Irs Form 4562 2013

What is the Irs Form 4562

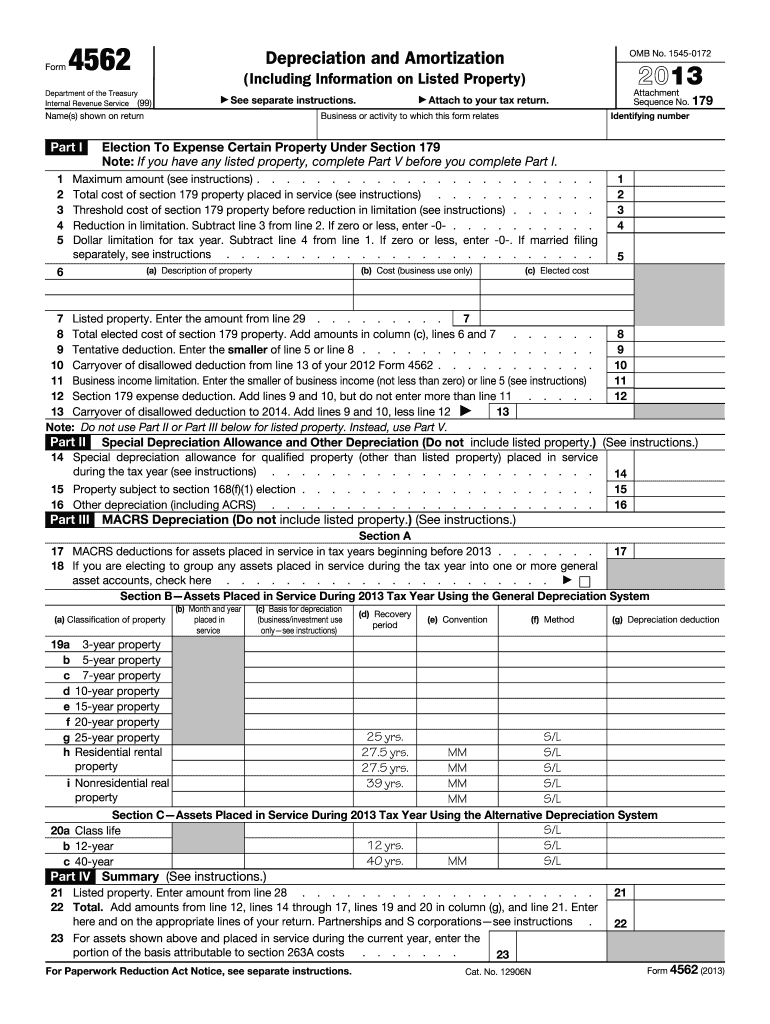

The Irs Form 4562 is a tax form used by businesses to claim depreciation and amortization on their assets. This form is essential for reporting the cost of property that is used in a trade or business. It allows taxpayers to deduct the depreciation expense from their taxable income, thereby reducing their overall tax liability. The form is particularly relevant for assets such as machinery, vehicles, and buildings that have a useful life of more than one year.

How to use the Irs Form 4562

Using the Irs Form 4562 involves several steps. First, determine the assets that qualify for depreciation. Next, gather the necessary information about each asset, including its cost, date placed in service, and method of depreciation. The form includes sections for listing these assets and calculating the depreciation deduction. Once completed, the form should be attached to your tax return when filing.

Steps to complete the Irs Form 4562

Completing the Irs Form 4562 requires careful attention to detail. Follow these steps:

- Begin by entering your name and taxpayer identification number at the top of the form.

- List each qualifying asset in Part III, providing details such as the description, date placed in service, and cost.

- Choose the appropriate depreciation method for each asset, such as straight-line or declining balance.

- Calculate the depreciation deduction for each asset and enter the totals in the designated sections.

- Review the form for accuracy before submitting it with your tax return.

Legal use of the Irs Form 4562

The Irs Form 4562 is legally binding when filled out correctly and submitted with the appropriate tax return. To ensure compliance, it is crucial to follow IRS guidelines regarding asset eligibility and depreciation methods. Additionally, maintaining accurate records of asset purchases and depreciation calculations is essential for legal use, as these documents may be requested during an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 4562 align with the overall tax return deadlines. Generally, individual taxpayers must file their returns by April 15, while businesses may have different deadlines based on their entity type. Extensions may be available, but it is important to check specific deadlines to avoid penalties. Timely submission ensures that you can claim depreciation deductions for the current tax year.

Examples of using the Irs Form 4562

Examples of using the Irs Form 4562 include a small business owner who purchases a new delivery van for $30,000. By completing the form, the owner can claim depreciation on the vehicle over its useful life, reducing taxable income. Another example is a manufacturing company that invests in new machinery. By accurately reporting the cost and depreciation, the company can lower its tax liability while ensuring compliance with IRS regulations.

Quick guide on how to complete 2013 irs form 4562

Effortlessly prepare Irs Form 4562 on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers since you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Irs Form 4562 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Irs Form 4562 effortlessly

- Find Irs Form 4562 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 4562 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 irs form 4562

Create this form in 5 minutes!

How to create an eSignature for the 2013 irs form 4562

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is IRS Form 4562 and why is it important?

IRS Form 4562 is a tax form used to report depreciation and amortization of property for tax purposes. It is essential for businesses claiming deductions on assets they have purchased or improved, thus reducing taxable income. Understanding how to correctly fill out IRS Form 4562 can maximize your tax benefits and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with completing IRS Form 4562?

airSlate SignNow provides a seamless platform for electronically signing and managing IRS Form 4562 and other tax documents. With our user-friendly interface, you can easily upload forms, gather signatures, and store them securely in one place. This boosts efficiency and reduces the hassle of paper-based processes.

-

Is there a cost associated with using airSlate SignNow for IRS Form 4562?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions allow you to eSign IRS Form 4562 and other essential documents without breaking the bank. You can choose a plan that suits your budget and enjoy unlimited access to our features.

-

What features does airSlate SignNow offer for managing IRS Form 4562?

airSlate SignNow includes features like templates, document tracking, and automated reminders, making it easier to manage IRS Form 4562. You can create custom templates for the form, ensuring consistency and saving time on future submissions. Our platform also provides real-time updates on document status.

-

Can I integrate airSlate SignNow with other software to manage IRS Form 4562?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing for efficient handling of IRS Form 4562. This integration enhances your workflow, making it easier to share and manage documents across platforms, ensuring you have everything you need for tax season.

-

What are the benefits of using airSlate SignNow for IRS Form 4562?

Using airSlate SignNow for IRS Form 4562 offers numerous benefits, including enhanced security, time savings, and improved collaboration. Our platform ensures that your documents are securely signed and stored, while also speeding up the process of getting necessary approvals. This means you can focus more on your business rather than paperwork.

-

How does airSlate SignNow ensure the security of IRS Form 4562?

airSlate SignNow prioritizes the security of your documents, including IRS Form 4562, with advanced encryption and secure cloud storage. We comply with industry standards to protect your sensitive information, ensuring that your tax documents are safe from unauthorized access. This provides peace of mind when managing important tax forms.

Get more for Irs Form 4562

Find out other Irs Form 4562

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free