Form 4562, Depreciation and Amortization IRS Gov 2007

What is the Form 4562, Depreciation And Amortization IRS gov

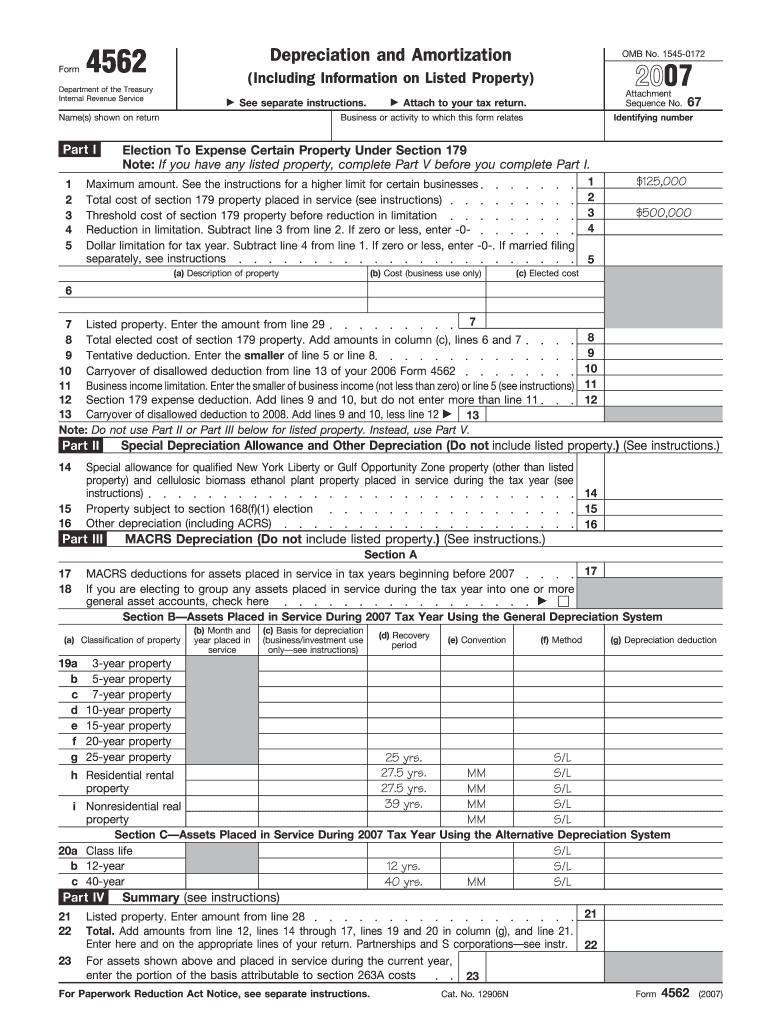

The Form 4562, Depreciation and Amortization, is a tax form used by businesses in the United States to report depreciation and amortization of assets. This form allows taxpayers to claim deductions for the depreciation of property used in their business, which can significantly reduce taxable income. It is essential for ensuring compliance with IRS regulations and accurately reflecting the value of business assets over time.

How to use the Form 4562, Depreciation And Amortization IRS gov

Using Form 4562 involves several steps to ensure accurate reporting. First, gather all necessary information regarding the assets being depreciated or amortized. This includes the purchase date, cost, and method of depreciation. Next, fill out the form by providing details about each asset, including the type of property and the applicable depreciation method. It is crucial to follow IRS guidelines closely to avoid errors that could lead to penalties or audits.

Steps to complete the Form 4562, Depreciation And Amortization IRS gov

Completing Form 4562 requires careful attention to detail. Begin by entering your business information at the top of the form. Then, proceed to Section A, where you will list the assets and their respective costs. In Section B, choose the appropriate depreciation method, such as straight-line or declining balance. Ensure to calculate the depreciation amount correctly for each asset. Finally, review the form for accuracy before submission.

Key elements of the Form 4562, Depreciation And Amortization IRS gov

Key elements of Form 4562 include sections for reporting the type of property, the date it was placed in service, and the depreciation method used. Additionally, the form requires information on any listed property, which has specific rules regarding depreciation. Understanding these elements is vital for correctly completing the form and maximizing potential deductions.

Filing Deadlines / Important Dates

Filing deadlines for Form 4562 generally align with the tax return deadlines for businesses. Typically, the form must be filed by the due date of the tax return, including extensions. For most businesses, this is March 15 for partnerships and corporations or April 15 for sole proprietors. It is important to stay aware of these dates to ensure compliance and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 4562 can be submitted through various methods. Taxpayers can file electronically using tax preparation software that supports IRS forms, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate IRS address based on the taxpayer's location and filing status. In-person submission is generally not an option for this form, as IRS offices typically do not accept forms directly.

Quick guide on how to complete form 4562 depreciation and amortization irsgov

Effortlessly prepare Form 4562, Depreciation And Amortization IRS gov on any device

The management of online documents has gained popularity among businesses and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to access the necessary templates and securely store them online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Handle Form 4562, Depreciation And Amortization IRS gov on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related tasks today.

The simplest method to modify and electronically sign Form 4562, Depreciation And Amortization IRS gov with ease

- Obtain Form 4562, Depreciation And Amortization IRS gov and click Get Form to begin.

- Utilize the provided tools to finalize your document.

- Emphasize important sections of your documents or hide sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to preserve your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that demand printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 4562, Depreciation And Amortization IRS gov and ensure outstanding communication during any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4562 depreciation and amortization irsgov

Create this form in 5 minutes!

How to create an eSignature for the form 4562 depreciation and amortization irsgov

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is Form 4562, Depreciation And Amortization IRS gov?

Form 4562, Depreciation And Amortization IRS gov, is an essential tax form used by businesses to claim deductions for the depreciation of assets and amortization of certain expenses. It allows entities to report and calculate the details of depreciation on property used in their operations. By accurately completing this form, businesses can maximize their deductions and improve their tax outcomes.

-

How can airSlate SignNow assist with completing Form 4562, Depreciation And Amortization IRS gov?

airSlate SignNow simplifies the process of completing Form 4562, Depreciation And Amortization IRS gov by enabling users to fill out and eSign documents securely online. With its intuitive interface, you can manage your forms efficiently without the hassle of printing or faxing. This ensures timely submissions to the IRS, which is crucial for claiming your tax deductions on time.

-

Is airSlate SignNow a cost-effective solution for managing Form 4562, Depreciation And Amortization IRS gov?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 4562, Depreciation And Amortization IRS gov. Our pricing plans cater to businesses of all sizes, providing features that reduce administrative costs related to document management. By streamlining the eSigning process, businesses save both time and resources.

-

What features does airSlate SignNow provide for users handling Form 4562, Depreciation And Amortization IRS gov?

airSlate SignNow provides a variety of features tailored for handling Form 4562, Depreciation And Amortization IRS gov. These include template management, real-time tracking of document status, team collaboration tools, and automated reminders. Such functionalities enhance productivity and ensure all necessary steps are completed promptly.

-

Can I integrate airSlate SignNow with other accounting software for Form 4562, Depreciation And Amortization IRS gov?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software solutions, making it easier to manage Form 4562, Depreciation And Amortization IRS gov. These integrations facilitate the automatic transfer of data, reducing errors and saving time. This allows businesses to maintain accurate records and streamline their financial processes.

-

What benefits does airSlate SignNow offer for businesses filing Form 4562, Depreciation And Amortization IRS gov?

Using airSlate SignNow for filing Form 4562, Depreciation And Amortization IRS gov offers numerous benefits, including enhanced security, improved efficiency, and compliance assurance. Our platform ensures that documents are securely stored and easily accessible, reducing the risk of loss or tampering. Plus, the ease of use enhances turnaround times and overall user satisfaction.

-

How does airSlate SignNow ensure the accuracy of Form 4562, Depreciation And Amortization IRS gov submissions?

airSlate SignNow employs built-in validation features that help users accurately complete Form 4562, Depreciation And Amortization IRS gov. These features guide users through the process, ensuring that all necessary data is correctly entered and accounted for. By minimizing errors, businesses can avoid complications and penalties from the IRS.

Get more for Form 4562, Depreciation And Amortization IRS gov

Find out other Form 4562, Depreciation And Amortization IRS gov

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP