Form 720 Rev April Quarterly Federal Excise Tax Return 2016

What is the Form 720 Rev April Quarterly Federal Excise Tax Return

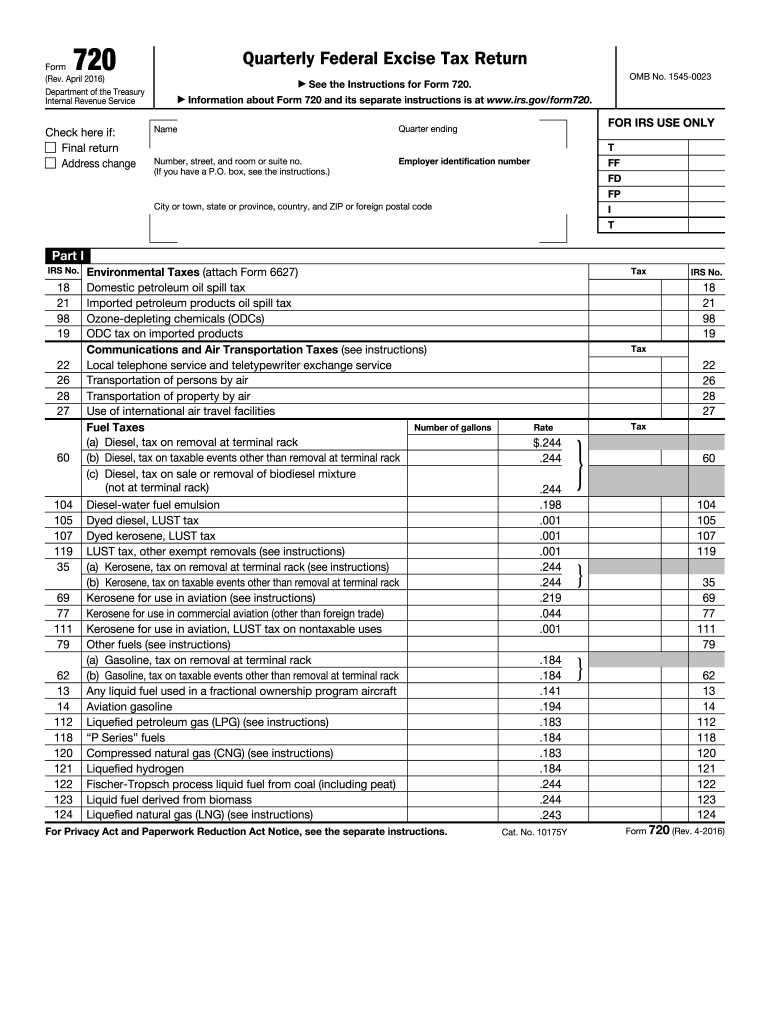

The Form 720 Rev April Quarterly Federal Excise Tax Return is a tax form used by businesses in the United States to report and pay federal excise taxes. These taxes are imposed on specific goods and activities, such as the sale of fuel, the use of certain types of equipment, and various environmental taxes. This form is essential for ensuring compliance with federal tax regulations and must be filed quarterly, reflecting the business's excise tax liabilities for the preceding quarter.

How to use the Form 720 Rev April Quarterly Federal Excise Tax Return

Using the Form 720 Rev April involves several steps. First, businesses need to gather relevant financial data regarding their excise tax liabilities. This includes information on the types of goods sold or activities conducted that are subject to excise tax. Next, the form must be filled out accurately, detailing the specific taxes owed. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the business and the requirements of the IRS.

Steps to complete the Form 720 Rev April Quarterly Federal Excise Tax Return

Completing the Form 720 Rev April requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial records related to excise taxes.

- Access the latest version of the Form 720 Rev April from the IRS website or other reliable sources.

- Fill in the required fields, including your business information and the types of excise taxes applicable.

- Calculate the total excise taxes owed for the quarter.

- Review the form for accuracy and completeness.

- Submit the form electronically or mail it to the appropriate IRS address.

Legal use of the Form 720 Rev April Quarterly Federal Excise Tax Return

The legal use of the Form 720 Rev April is crucial for businesses to avoid penalties and ensure compliance with federal tax laws. This form must be filed accurately and on time to fulfill legal obligations regarding excise taxes. Failure to comply can result in fines, interest on unpaid taxes, and potential legal action from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 Rev April are typically set on a quarterly basis. Businesses must submit the form by the last day of the month following the end of each quarter. For example, the deadline for the first quarter (January to March) is usually April 30. It is essential to keep track of these dates to avoid late filing penalties and ensure timely payment of any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The Form 720 Rev April can be submitted through various methods. Businesses have the option to file electronically via the IRS e-file system, which is often quicker and more efficient. Alternatively, the form can be mailed to the appropriate IRS address, or, in some cases, filed in person at designated IRS offices. Each method has its own advantages, and businesses should choose the one that best fits their needs.

Quick guide on how to complete form 720 rev april 2016 quarterly federal excise tax return

Complete Form 720 Rev April Quarterly Federal Excise Tax Return effortlessly on any device

Web-based document management has become a favorite among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 720 Rev April Quarterly Federal Excise Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 720 Rev April Quarterly Federal Excise Tax Return seamlessly

- Locate Form 720 Rev April Quarterly Federal Excise Tax Return and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your changes.

- Select your preferred method of sharing the form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 720 Rev April Quarterly Federal Excise Tax Return while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 720 rev april 2016 quarterly federal excise tax return

Create this form in 5 minutes!

How to create an eSignature for the form 720 rev april 2016 quarterly federal excise tax return

How to make an electronic signature for the Form 720 Rev April 2016 Quarterly Federal Excise Tax Return in the online mode

How to generate an eSignature for your Form 720 Rev April 2016 Quarterly Federal Excise Tax Return in Chrome

How to make an eSignature for putting it on the Form 720 Rev April 2016 Quarterly Federal Excise Tax Return in Gmail

How to make an electronic signature for the Form 720 Rev April 2016 Quarterly Federal Excise Tax Return from your smart phone

How to create an eSignature for the Form 720 Rev April 2016 Quarterly Federal Excise Tax Return on iOS

How to make an eSignature for the Form 720 Rev April 2016 Quarterly Federal Excise Tax Return on Android

People also ask

-

What is the Form 720 Rev April Quarterly Federal Excise Tax Return?

The Form 720 Rev April Quarterly Federal Excise Tax Return is a tax form used by businesses to report and pay federal excise taxes. This return is due quarterly and covers various taxes imposed on specific goods and services. Understanding this form is crucial for compliance, ensuring that your business meets its tax obligations efficiently.

-

How can airSlate SignNow help with the Form 720 Rev April Quarterly Federal Excise Tax Return?

airSlate SignNow streamlines the process of completing and submitting the Form 720 Rev April Quarterly Federal Excise Tax Return. With our electronic signature capabilities, businesses can effortlessly sign and send documents, ensuring quick submission to the IRS. This reduces paperwork and increases efficiency in your tax filing process.

-

What features does airSlate SignNow offer for tax-related documents like Form 720 Rev April?

airSlate SignNow provides features like secure e-signatures, document templates, and real-time tracking for your Form 720 Rev April Quarterly Federal Excise Tax Return. These functionalities help ensure documents are completed accurately and on time. Additionally, users benefit from integrations with popular accounting software for seamless tax management.

-

Is airSlate SignNow cost-effective for small businesses filing the Form 720 Rev April?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to file the Form 720 Rev April Quarterly Federal Excise Tax Return. Our pricing plans are designed to be affordable while providing powerful features that enhance productivity. This makes it a suitable choice for small business owners managing their tax obligations.

-

Can I integrate airSlate SignNow with my accounting software for Form 720 Rev April?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, facilitating the completion and management of the Form 720 Rev April Quarterly Federal Excise Tax Return. This feature enables you to transfer data easily and streamline your tax filing process. Integrations enhance accuracy and reduce the duplication of effort.

-

What are the benefits of using airSlate SignNow for the Form 720 Rev April Quarterly Federal Excise Tax Return?

Using airSlate SignNow for the Form 720 Rev April Quarterly Federal Excise Tax Return provides numerous benefits, including enhanced compliance, reduced time spent on paperwork, and improved document security. Our platform allows for easy tracking and management of your tax filings, ensuring that you stay organized. Ultimately, this leads to a smoother tax filing experience.

-

Is it secure to eSign the Form 720 Rev April with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents, including the Form 720 Rev April Quarterly Federal Excise Tax Return. Our platform uses advanced encryption and complies with industry standards to protect sensitive data throughout the signing process. This ensures that your tax documents are handled securely and confidentially.

Get more for Form 720 Rev April Quarterly Federal Excise Tax Return

- Di 1020 form

- Direct deposit form combined studentemployment neu

- Direct deposit enrollment form the college of mount saint vincent mountsaintvincent

- Par questionnaire american bar association apps americanbar form

- Commision disbursement form

- Prepaid visa phone form

- Real estate disbursement form

- Axa fillable form life

Find out other Form 720 Rev April Quarterly Federal Excise Tax Return

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast