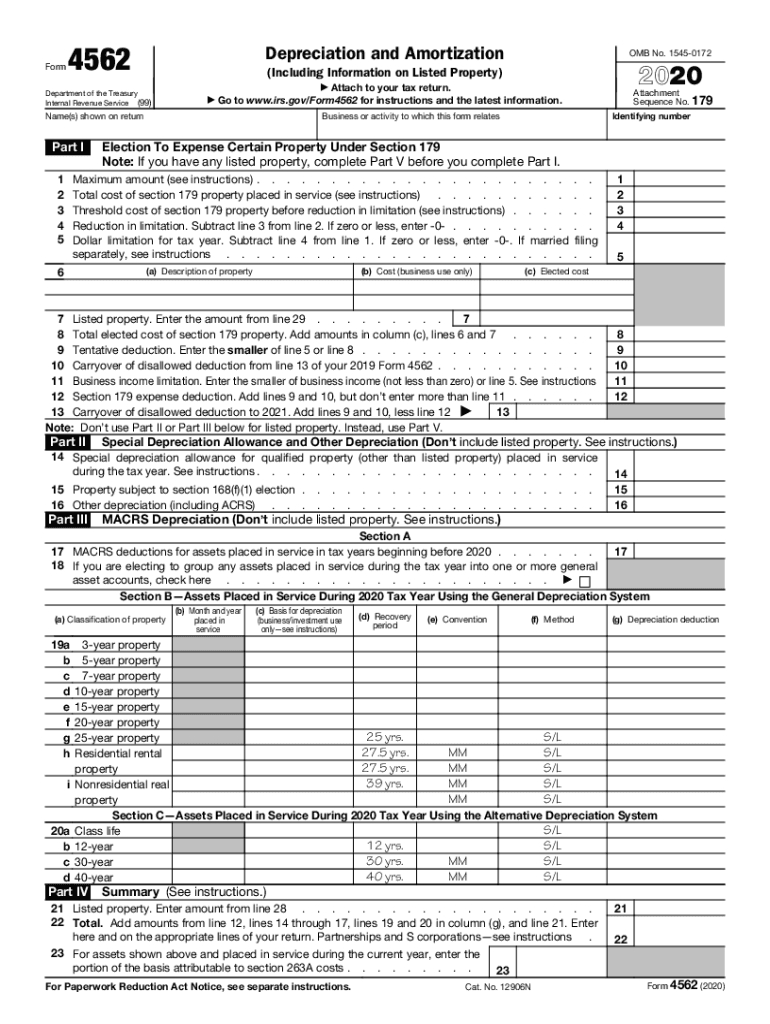

PDF Form 4562, Depreciation and Amortization Internal Revenue Service 2020

What is the PDF Form 4562, Depreciation And Amortization Internal Revenue Service

The IRS Form 4562 is a crucial document used for reporting depreciation and amortization of assets. This form allows taxpayers to claim deductions for the depreciation of property used in a trade or business. It is essential for individuals and businesses that purchase significant assets, as it helps to reduce taxable income. The form covers various aspects, including the types of property eligible for depreciation, the methods of calculating depreciation, and the necessary information required to complete the form accurately.

Steps to complete the PDF Form 4562, Depreciation And Amortization Internal Revenue Service

Completing the IRS Form 4562 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the assets you wish to depreciate, including purchase dates, costs, and the method of depreciation you plan to use. Next, fill out the form by entering details in the appropriate sections, such as Part I for Section 179 expense deduction and Part III for MACRS depreciation. Ensure that you double-check your entries for accuracy and completeness. Finally, sign and date the form before submitting it with your tax return.

Legal use of the PDF Form 4562, Depreciation And Amortization Internal Revenue Service

The legal use of IRS Form 4562 is governed by tax regulations that dictate how depreciation and amortization should be reported. It is essential for taxpayers to understand the legal implications of the information provided on this form. Accurate reporting is necessary to avoid penalties and ensure compliance with IRS guidelines. The form must be filed in conjunction with your annual tax return to claim the appropriate deductions legally. Failure to comply with these regulations can result in audits or penalties from the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of Form 4562. Taxpayers must adhere to the instructions outlined in the IRS publication associated with the form, which details eligibility criteria, reporting requirements, and deadlines. It is important to stay updated on any changes to tax laws that may affect how depreciation is calculated and reported. Following these guidelines helps ensure that taxpayers receive the full benefits of their depreciation deductions while remaining compliant with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 4562 align with the deadlines for submitting your annual tax return. Typically, individual taxpayers must file their returns by April 15, while businesses may have different deadlines depending on their structure and fiscal year. It is crucial to submit Form 4562 by the appropriate deadline to avoid penalties and interest on any unpaid taxes. Taxpayers should also be aware of any extensions that may apply, which can provide additional time for filing without incurring penalties.

Examples of using the PDF Form 4562, Depreciation And Amortization Internal Revenue Service

Examples of using IRS Form 4562 can vary widely depending on the taxpayer's situation. For instance, a self-employed individual who purchases a vehicle for business use may utilize the form to claim depreciation on that vehicle. Similarly, a business that invests in machinery or equipment can report the depreciation of those assets on Form 4562. Each example illustrates the importance of accurately reporting depreciation to maximize tax deductions and ensure compliance with IRS regulations.

Quick guide on how to complete pdf form 4562 depreciation and amortization internal revenue service

Complete PDF Form 4562, Depreciation And Amortization Internal Revenue Service effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage PDF Form 4562, Depreciation And Amortization Internal Revenue Service on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign PDF Form 4562, Depreciation And Amortization Internal Revenue Service effortlessly

- Obtain PDF Form 4562, Depreciation And Amortization Internal Revenue Service and select Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to submit your form, either by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from your preferred device. Modify and eSign PDF Form 4562, Depreciation And Amortization Internal Revenue Service and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form 4562 depreciation and amortization internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the pdf form 4562 depreciation and amortization internal revenue service

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 4562 for and why is it important?

Form 4562 is used to depreciate property and claim deductions on business assets. It is essential for businesses to accurately report their depreciation to the IRS, ensuring they get the tax benefits they deserve.

-

How can airSlate SignNow assist with Form 4562 for eSignatures?

airSlate SignNow simplifies the signing process for Form 4562 by allowing users to eSign documents securely and efficiently. With just a few clicks, you can send, sign, and manage your Form 4562 for easy compliance.

-

What features does airSlate SignNow offer for managing Form 4562 for my business?

airSlate SignNow offers robust features including customizable templates, automated workflows, and real-time tracking for Form 4562. These tools streamline the signing process, enhancing productivity and reducing turnaround time.

-

Is there a cost associated with using airSlate SignNow for Form 4562 for my documents?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Whether you're a freelancer or a large enterprise, you can find an affordable solution to manage Form 4562 and other essential documents.

-

Can I integrate airSlate SignNow with other software while handling Form 4562 for my business?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and Microsoft Office. These integrations enhance your ability to manage and store Form 4562 efficiently.

-

What benefits does eSigning Form 4562 for provide to my workflow?

eSigning Form 4562 for increases efficiency and reduces paperwork, enabling quicker approvals. This digital approach minimizes the risk of errors and allows access to documents from anywhere, streamlining business operations.

-

Is airSlate SignNow secure for handling sensitive Form 4562 for data?

Yes, airSlate SignNow prioritizes security with encryption, secure storage, and compliant practices. You can confidently manage the sensitive information within Form 4562 for, knowing your data is protected.

Get more for PDF Form 4562, Depreciation And Amortization Internal Revenue Service

Find out other PDF Form 4562, Depreciation And Amortization Internal Revenue Service

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free