Form 4562 2012

What is the Form 4562

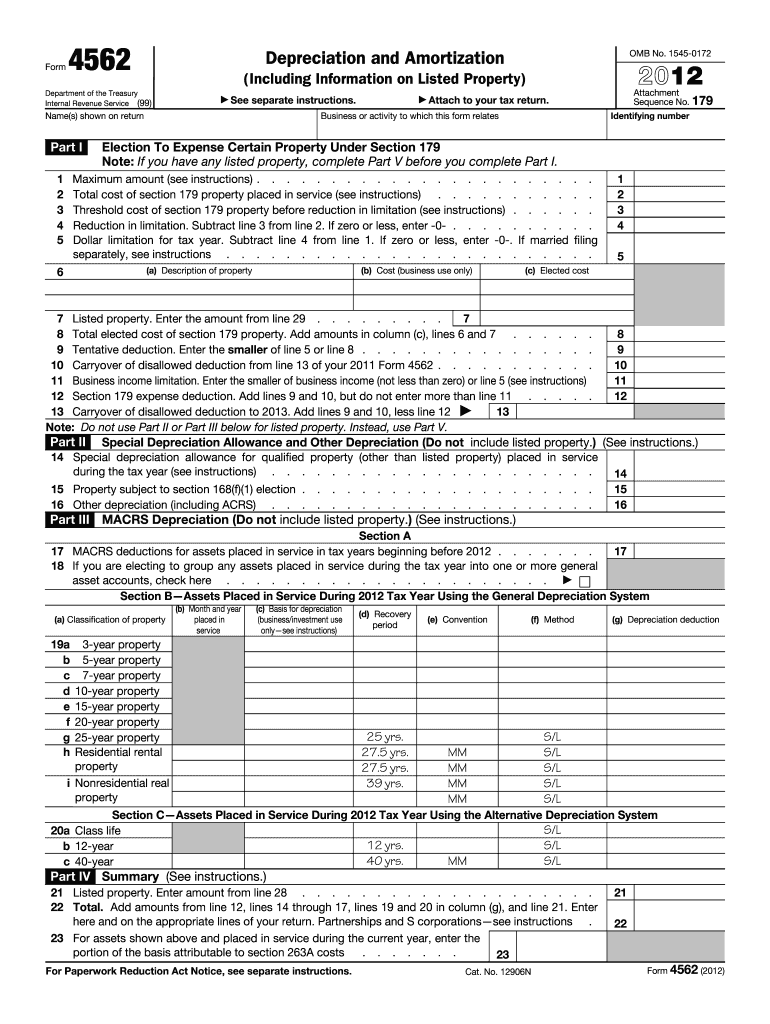

The Form 4562, also known as the Depreciation and Amortization form, is a tax document used by businesses to report depreciation and amortization expenses. This form is essential for claiming deductions on property, including vehicles, machinery, and buildings. It allows taxpayers to outline the assets they own and how they have depreciated over time, which can significantly impact their overall tax liability. Understanding this form is crucial for accurate tax reporting and maximizing allowable deductions.

How to use the Form 4562

Using the Form 4562 involves several key steps to ensure accurate reporting of depreciation and amortization. Taxpayers must first gather information about their assets, including purchase dates, costs, and the method of depreciation they plan to use. The form requires detailed entries for each asset, including the type of property, the date placed in service, and the depreciation method chosen. Completing the form accurately is vital, as errors can lead to delays in processing or issues with the IRS.

Steps to complete the Form 4562

Completing the Form 4562 involves a systematic approach:

- Gather all necessary documentation related to your assets.

- Determine the appropriate depreciation method (e.g., straight-line, declining balance).

- Fill out Part I for Section 179 expense deduction if applicable.

- Complete Part II to report the assets placed in service during the tax year.

- Fill out Part III for listed property, if applicable.

- Review all entries for accuracy before submission.

Legal use of the Form 4562

The legal use of Form 4562 is governed by IRS regulations, which stipulate that it must be filed to claim depreciation and amortization deductions. Accurate completion of the form is necessary to ensure compliance with tax laws. Failing to file the form correctly can result in penalties and the disallowance of deductions. Therefore, it is important to understand the legal implications of the information reported on this form and maintain proper records to support the entries made.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 4562. Taxpayers should refer to the IRS instructions for the form, which detail eligibility criteria, filing procedures, and common mistakes to avoid. Adhering to these guidelines helps ensure that the form is filled out correctly and submitted on time, reducing the risk of audits or penalties. It is advisable to consult these guidelines annually, as they may change based on tax law updates.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4562 align with the overall tax filing deadlines for businesses. Typically, the form must be submitted by the due date of the tax return for the year in which the assets were placed in service. For most businesses, this is April fifteenth of the following year, unless an extension is filed. Understanding these deadlines is crucial for ensuring timely submission and avoiding late fees or penalties.

Quick guide on how to complete 2012 form 4562

Complete Form 4562 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Form 4562 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Form 4562 with ease

- Locate Form 4562 and then click Get Form to begin.

- Utilize the tools available to submit your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to secure your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and eSign Form 4562 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 4562

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 4562

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is Form 4562 and why is it important?

Form 4562 is an IRS form used to claim depreciation and amortization for assets. It's important because it helps businesses accurately report their capital expenditures and ensure compliance with tax regulations.

-

How can airSlate SignNow assist with Form 4562?

airSlate SignNow streamlines the process of completing and signing Form 4562 by providing an easy-to-use platform for eSigning and managing documents. This tool helps ensure accuracy and efficiency in tax filing.

-

Is there a cost associated with using airSlate SignNow for Form 4562?

Yes, airSlate SignNow offers a cost-effective solution with flexible pricing plans tailored to suit businesses of all sizes. You can choose a plan that fits your budget while ensuring that Form 4562 and other documents can be signed seamlessly.

-

What features does airSlate SignNow offer for Form 4562 processing?

airSlate SignNow provides features such as document templates, customizable workflows, and secure eSignatures, making it easier to manage Form 4562. These features enhance productivity and help maintain compliance with IRS requirements.

-

Are there any integrations available with airSlate SignNow for handling Form 4562?

Yes, airSlate SignNow integrates with various accounting and business software, allowing for smooth data transfers and document management. This can be particularly helpful when preparing Form 4562 and other related documents online.

-

Can airSlate SignNow help ensure accurate filing of Form 4562?

Indeed, airSlate SignNow aids in ensuring accurate filing of Form 4562 by providing templates and checklists that guide users through the completion process. This reduces the likelihood of errors and facilitates timely submissions.

-

How does the eSigning process work for Form 4562 with airSlate SignNow?

The eSigning process with airSlate SignNow is simple: upload your Form 4562, add the necessary signers, and send it for signature. The platform notifies signers and allows them to eSign from any device securely.

Get more for Form 4562

- Pdf subject examinations content outlines and sample items form

- Childrens financial assistance application english form

- Illinois library organtissue donor drive lifegoesoncom form

- Physicians statement for occupational disability tmrs40oc physicians statement for occupational disability tmrs40oc form

- Rider status form

- Building inspections port st lucie form

- Nb 12 rev 31 r application form

- Extending your study permit form

Find out other Form 4562

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation