720 Tax Form 2023

What is the 720 Tax Form

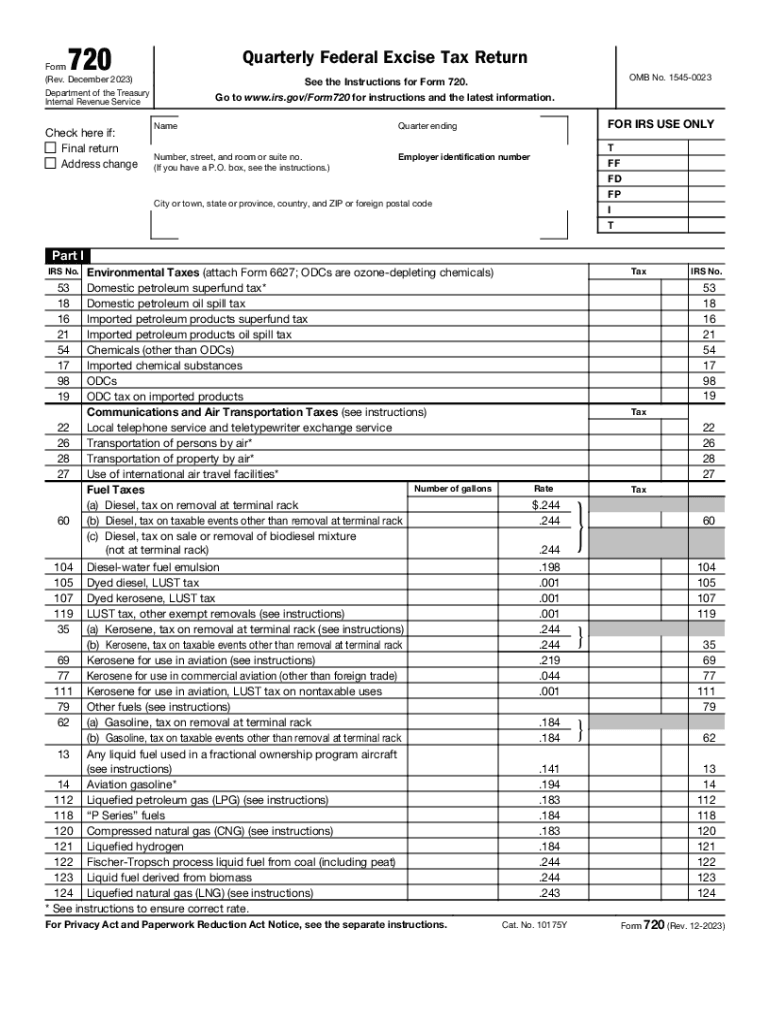

The 720 tax form, officially known as IRS Form 720, is used to report and pay federal excise taxes. This form is primarily for businesses that engage in activities subject to excise tax, such as manufacturing or selling certain goods, or providing specific services. Excise taxes can apply to a variety of products, including fuel, tobacco, and alcohol, as well as certain environmental taxes. Understanding the purpose of Form 720 is essential for compliance with federal tax regulations.

How to use the 720 Tax Form

To use the 720 tax form effectively, businesses must first determine if their activities are subject to excise tax. If so, they need to fill out the form accurately, reporting the relevant tax liabilities. The form includes sections for different types of excise taxes, allowing users to specify which taxes apply to their business. Once completed, the form must be submitted to the IRS, along with any payment due. It is crucial to keep accurate records of transactions related to excise tax liabilities for future reference and compliance.

Steps to complete the 720 Tax Form

Completing the 720 tax form involves several key steps:

- Gather necessary information, including business details and specific excise tax rates applicable to your products or services.

- Fill out the form, ensuring that all sections are completed accurately, including gross receipts and tax calculations.

- Review the form for any errors or omissions, as mistakes can lead to penalties or delays in processing.

- Submit the completed form to the IRS by the due date, along with any required payment.

Filing Deadlines / Important Dates

Filing deadlines for the 720 tax form can vary based on the specific tax liability and the frequency of filing. Generally, businesses must file Form 720 quarterly, with the due dates typically falling on the last day of the month following the end of each quarter. For example, the due date for the first quarter is April 30, for the second quarter is July 31, for the third quarter is October 31, and for the fourth quarter is January 31 of the following year. It is essential to adhere to these deadlines to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 720. These guidelines include detailed instructions on how to report different types of excise taxes, eligibility criteria for various exemptions, and the requirements for electronic filing. Businesses should refer to the IRS website or the instructions included with the form for the most current information and updates. Staying informed about IRS guidelines helps ensure compliance and reduces the risk of errors.

Penalties for Non-Compliance

Failure to file Form 720 or to pay the associated excise taxes on time can result in significant penalties. The IRS may impose fines for late filing, which can accumulate over time. Additionally, businesses may face interest charges on any unpaid taxes. Understanding the potential consequences of non-compliance is crucial for business owners to avoid financial repercussions and maintain good standing with the IRS.

Quick guide on how to complete 720 tax form

Accomplish 720 Tax Form seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 720 Tax Form on any system with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign 720 Tax Form effortlessly

- Locate 720 Tax Form and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in a few clicks from any device of your choice. Adjust and electronically sign 720 Tax Form and guarantee effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 720 tax form

Create this form in 5 minutes!

How to create an eSignature for the 720 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer with its 720 pricing plan?

The 720 pricing plan includes a comprehensive suite of features such as unlimited eSigning, customizable templates, and advanced document tracking. Users can easily manage workflows and collaborate in real-time on documents, making it a robust solution for businesses of all sizes. With airSlate SignNow, you can increase productivity while maintaining a professional image.

-

How does the 720 plan compare to other pricing tiers in airSlate SignNow?

The 720 plan offers a balanced mix of features that cater to small and medium-sized businesses. While it is cost-effective, other higher-tier plans provide additional functionalities like advanced integrations and compliance options. Choosing the right plan depends on your specific business requirements, but the 720 plan delivers great value for essential eSigning needs.

-

Can I integrate airSlate SignNow with other applications within the 720 plan?

Yes, the 720 plan allows for seamless integrations with popular applications such as Google Drive, Dropbox, and CRMs like Salesforce. This ensures that you can streamline your workflows and enhance overall efficiency without needing to switch between different platforms. Integrating airSlate SignNow with your existing tools is straightforward and enhances your document management capabilities.

-

What benefits does the 720 plan provide for small businesses?

The 720 plan is particularly beneficial for small businesses as it combines affordability with essential eSigning features. This plan enables small teams to send, sign, and manage documents digitally without the need for extensive training. With airSlate SignNow, small businesses can improve turnaround times and reduce paperwork, ultimately saving time and resources.

-

Is there a mobile app available for airSlate SignNow under the 720 plan?

Yes, airSlate SignNow offers a powerful mobile app compatible with the 720 plan, allowing users to sign documents on-the-go. The mobile app ensures that you can manage your documents anytime and anywhere, providing flexibility in your workflow. This feature is especially useful for professionals who require mobility and convenience in their signing processes.

-

What security measures are in place for documents signed under the 720 plan?

Documents signed using the 720 plan come with industry-standard security measures including encryption, secure storage, and compliance with regulations like GDPR and eSignature laws. These safeguards ensure that your sensitive information remains protected throughout the signing process. With airSlate SignNow, you can trust that your documents are safe and secure.

-

Can I customize templates for my documents with the 720 plan?

Absolutely! The 720 plan allows you to create and customize templates for your documents. This means you can save time by reusing your frequently used documents while ensuring consistency in branding and presentation across all communications. Custom templates streamline the eSigning experience, making it more efficient for your business.

Get more for 720 Tax Form

Find out other 720 Tax Form

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure