Form 4562 Depreciation and Amortization Including Information on Listed Property 2024

Understanding Form 4562: Depreciation and Amortization

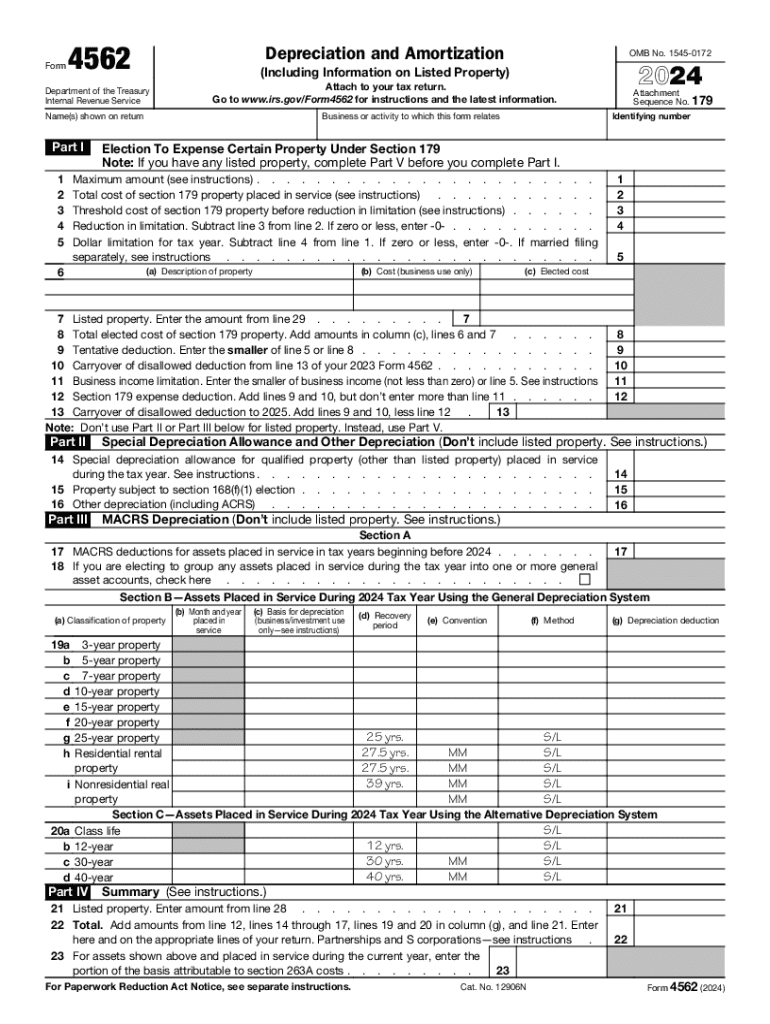

Form 4562 is utilized by businesses and individuals to report depreciation and amortization on their tax returns. This form is essential for claiming deductions on property used in a trade or business, as well as for certain types of property, including vehicles and equipment. It includes information on listed property, which refers to specific assets that may have stricter rules regarding their depreciation. Understanding how to accurately complete this form is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Steps to Complete Form 4562

Completing Form 4562 involves several key steps:

- Gather Necessary Information: Collect details about the assets for which you are claiming depreciation, including purchase dates, costs, and the method of depreciation you plan to use.

- Fill Out Part I: This section covers the election to expense certain property under Section 179. Determine if you qualify for this deduction and enter the appropriate amounts.

- Complete Part II: This part is for the calculation of depreciation on property placed in service during the tax year. Select the correct depreciation method and fill in the required information.

- Address Listed Property in Part III: If applicable, provide details about any listed property, including usage percentages and whether the property is used for business or personal purposes.

- Review and Submit: Double-check all entries for accuracy before submitting the form with your tax return. Ensure you retain copies for your records.

Obtaining Form 4562

Form 4562 can be obtained directly from the IRS website, where it is available for download in PDF format. It is also accessible through various tax preparation software, which may streamline the completion process. Ensure you are using the correct version for the tax year you are filing, such as the 2024 Form 4562, to comply with current IRS guidelines.

IRS Guidelines for Form 4562

The IRS provides specific guidelines regarding the use of Form 4562. Taxpayers must adhere to the rules outlined in the IRS publications related to depreciation and amortization. Key points include:

- Understanding the different methods of depreciation, such as straight-line and declining balance.

- Recognizing the limits on Section 179 deductions, which may change annually.

- Awareness of the requirements for listed property, including the need for substantiation of business use.

Penalties for Non-Compliance

Failure to accurately report depreciation and amortization on Form 4562 can result in penalties from the IRS. These may include:

- Increased tax liability due to disallowed deductions.

- Interest charges on unpaid taxes.

- Potential fines for failure to file or inaccuracies in reporting.

It is essential to ensure compliance with all IRS regulations to avoid these consequences.

Examples of Using Form 4562

Form 4562 is commonly used in various scenarios, such as:

- A small business claiming depreciation on new equipment purchased during the tax year.

- An individual taxpayer expensing a vehicle used for business purposes under Section 179.

- A partnership reporting depreciation on shared property assets.

Each of these examples illustrates the versatility of Form 4562 in different tax situations, highlighting its importance in tax compliance and planning.

Handy tips for filling out Form 4562 Depreciation And Amortization Including Information On Listed Property online

Quick steps to complete and e-sign Form 4562 Depreciation And Amortization Including Information On Listed Property online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a GDPR and HIPAA compliant service for optimum efficiency. Use signNow to electronically sign and send Form 4562 Depreciation And Amortization Including Information On Listed Property for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 4562 depreciation and amortization including information on listed property

Create this form in 5 minutes!

How to create an eSignature for the form 4562 depreciation and amortization including information on listed property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4562 and why is it important?

Form 4562 is used to claim depreciation and amortization for assets. It is essential for businesses to accurately report their asset depreciation to the IRS, ensuring compliance and maximizing tax benefits. Understanding how to fill out form 4562 can help businesses save money and avoid potential penalties.

-

How can airSlate SignNow help with form 4562?

airSlate SignNow simplifies the process of completing and signing form 4562 by providing an intuitive platform for document management. Users can easily fill out the form, add electronic signatures, and send it securely to recipients. This streamlines the workflow and ensures that all necessary documentation is handled efficiently.

-

Is there a cost associated with using airSlate SignNow for form 4562?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that enhance the management of documents like form 4562. Investing in airSlate SignNow can lead to signNow time savings and improved productivity.

-

What features does airSlate SignNow offer for managing form 4562?

airSlate SignNow includes features such as customizable templates, electronic signatures, and secure cloud storage, all of which are beneficial for managing form 4562. These features allow users to create, edit, and store their forms efficiently. Additionally, the platform supports collaboration, making it easy for teams to work together on form 4562.

-

Can I integrate airSlate SignNow with other software for form 4562?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing the functionality for managing form 4562. Whether you use accounting software or CRM systems, these integrations help streamline your workflow and ensure that all your documents are connected and easily accessible.

-

What are the benefits of using airSlate SignNow for form 4562?

Using airSlate SignNow for form 4562 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick electronic signatures, which speeds up the approval process. Additionally, it ensures that your documents are stored securely and are easily retrievable when needed.

-

Is airSlate SignNow user-friendly for completing form 4562?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete form 4562. The platform features a straightforward interface that guides users through the process of filling out and signing documents. This accessibility ensures that even those with minimal technical skills can navigate the system effectively.

Get more for Form 4562 Depreciation And Amortization Including Information On Listed Property

Find out other Form 4562 Depreciation And Amortization Including Information On Listed Property

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document