What is IRS Form 720? TurboTax Tax Tips & Videos Intuit 2023

Understanding IRS Form 720

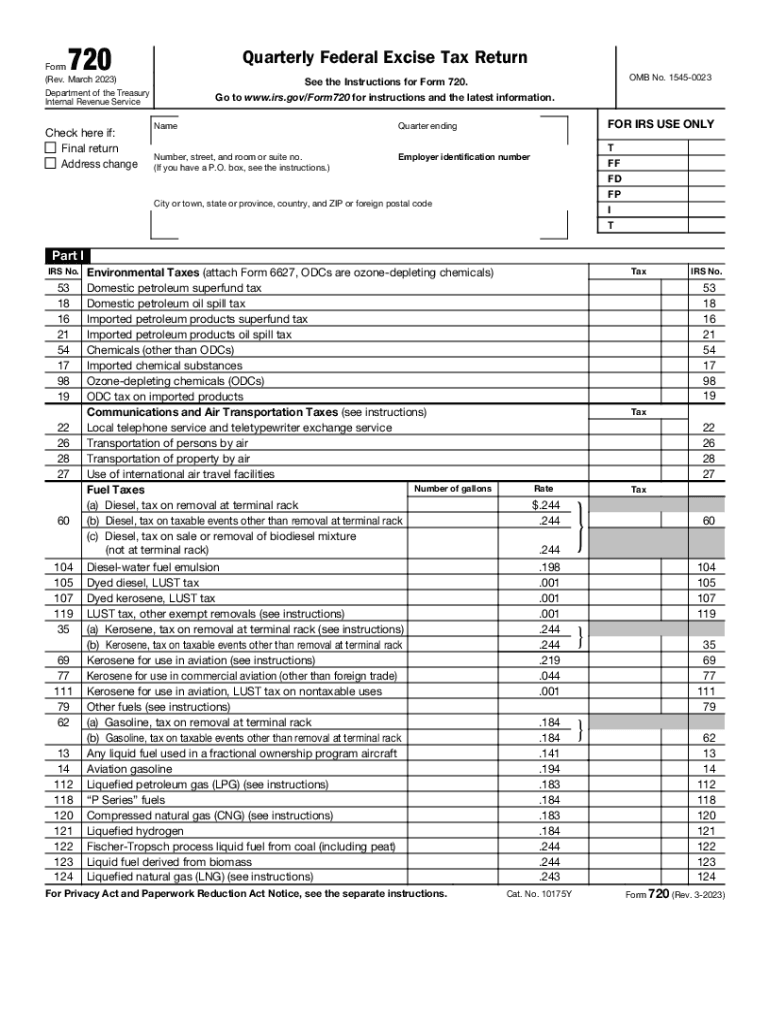

IRS Form 720, also known as the quarterly federal excise tax return, is a crucial document for businesses that are liable for federal excise taxes. This form is used to report and pay taxes on specific goods and services, including but not limited to fuel, air transportation, and certain types of insurance. The form must be filed quarterly, ensuring that businesses remain compliant with federal tax regulations.

Steps to Complete IRS Form 720

Completing IRS Form 720 involves several key steps:

- Gather necessary information, including your business details and the specific excise taxes applicable to your operations.

- Download the latest version of Form 720 from the IRS website or use a fillable version for ease of completion.

- Fill out the form accurately, ensuring that all required fields are completed. Pay attention to the specific tax rates and calculations for each applicable tax type.

- Review the completed form for accuracy, as errors can lead to penalties or delays in processing.

- Submit the form electronically or by mail, depending on your preference and the requirements set forth by the IRS.

Key Elements of IRS Form 720

The form consists of several key sections that must be understood for proper completion:

- Identification Information: This section requires basic information about the business, including the name, address, and employer identification number (EIN).

- Tax Liability Calculation: This part details the specific excise taxes owed, categorized by type, such as environmental taxes or communications taxes.

- Payment Information: Here, you will indicate the total amount due and how you plan to remit payment, whether electronically or via check.

Filing Deadlines for IRS Form 720

Filing deadlines for IRS Form 720 are critical to avoid penalties. The form must be submitted quarterly, with deadlines typically falling on the last day of the month following the end of each quarter:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Legal Use of IRS Form 720

IRS Form 720 serves as a legal document for reporting and paying federal excise taxes. It is important to ensure that the form is filled out correctly and submitted on time to maintain compliance with federal tax laws. Failure to file or pay the taxes owed can result in penalties, interest, and potential legal action by the IRS.

Digital vs. Paper Version of IRS Form 720

Businesses have the option to file IRS Form 720 either digitally or via paper submission. The digital version is often preferred for its convenience and speed, allowing for quicker processing and confirmation of submission. Electronic filing also reduces the risk of errors associated with manual entry, as many e-signature solutions provide built-in checks and balances to ensure accuracy.

Quick guide on how to complete what is irs form 720 turbotax tax tips ampamp videos intuit

Prepare What Is IRS Form 720? TurboTax Tax Tips & Videos Intuit effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly option to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle What Is IRS Form 720? TurboTax Tax Tips & Videos Intuit on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign What Is IRS Form 720? TurboTax Tax Tips & Videos Intuit with ease

- Obtain What Is IRS Form 720? TurboTax Tax Tips & Videos Intuit and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign What Is IRS Form 720? TurboTax Tax Tips & Videos Intuit and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is irs form 720 turbotax tax tips ampamp videos intuit

Create this form in 5 minutes!

How to create an eSignature for the what is irs form 720 turbotax tax tips ampamp videos intuit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 720 and why is it important?

IRS Form 720 is used to report and pay federal excise taxes. Understanding this form is crucial for businesses as it ensures compliance with tax regulations, avoiding penalties. Proper handling of IRS Form 720 can streamline financial operations and maintain regulatory requirements.

-

How can airSlate SignNow help me manage IRS Form 720?

With airSlate SignNow, you can easily prepare, send, and eSign IRS Form 720 digitally. Our platform enhances efficiency and accuracy, minimizing the chances of errors associated with manual processing. Plus, it ensures your documents are secure and accessible at any time.

-

What features does airSlate SignNow offer for handling IRS Form 720?

airSlate SignNow offers features like customizable templates, eSignature options, and real-time tracking specifically for IRS Form 720. These tools help you streamline the submission process and ensure your taxes are filed correctly. Additionally, our intuitive interface makes it easy for anyone in your team to use.

-

Is airSlate SignNow cost-effective for managing IRS Form 720?

Yes, airSlate SignNow provides a cost-effective solution for managing IRS Form 720 and other documents. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you get the best value without compromising on features. By switching to our platform, you can save both time and money.

-

How does airSlate SignNow integrate with other software for IRS Form 720?

airSlate SignNow seamlessly integrates with various accounting and business management software, simplifying the entire process of handling IRS Form 720. This connectivity allows for easy data transfer and collaboration with existing systems, enhancing overall productivity. Integration ensures that all relevant information is consolidated in one place.

-

Can I access IRS Form 720 on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access IRS Form 720 from any device. This flexibility ensures you can manage your documents on the go, making it easy to stay compliant no matter where you are. ESigning is just as seamless on mobile as it is on desktop.

-

What security measures does airSlate SignNow implement for IRS Form 720?

Security is a top priority at airSlate SignNow. We implement advanced encryption and comply with industry regulations to protect your IRS Form 720 and other sensitive data. You can trust that your documents are secure, allowing you to focus on your business without worrying about data bsignNowes.

Get more for What Is IRS Form 720? TurboTax Tax Tips & Videos Intuit

Find out other What Is IRS Form 720? TurboTax Tax Tips & Videos Intuit

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF