Form 720 Rev January Quarterly Federal Excise Tax Return 2016

What is the Form 720 Rev January Quarterly Federal Excise Tax Return

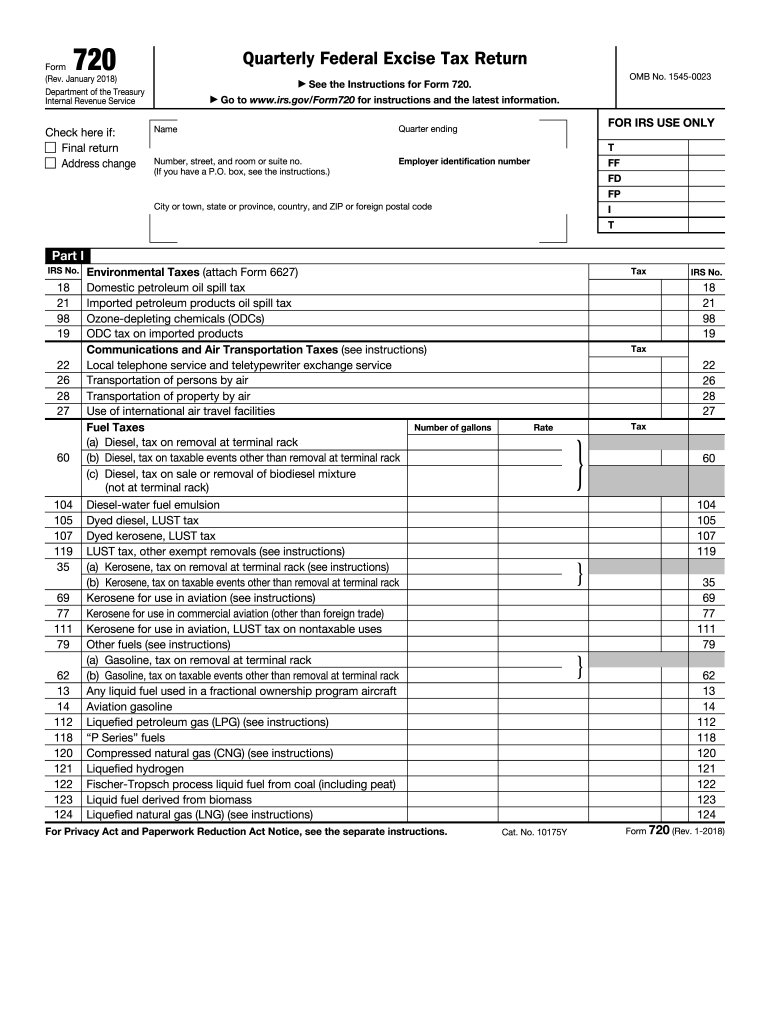

The Form 720 Rev January Quarterly Federal Excise Tax Return is a tax form used by businesses in the United States to report and pay federal excise taxes. This form is essential for entities that engage in activities subject to excise tax, such as the sale of certain goods, services, or use of specific types of equipment. It is typically filed on a quarterly basis, ensuring that the IRS receives timely information about tax liabilities related to these activities.

How to use the Form 720 Rev January Quarterly Federal Excise Tax Return

Using the Form 720 Rev January involves several steps. First, businesses must gather relevant financial data regarding sales and activities that incur excise taxes. This includes information on taxable sales, the applicable tax rates, and any exemptions that may apply. Once the necessary data is compiled, the form can be filled out accurately, ensuring all required fields are completed. After filling out the form, businesses must submit it to the IRS along with any taxes owed, either electronically or via mail.

Steps to complete the Form 720 Rev January Quarterly Federal Excise Tax Return

Completing the Form 720 Rev January involves a systematic approach:

- Gather necessary financial records, including sales data and previous tax returns.

- Identify the applicable excise tax rates for your business activities.

- Fill out the form, ensuring all sections are completed accurately.

- Calculate the total excise tax owed based on your reported activities.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS by the designated deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 Rev January are crucial for compliance. The form must be submitted quarterly, with specific due dates typically falling on the last day of the month following the end of the quarter. For example, the due date for the first quarter (January to March) is usually April 30. It is important for businesses to mark these dates on their calendars to avoid late penalties.

Legal use of the Form 720 Rev January Quarterly Federal Excise Tax Return

The Form 720 Rev January is legally binding when filled out and submitted according to IRS regulations. To ensure its legal standing, businesses must adhere to the guidelines set forth by the IRS, including accurate reporting of taxable activities and timely submission. Additionally, using a reliable eSignature solution can enhance the legal validity of the form when submitted electronically.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Form 720 Rev January can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal repercussions for ongoing non-compliance. It is essential for businesses to understand these risks and prioritize timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete form 720 rev january 2019 quarterly federal excise tax return

Complete Form 720 Rev January Quarterly Federal Excise Tax Return seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to generate, modify, and electronically sign your documents swiftly without hold-ups. Manage Form 720 Rev January Quarterly Federal Excise Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Form 720 Rev January Quarterly Federal Excise Tax Return effortlessly

- Find Form 720 Rev January Quarterly Federal Excise Tax Return and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Form 720 Rev January Quarterly Federal Excise Tax Return while ensuring superior communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 720 rev january 2019 quarterly federal excise tax return

Create this form in 5 minutes!

How to create an eSignature for the form 720 rev january 2019 quarterly federal excise tax return

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the Form 720 Rev January Quarterly Federal Excise Tax Return?

The Form 720 Rev January Quarterly Federal Excise Tax Return is a tax form used by businesses to report and pay federal excise taxes on specific goods and services. This quarterly form is essential for compliance with IRS regulations and ensures your business meets its tax obligations. Proper completion of this form is vital to avoid penalties.

-

How can airSlate SignNow help with filing Form 720 Rev January?

airSlate SignNow simplifies the process of filing Form 720 Rev January Quarterly Federal Excise Tax Return by providing an easy-to-use platform for document management and eSigning. You can quickly create, send, and sign the tax form electronically, ensuring a streamlined and efficient filing process while maintaining compliance. With our service, accuracy and speed are prioritized.

-

What features does airSlate SignNow offer for managing the Form 720 Rev January?

airSlate SignNow offers features such as document templates, collaboration tools, and secure storage, specifically tailored for managing Form 720 Rev January Quarterly Federal Excise Tax Return efficiently. Our platform allows you to edit and customize your tax form with ease, ensuring that all necessary information is included. Plus, the electronic signature feature ensures quick approvals.

-

Is airSlate SignNow cost-effective for small businesses filing Form 720 Rev January?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to file the Form 720 Rev January Quarterly Federal Excise Tax Return. Our pricing plans are designed to accommodate various business sizes, allowing you to choose the plan that fits your budget and requirements. The potential time and resource savings make it a smart investment for any small business.

-

Can airSlate SignNow integrate with my accounting software for Form 720 Rev January?

Absolutely! airSlate SignNow offers integrations with various accounting software, enabling you to sync data related to your Form 720 Rev January Quarterly Federal Excise Tax Return easily. This integration helps reduce manual entries, minimizes errors, and allows for seamless transfer of tax information, improving your overall workflow.

-

How secure is airSlate SignNow for submitting Form 720 Rev January?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and secure servers to protect your data while submitting the Form 720 Rev January Quarterly Federal Excise Tax Return. With these measures in place, you can confidently send and store sensitive tax documents without compromising on security.

-

What support does airSlate SignNow offer for users working on Form 720 Rev January?

To ensure a smooth experience while working on your Form 720 Rev January Quarterly Federal Excise Tax Return, airSlate SignNow offers dedicated customer support through various channels, including email, chat, and phone. Our support team is available to answer your questions or assist with any issues you may encounter while using our platform. We're here to help you every step of the way.

Get more for Form 720 Rev January Quarterly Federal Excise Tax Return

- Earned income credit eic american opportunity tax credit aotc form

- About form 8824 like kind exchangesinternal revenue service

- 2020 form 8880 credit for qualified retirement savings contributions

- Form w 10 rev october 2020 dependent care providers identification and certification

- 2020 form 1098 e student loan interest statement

- 2018 form 1095 c internal revenue service

- 2020 form 1120 pc us property and casualty insurance company income tax return

- To order official irs information returns such as forms w 2 and w 3 which include a

Find out other Form 720 Rev January Quarterly Federal Excise Tax Return

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast