IRS Form 720 Instructions What Employers Should Know 2024

What is IRS Form 720?

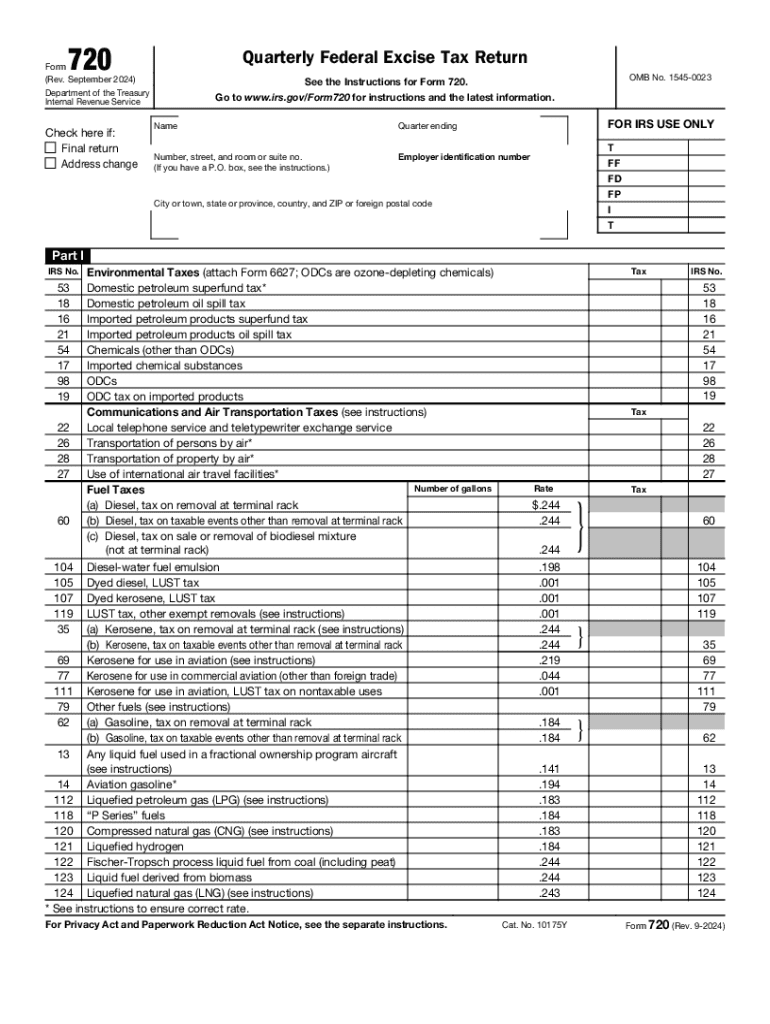

IRS Form 720 is a tax form used by businesses to report and pay certain federal excise taxes. This form is typically utilized for various specific taxes, including those on environmental taxes, communications services, and fuel taxes. Understanding the purpose of Form 720 is crucial for ensuring compliance with federal tax regulations. It is essential for businesses that engage in activities subject to these excise taxes to file this form accurately and on time.

Steps to Complete IRS Form 720

Completing IRS Form 720 involves several key steps to ensure accuracy and compliance. The process generally includes:

- Gathering necessary information about your business and the applicable excise taxes.

- Filling out the form with accurate figures, including the amounts owed for each type of tax.

- Reviewing the completed form for any errors or omissions before submission.

- Submitting the form by the due date, either electronically or via mail.

Each step is vital to avoid penalties and ensure that your business remains compliant with IRS regulations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for IRS Form 720 is crucial for businesses to avoid late fees and penalties. The form is typically due quarterly, with specific deadlines for each quarter:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

It is important to keep these dates in mind to ensure timely filing and compliance.

Required Documents

When preparing to file IRS Form 720, certain documents and information are necessary. These may include:

- Records of sales and transactions subject to excise taxes.

- Previous filings of Form 720 for reference.

- Details of any applicable exemptions or credits.

Having these documents ready can streamline the completion process and help ensure accuracy.

Penalties for Non-Compliance

Failing to file IRS Form 720 on time or inaccurately can lead to significant penalties. Common penalties include:

- Late filing penalties, which can accumulate quickly.

- Interest on unpaid taxes, which is charged from the due date until payment is made.

- Potential audits or increased scrutiny from the IRS.

Being aware of these penalties can motivate timely and accurate filing.

Digital vs. Paper Version

Businesses have the option to file IRS Form 720 either digitally or on paper. The digital version allows for easier submission and may provide immediate confirmation of receipt. On the other hand, the paper version requires mailing the form to the appropriate IRS address, which can lead to longer processing times. Choosing the right method depends on your business's needs and preferences.

Handy tips for filling out IRS Form 720 Instructions What Employers Should Know online

Quick steps to complete and e-sign IRS Form 720 Instructions What Employers Should Know online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant service for maximum simplicity. Use signNow to e-sign and send out IRS Form 720 Instructions What Employers Should Know for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct irs form 720 instructions what employers should know

Create this form in 5 minutes!

How to create an eSignature for the irs form 720 instructions what employers should know

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 720 and why is it important?

IRS Form 720 is used to report and pay federal excise taxes. It is important for businesses to file this form accurately to avoid penalties and ensure compliance with tax regulations. Understanding how to complete IRS Form 720 can help streamline your tax processes.

-

How can airSlate SignNow help with IRS Form 720?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending IRS Form 720. With our solution, you can ensure that your documents are securely signed and submitted on time, reducing the risk of errors and delays.

-

What features does airSlate SignNow offer for managing IRS Form 720?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage for IRS Form 720. These features help you manage your documents efficiently and keep all your tax-related paperwork organized.

-

Is airSlate SignNow cost-effective for filing IRS Form 720?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to file IRS Form 720. Our pricing plans are designed to fit various budgets, ensuring that you can access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for IRS Form 720?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow when handling IRS Form 720. This integration helps you connect your existing tools and enhances your overall efficiency.

-

What are the benefits of using airSlate SignNow for IRS Form 720?

Using airSlate SignNow for IRS Form 720 offers numerous benefits, including faster processing times, enhanced security, and improved compliance. Our platform simplifies the signing process, making it easier for you to manage your tax documents.

-

How secure is airSlate SignNow when handling IRS Form 720?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your IRS Form 720 and other sensitive documents. You can trust that your information is safe and secure while using our platform.

Get more for IRS Form 720 Instructions What Employers Should Know

- Wells fargo wire instructions pdf form

- Download st certificate meghalaya form

- Change form

- Public notice fictitious business name form

- At peace during pause in fighting stars and stripes form

- Buyer loyalty agreement form

- Loyalty agreement template form

- Board of zoning appeal bza application cambridge ma cambridgema form

Find out other IRS Form 720 Instructions What Employers Should Know

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe