Schedule K 1 Form 1041 Beneficiary's Share of Income, Deductions, Credits, Etc 2022

What is the Schedule K-1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc

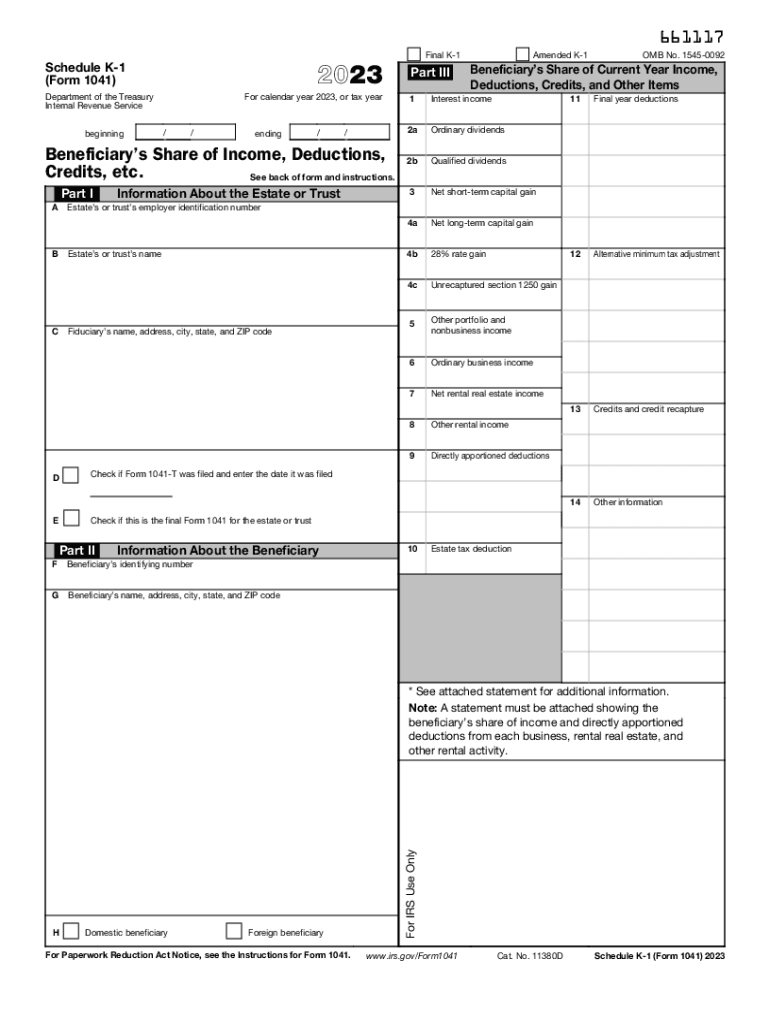

The Schedule K-1 Form 1041 is a tax document used to report a beneficiary's share of income, deductions, and credits from a trust or estate. This form is essential for beneficiaries receiving distributions from an estate or trust, as it details the amounts that must be reported on their individual tax returns. Each beneficiary receives a separate Schedule K-1, which outlines their specific share of the trust's or estate's taxable income, as well as any deductions or credits that may apply.

Steps to complete the Schedule K-1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc

Completing the Schedule K-1 Form 1041 involves several key steps:

- Gather necessary information, including the trust or estate's name, tax identification number, and the beneficiary's details.

- Determine the total income, deductions, and credits from the trust or estate for the tax year.

- Allocate the appropriate share of income, deductions, and credits to each beneficiary based on the trust's governing documents.

- Complete each section of the form accurately, ensuring all amounts are reported correctly.

- Provide a copy of the completed Schedule K-1 to each beneficiary and retain a copy for your records.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Schedule K-1 Form 1041. It is important to follow these guidelines to ensure compliance and avoid penalties. Key points include:

- Ensure that the form is filled out accurately and completely.

- File the Schedule K-1 with the Form 1041 by the required deadline, typically the 15th day of the fourth month after the end of the tax year.

- Keep records of all income, deductions, and credits reported on the form, as the IRS may request documentation during an audit.

How to obtain the Schedule K-1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc

Beneficiaries can obtain the Schedule K-1 Form 1041 from the trustee or executor of the estate or trust. The trustee is responsible for preparing and distributing the form to each beneficiary. It is advisable for beneficiaries to request their Schedule K-1 early in the tax season to ensure they have adequate time to report the information on their individual tax returns.

Legal use of the Schedule K-1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc

The Schedule K-1 Form 1041 is legally required for beneficiaries of estates and trusts to report their share of income, deductions, and credits. Failure to report this information can lead to penalties and interest on unpaid taxes. Beneficiaries must include the amounts reported on their Schedule K-1 when filing their personal tax returns, ensuring compliance with federal tax laws.

Key elements of the Schedule K-1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc

Key elements of the Schedule K-1 Form 1041 include:

- Beneficiary Information: Name, address, and taxpayer identification number.

- Trust or Estate Information: Name and tax identification number of the trust or estate.

- Income Details: Breakdown of various types of income such as interest, dividends, and capital gains.

- Deductions and Credits: Any deductions and credits that the beneficiary can claim based on their share.

Quick guide on how to complete schedule k 1 form 1041 beneficiarys share of income deductions credits etc

Finalize Schedule K 1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc seamlessly on any device

Digital document handling has gained signNow traction among businesses and individuals alike. It serves as an ideal green alternative to traditional printed and signed documents, enabling you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly, free from delays. Manage Schedule K 1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest approach to alter and eSign Schedule K 1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc without hassle

- Obtain Schedule K 1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as an old-fashioned wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to submit your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document handling needs with just a few clicks from any device you prefer. Edit and eSign Schedule K 1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc to guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form 1041 beneficiarys share of income deductions credits etc

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 1041 beneficiarys share of income deductions credits etc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1041 K-1 and why is it important?

A 1041 K-1 is a tax document used to report income, deductions, and credits from a partnership or estate. It's essential for ensuring that partners or beneficiaries accurately report their share of income on their tax returns. Understanding the 1041 K-1 form can help streamline your tax preparation process.

-

How can airSlate SignNow assist with the 1041 K-1 document process?

airSlate SignNow allows users to easily send, sign, and manage 1041 K-1 documents digitally. This eliminates the hassle of paper documents, making it simple to collaborate and ensure timely submissions. With our platform, you can securely handle your 1041 K-1 forms without the stress of paperwork.

-

What features does airSlate SignNow offer for 1041 K-1 documents?

Our platform offers robust features for managing 1041 K-1 documents, including customizable templates, secure eSignatures, and real-time tracking. You can streamline the entire process, reducing the time spent on each transaction. Additionally, our cloud storage ensures your documents are safe and easily accessible.

-

Is airSlate SignNow pricing flexible for businesses handling multiple 1041 K-1 forms?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses dealing with multiple 1041 K-1 forms. Our plans can scale to meet your needs, from individual users to larger teams. This flexibility ensures you only pay for what you need, making it a cost-effective choice.

-

Can I integrate airSlate SignNow with other software for handling 1041 K-1 forms?

Absolutely! airSlate SignNow provides seamless integrations with popular accounting and tax software, allowing for smooth management of 1041 K-1 forms. This means you can automate workflows and enhance efficiency by connecting our eSignature solution with your existing tools.

-

What are the benefits of using airSlate SignNow for 1041 K-1 management?

Using airSlate SignNow for 1041 K-1 management provides numerous benefits, including increased efficiency, enhanced security, and a decrease in turnaround time. Digital signatures remove the need for physical paperwork, and our system ensures compliance with legal standards. This means less hassle and more time for important tasks.

-

Is airSlate SignNow secure for signing 1041 K-1 documents?

Yes, airSlate SignNow prioritizes security for all documents, including 1041 K-1 forms. We employ advanced encryption and authentication measures to protect your data. Our platform meets industry compliance standards, giving you peace of mind when managing sensitive tax documents.

Get more for Schedule K 1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc

- High school florida agricultural and mechanical university form

- Lausd safety plan form

- Example to another bank to release a vehicle title in louisiana form

- Nazarene church matching form 475347605

- Ergo evaluation form

- 504 school form pdf for the classroom

- West academic renewal form

- Amc financial aid guide albany medical center amc form

Find out other Schedule K 1 Form 1041 Beneficiary's Share Of Income, Deductions, Credits, Etc

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form