Form 4562 2015

What is the Form 4562

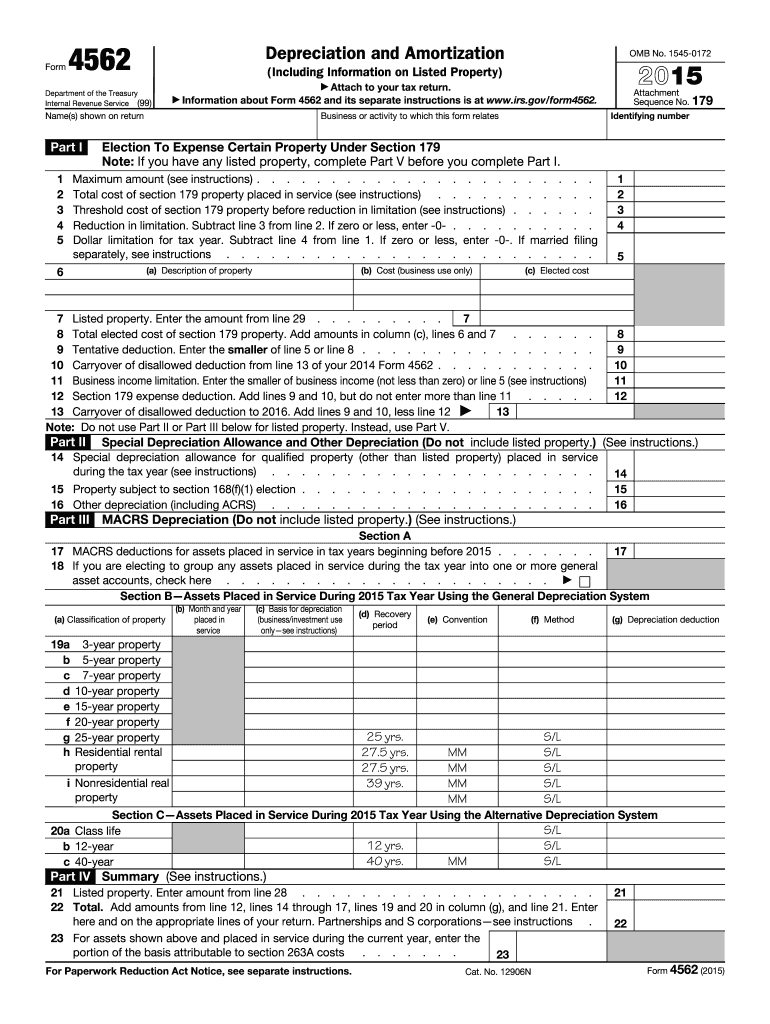

The Form 4562, officially known as the "Depreciation and Amortization" form, is used by taxpayers in the United States to report depreciation on property and to claim deductions for certain types of property. This form is essential for businesses and individuals who own assets that depreciate over time, such as vehicles, buildings, and machinery. It helps taxpayers calculate the amount of depreciation they can deduct from their taxable income, thereby reducing their overall tax liability. Understanding the purpose of this form is crucial for accurate tax reporting and compliance.

How to obtain the Form 4562

To obtain the Form 4562, taxpayers can visit the official IRS website, where they can download the form in PDF format. The form is also available at various tax preparation offices and libraries. It is important to ensure that you are using the most current version of the form, as tax laws and requirements can change annually. Additionally, some tax software programs include the Form 4562, making it easier for users to complete their tax returns electronically.

Steps to complete the Form 4562

Completing the Form 4562 involves several key steps:

- Gather necessary information about the property, including purchase date, cost, and method of depreciation.

- Fill out Part I to report the current year's depreciation for assets placed in service during the tax year.

- Complete Part II if you are claiming a Section 179 deduction, which allows you to deduct the full purchase price of qualifying equipment.

- Use Part III to report any listed property, which includes items such as vehicles and computers that may have personal use.

- Finally, review your entries for accuracy and ensure all required information is included before submission.

Legal use of the Form 4562

The legal use of the Form 4562 is governed by IRS regulations, which dictate how depreciation and amortization should be reported for tax purposes. To ensure compliance, taxpayers must accurately report all relevant information and adhere to the guidelines set forth by the IRS. Misreporting or failing to file the form can result in penalties or audits. It is essential for taxpayers to maintain proper documentation to support their claims, as this can be required in the event of an IRS inquiry.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 4562. These guidelines include instructions on which assets qualify for depreciation, the methods available for calculating depreciation, and the deadlines for filing the form. Taxpayers should refer to the IRS instructions accompanying the form for detailed information on eligibility criteria and any changes in tax law that may affect their reporting obligations. Staying informed about IRS guidelines helps ensure compliance and maximizes potential deductions.

Filing Deadlines / Important Dates

The filing deadlines for the Form 4562 coincide with the tax return deadlines for individuals and businesses. Typically, individual taxpayers must file their returns by April 15, while corporations may have different deadlines based on their fiscal year. If additional time is needed, taxpayers can file for an extension, but they must still ensure that any taxes owed are paid by the original due date to avoid penalties. Being aware of these important dates is crucial for timely and accurate tax reporting.

Examples of using the Form 4562

There are various scenarios in which the Form 4562 is utilized. For instance, a small business owner who purchases new equipment for their operations can use this form to claim depreciation on that equipment. Similarly, a self-employed individual who uses a vehicle for business purposes can report the depreciation of that vehicle using Form 4562. These examples illustrate the form's importance in helping taxpayers reduce their taxable income through appropriate deductions.

Quick guide on how to complete 2015 form 4562

Effortlessly complete Form 4562 on any gadget

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage Form 4562 on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

The most efficient way to edit and eSign Form 4562 seamlessly

- Find Form 4562 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Form 4562 and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 4562

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 4562

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is Form 4562?

Form 4562 is used to claim depreciation on certain tangible assets for tax purposes. It helps businesses report their asset depreciation correctly, which can signNowly impact their tax liability. airSlate SignNow integrates seamlessly with Form 4562, ensuring that your documentation process remains efficient.

-

How does airSlate SignNow simplify the Form 4562 process?

airSlate SignNow streamlines the process of signing and submitting Form 4562 by allowing users to electronically sign and send documents securely. Our easy-to-use interface ensures that your team can quickly prepare, sign, and manage Form 4562 without the hassle of printing and scanning paperwork. This saves time and enhances productivity.

-

Is airSlate SignNow cost-effective for handling Form 4562?

Yes, airSlate SignNow is a cost-effective solution for managing Form 4562 and other documentation needs. With various pricing plans tailored to different business sizes, you can choose the option that best suits your budget while accessing essential features that improve your workflow. Get the most value for your investment and simplify your tax preparation.

-

What features does airSlate SignNow offer for Form 4562 management?

airSlate SignNow provides robust features such as document templates, automated reminders, and cloud storage for managing Form 4562. With these features, users can easily create, send, and track the status of their documents, ensuring they stay organized and compliant with tax regulations. This comprehensive approach enhances your overall document management.

-

Can I integrate airSlate SignNow with other software for Form 4562?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, making it easier to manage Form 4562. This allows for seamless data transfer between applications, ensuring accuracy in your tax filings. Simplifying your workflow with integrations means less time spent on manual data entry.

-

What are the benefits of using airSlate SignNow for Form 4562?

Using airSlate SignNow for Form 4562 provides numerous benefits, including enhanced security for sensitive financial information, faster document turnaround times, and improved collaboration among team members. By digitizing your documentation process, you can focus more on your business and less on paperwork. Experience the advantages of modern document management.

-

Is electronic signing valid for Form 4562?

Yes, electronic signatures are valid for Form 4562 and recognized by IRS regulations. airSlate SignNow complies with all legal standards, ensuring your electronically signed documents are secure and legally binding. This means you can confidently submit your Form 4562 digitally without any worries.

Get more for Form 4562

- Form it 21059 underpayment of estimated income tax by individuals and fiduciaries tax year 2020

- Form ct 399 depreciation adjustment schedule tax year 2020

- Form ct 3 s new york s corporation franchise tax return tax year 2020

- Form ct 248 claim for empire state film production credit tax year 2020

- By a corporation form

- Missouri form 53 v 548261509

- Dmv dealer certificate form state of oregon

- If yes submit a copy with this form

Find out other Form 4562

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online