Form 720 2020

What is the Form 720

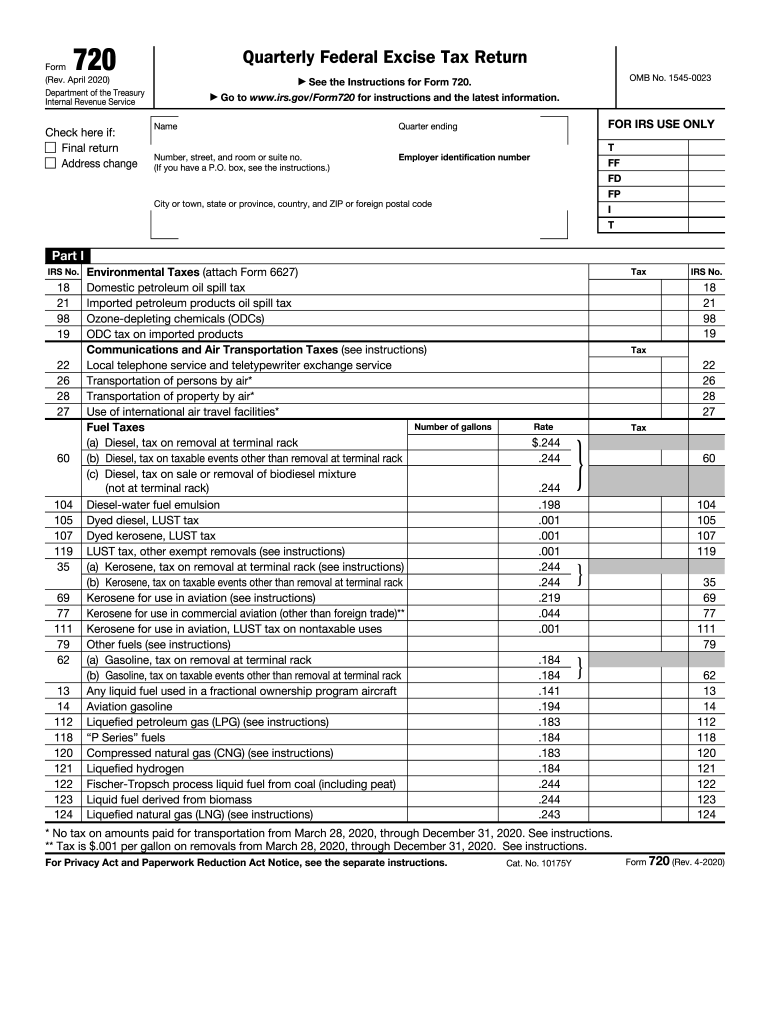

The IRS Form 720 is a federal tax form used by businesses to report and pay certain federal excise taxes. This form is essential for entities involved in activities that are subject to excise taxes, such as environmental taxes, communications taxes, and air transportation taxes. The form provides a comprehensive overview of the taxes owed, allowing the IRS to track and manage these specific tax obligations effectively.

How to use the Form 720

To use the IRS Form 720, businesses must first determine if they are liable for any excise taxes. Once confirmed, they can complete the form by detailing the applicable taxes and calculating the total amount owed. The form consists of various sections that require specific information about the business and the types of taxes being reported. After filling out the form, it should be submitted to the IRS along with any payment due.

Steps to complete the Form 720

Completing the IRS Form 720 involves several key steps:

- Gather necessary information about your business, including your Employer Identification Number (EIN).

- Identify the specific excise taxes applicable to your business activities.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total excise tax owed based on the information provided.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS by the due date, along with any payment required.

Legal use of the Form 720

The legal use of the IRS Form 720 is governed by federal tax regulations. Businesses must ensure compliance with all relevant laws when reporting excise taxes. This includes accurately reporting income, maintaining proper records, and submitting the form within the specified deadlines. Failure to comply can result in penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 720 can vary based on the specific excise taxes being reported. Generally, the form is filed quarterly, with due dates falling on the last day of the month following the end of each quarter. It is crucial for businesses to stay informed about these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 720 can be submitted through various methods, including:

- Online submission via the IRS e-file system for eligible taxpayers.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this method is less common.

Quick guide on how to complete form 720

Prepare Form 720 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 720 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 720 without any hassle

- Find Form 720 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Forget about missing or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Form 720 to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 720

Create this form in 5 minutes!

How to create an eSignature for the form 720

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the primary difference between 720 and 2020 versions of airSlate SignNow?

The 720 v 2020 versions of airSlate SignNow differ mainly in terms of features and enhancements. While the core functionality remains the same, the 2020 version includes advanced eSigning options and improved integration capabilities, providing a more seamless experience for users.

-

How does airSlate SignNow's pricing compare for 720 vs 2020?

Pricing for airSlate SignNow varies between the 720 v 2020 versions due to the additional features offered in the 2020 edition. Users can benefit from cost-effective plans that align with their needs, making it easier to choose the right version for their budget.

-

What key features are included in the 720 v 2020 versions?

The 720 v 2020 versions offer features such as document templates and bulk sending, but the 2020 version enhances these with additional security options and customization capabilities. Businesses can choose the version that best fits their document management requirements.

-

Are there any specific benefits to using the 2020 version over 720?

Yes, the 2020 version of airSlate SignNow comes with updated user experience enhancements that signNowly streamline the signing process. Benefits include faster document turnaround times and improved collaboration features, making it a more efficient choice.

-

Can I integrate airSlate SignNow 720 v 2020 with other software?

Both versions, 720 and 2020, support various integrations across popular platforms. However, the 2020 version offers expanded integration capabilities, making it easier to sync with tools your business already uses, enhancing overall workflow efficiency.

-

Is customer support different between the 720 and 2020 versions?

Customer support remains consistent across both the 720 v 2020 versions, with comprehensive resources available for all users. However, users of the 2020 version may find additional support options tailored to the latest features and updates.

-

What industries can benefit most from airSlate SignNow's 720 v 2020 solutions?

Businesses across various industries, including real estate, healthcare, and finance, can effectively benefit from the airSlate SignNow 720 v 2020 solutions. The versatility of both versions allows industries to manage their document signing securely and efficiently.

Get more for Form 720

Find out other Form 720

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online