Form 940 for Irs 2024

What is the Form 940 for IRS

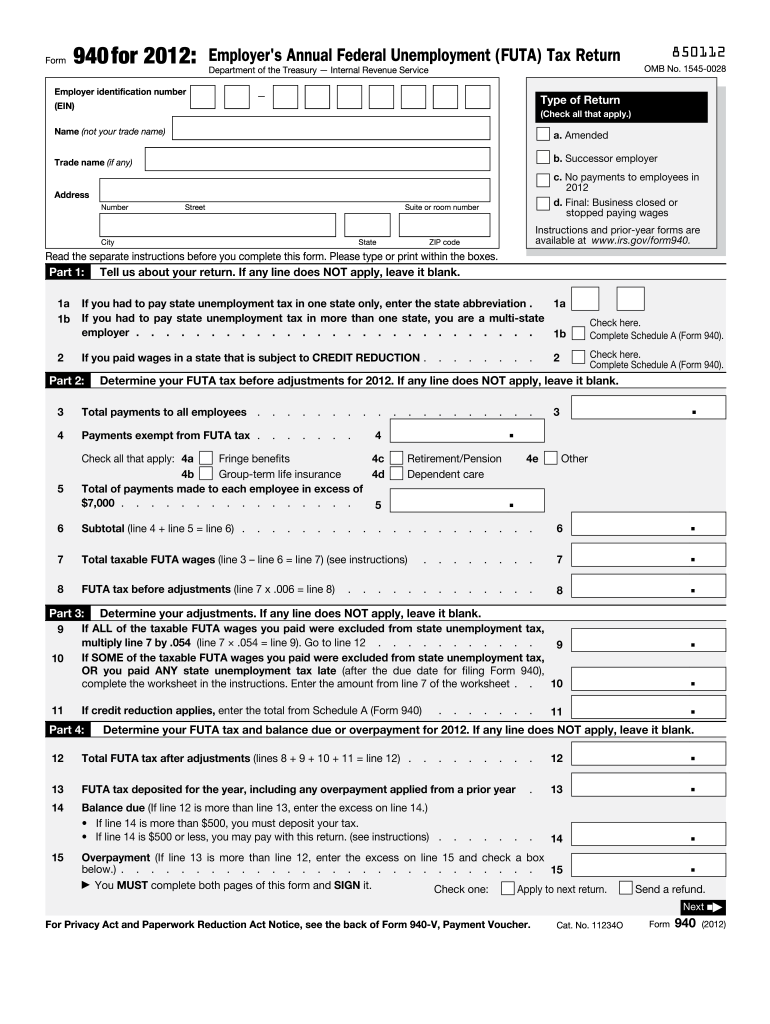

The Form 940 is an annual tax form used by employers in the United States to report their Federal Unemployment Tax Act (FUTA) liabilities. This form is crucial for businesses that pay unemployment taxes to the federal government. It helps the IRS track the amount of unemployment tax owed and ensures that employers comply with federal regulations. The form is typically filed once a year, reporting the total wages paid to employees and the corresponding tax due for the year.

How to Use the Form 940 for IRS

Using the Form 940 involves several steps to ensure accurate reporting of unemployment taxes. Employers must first calculate their FUTA tax liability based on the wages paid to employees. The form requires detailed information, including the total number of employees and the total wages subject to unemployment tax. Once completed, the form can be filed electronically or via mail, depending on the employer's preference. It is essential to keep records of all calculations and supporting documents for future reference and compliance.

Steps to Complete the Form 940 for IRS

Completing the Form 940 involves a systematic approach:

- Gather necessary information, including employee wages and any adjustments for previous years.

- Fill out the form by entering the total wages paid, calculating the FUTA tax, and reporting any credits or adjustments.

- Review the completed form for accuracy, ensuring all figures align with payroll records.

- Submit the form by the deadline, either electronically or by mailing it to the appropriate IRS address.

Filing Deadlines / Important Dates

The deadline for filing the Form 940 is typically January 31 of the year following the tax year being reported. If employers are making timely deposits of their FUTA tax, they may have until February 10 to file the form. It is essential for employers to be aware of these deadlines to avoid penalties and interest on late payments. Keeping a calendar of important tax dates can help ensure compliance.

Legal Use of the Form 940 for IRS

The Form 940 is legally required for employers who meet specific criteria under the Federal Unemployment Tax Act. Employers must file this form if they paid wages of $1,500 or more in any calendar quarter or had at least one employee for any part of a day in twenty or more weeks during the year. Accurate completion and timely submission of the form are essential to avoid potential legal repercussions, including fines and penalties.

Key Elements of the Form 940 for IRS

Key elements of the Form 940 include:

- Employer Information: Name, address, and Employer Identification Number (EIN).

- Wages Paid: Total wages subject to FUTA tax for the year.

- Tax Calculation: The calculated FUTA tax based on the wages reported.

- Credits: Any credits claimed for state unemployment taxes paid.

Create this form in 5 minutes or less

Find and fill out the correct form 940 for irs

Create this form in 5 minutes!

How to create an eSignature for the form 940 for irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 940 for IRS and why is it important?

Form 940 for IRS is an annual federal tax form used by employers to report their Federal Unemployment Tax Act (FUTA) tax. It is important because it helps businesses comply with federal tax regulations and ensures that they are contributing to unemployment benefits for their employees.

-

How can airSlate SignNow help with completing Form 940 for IRS?

airSlate SignNow provides an easy-to-use platform that allows businesses to fill out and eSign Form 940 for IRS digitally. This streamlines the process, reduces paperwork, and ensures that your form is submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for Form 940 for IRS?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides a cost-effective solution for managing Form 940 for IRS and other document signing needs.

-

What features does airSlate SignNow offer for Form 940 for IRS?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Form 940 for IRS. These features enhance efficiency and ensure that your forms are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for Form 940 for IRS?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to manage Form 940 for IRS alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for Form 940 for IRS?

Using airSlate SignNow for Form 940 for IRS offers numerous benefits, including time savings, reduced errors, and enhanced security. The platform simplifies the eSigning process, making it easier for businesses to stay compliant with IRS regulations.

-

How secure is airSlate SignNow when handling Form 940 for IRS?

airSlate SignNow prioritizes security and employs advanced encryption methods to protect your data when handling Form 940 for IRS. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Form 940 For Irs

Find out other Form 940 For Irs

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA