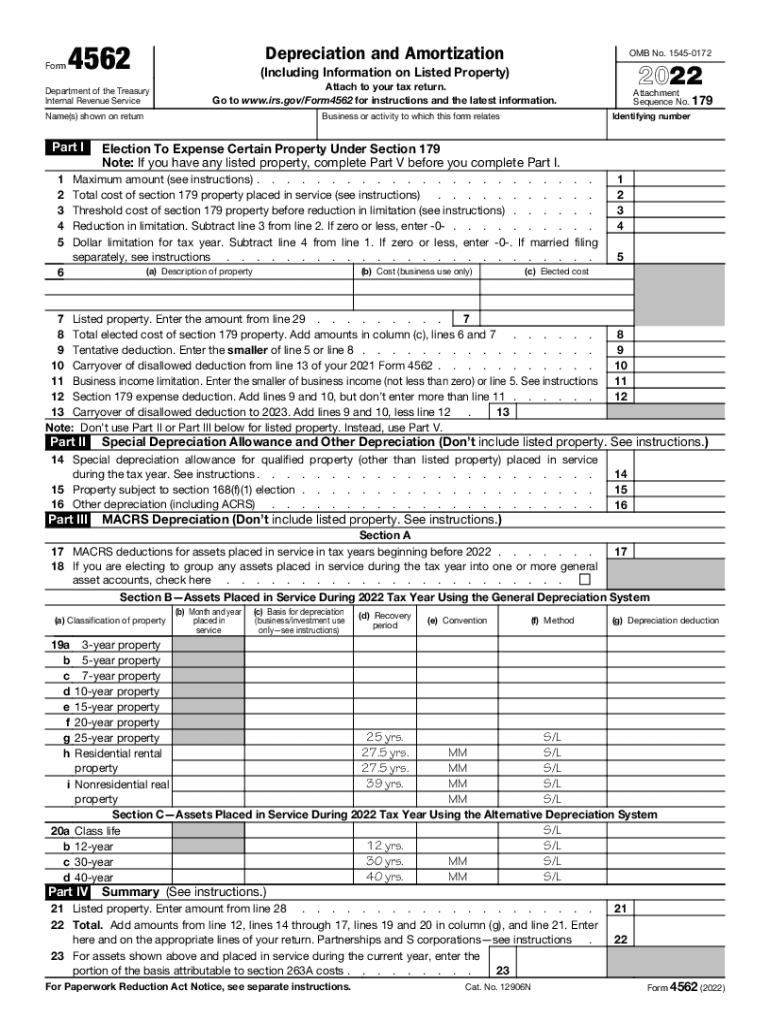

The Form 4562 is a tax document used by businesses and individuals to report depreciation and amortization of property. This form is particularly important for those who own listed property, which includes assets like vehicles and certain types of equipment that may have personal use. The form allows taxpayers to claim deductions for the depreciation of their assets, thereby reducing their taxable income. Understanding the nuances of this form is essential for accurate tax reporting and compliance with IRS regulations.

How to Use the Form 4562 Depreciation and Amortization Including Information on Listed Property

Using Form 4562 involves several steps. First, gather all necessary information regarding your assets, including their purchase dates, costs, and any prior depreciation claimed. Next, determine the method of depreciation you will use, such as straight-line or declining balance. Fill out the form by entering the relevant details in the appropriate sections, ensuring that you accurately report any listed property. After completing the form, it should be submitted with your tax return to the IRS, ensuring that you keep a copy for your records.

Steps to Complete the Form 4562 Depreciation and Amortization Including Information on Listed Property

Completing Form 4562 requires careful attention to detail. Follow these steps:

- Begin with Part I, where you list the property placed in service during the tax year.

- In Part II, calculate the depreciation deduction for the current year using the appropriate method.

- Complete Part III if you are claiming a section 179 deduction, which allows for immediate expensing of certain assets.

- In Part IV, provide information on listed property, detailing any personal use that may affect your deduction.

- Finally, review the form for accuracy and submit it with your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing Form 4562. It is crucial to adhere to these rules to ensure compliance and avoid penalties. The IRS outlines the types of property that can be depreciated, the methods available for depreciation, and the requirements for claiming listed property. Familiarizing yourself with these guidelines can help you navigate the form more effectively and maximize your deductions.

Filing Deadlines / Important Dates

Filing deadlines for Form 4562 align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15, while businesses may have different deadlines based on their structure. If you need to file for an extension, be aware that Form 4562 must still be submitted with your extended return. Keeping track of these dates is essential to avoid late fees and ensure that your deductions are processed in a timely manner.

Penalties for Non-Compliance

Failure to comply with the requirements associated with Form 4562 can result in significant penalties. The IRS may impose fines for incorrect reporting of depreciation, which can lead to increased tax liability. Additionally, if you fail to file the form altogether, you may lose the opportunity to claim valuable deductions. It is important to understand these risks and ensure that your form is completed accurately and submitted on time.

Quick guide on how to complete 2022 form 4562 depreciation and amortization including information on listed property

Prepare Form 4562 Depreciation And Amortization Including Information On Listed Property effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the required form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly and without delays. Handle Form 4562 Depreciation And Amortization Including Information On Listed Property on any platform with airSlate SignNow Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Form 4562 Depreciation And Amortization Including Information On Listed Property with ease

- Locate Form 4562 Depreciation And Amortization Including Information On Listed Property and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize related sections of your documents or obscure sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 4562 Depreciation And Amortization Including Information On Listed Property and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 4562 depreciation and amortization including information on listed property

Create this form in 5 minutes!

People also ask

-

What is the importance of 2016 depreciation in accounting?

2016 depreciation is crucial for accurately calculating asset values and tax obligations. By understanding 2016 depreciation methods, businesses can ensure compliance with financial regulations and make informed decisions regarding their asset management.

-

How does airSlate SignNow help with managing 2016 depreciation documents?

airSlate SignNow simplifies the management of 2016 depreciation documents by allowing users to easily send, eSign, and store important files securely. This streamlines the documentation process, making it more efficient for accountants and financial professionals handling depreciation calculations.

-

What features of airSlate SignNow are beneficial for tracking 2016 depreciation?

Key features like document templates, reminders, and secure storage in airSlate SignNow assist in tracking 2016 depreciation effectively. These tools enable businesses to quickly access and manage their financial documents, ensuring compliance and accuracy in reporting.

-

Is there a cost-effective pricing plan for businesses managing 2016 depreciation?

Yes, airSlate SignNow offers cost-effective pricing plans designed for businesses of all sizes managing 2016 depreciation. These plans can help organizations save on overhead costs while still providing essential features for document management and eSigning.

-

Can airSlate SignNow integrate with other accounting software for 2016 depreciation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to manage 2016 depreciation data. This integration helps in synchronization of financial records, ensuring accurate tracking and reporting.

-

How does eSigning documents relate to 2016 depreciation?

eSigning documents related to 2016 depreciation ensures that all parties can confirm their agreements in a secure and timely manner. This electronic signature process fast-tracks approvals, making the depreciation management process more efficient.

-

What are the benefits of using airSlate SignNow for 2016 depreciation?

Using airSlate SignNow for 2016 depreciation provides several benefits, including improved accuracy, enhanced compliance, and time savings. The platform's intuitive interface allows users to manage financial documents easily and respond quickly to audits or required changes.

Get more for Form 4562 Depreciation And Amortization Including Information On Listed Property

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant new mexico form

- Transfer death deed 497319876 form

- Warranty deed one individual to three individuals new mexico form

- New mexico workers 497319878 form

- New mexico trust 497319879 form

- New mexico deed 497319880 form

- Quitclaim deed individual to a trust new mexico form

- New mexico mineral deed form

Find out other Form 4562 Depreciation And Amortization Including Information On Listed Property

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast