Form 720 Rev December Quarterly Federal Excise Tax Return 2022

What is the Form 720 Rev December Quarterly Federal Excise Tax Return

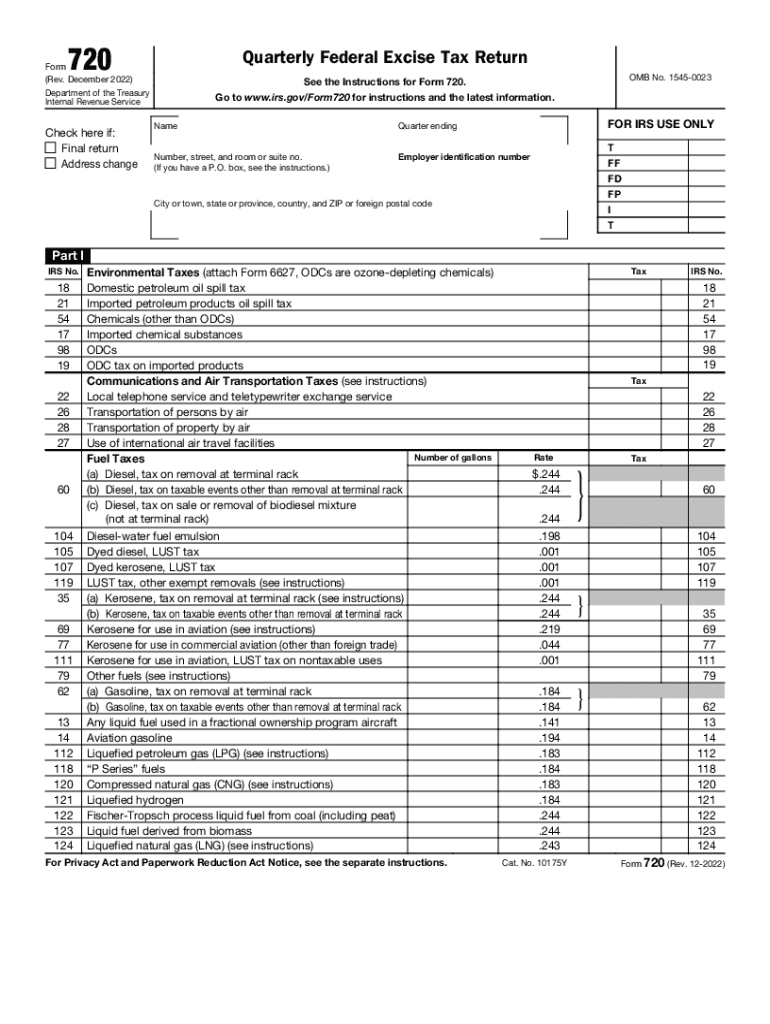

The Form 720 Rev December is the official document used by businesses to report and pay federal excise taxes on a quarterly basis. This form is essential for various industries, including those involved in the sale of certain goods, such as fuel, and services that are subject to excise taxes. The form captures important information about the types of taxes owed and the amounts due, allowing the IRS to track compliance and revenue effectively.

Steps to complete the Form 720 Rev December Quarterly Federal Excise Tax Return

Completing the Form 720 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial records related to excise tax liabilities. This includes sales records, tax rates, and any previous filings. Next, fill out the form by entering the required information in the designated sections, such as the taxpayer's identification details, the types of excise taxes applicable, and the calculation of total taxes owed. After completing the form, review it thoroughly for any errors before submission.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines for the Form 720 to avoid penalties. The IRS requires that the form be submitted quarterly, with specific due dates typically falling on the last day of the month following the end of each quarter. For example, the deadlines for the first quarter are usually April 30, for the second quarter July 31, for the third quarter October 31, and for the fourth quarter January 31 of the following year. Staying informed about these dates helps ensure timely compliance.

Legal use of the Form 720 Rev December Quarterly Federal Excise Tax Return

The Form 720 is legally binding when completed accurately and submitted on time. It serves as an official record of the excise taxes owed by a business and must be filed in accordance with IRS regulations. Failure to file or inaccuracies in the form can lead to penalties and interest on unpaid taxes. It is important for businesses to understand their obligations under federal law to maintain compliance and avoid legal repercussions.

How to obtain the Form 720 Rev December Quarterly Federal Excise Tax Return

The Form 720 can be obtained directly from the IRS website or through authorized tax preparation software. It is available in a downloadable PDF format, which can be printed and filled out manually, or completed electronically using e-filing options. Businesses should ensure they are using the most current version of the form to comply with any updates or changes in tax regulations.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 720 can result in significant penalties. The IRS may impose fines for late submissions, inaccuracies, or failure to pay the taxes owed. These penalties can accumulate quickly, leading to increased financial burdens for businesses. Understanding the implications of non-compliance emphasizes the importance of timely and accurate filing.

Quick guide on how to complete form 720 rev december 2022 quarterly federal excise tax return

Effortlessly Manage Form 720 Rev December Quarterly Federal Excise Tax Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Manage Form 720 Rev December Quarterly Federal Excise Tax Return on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

How to Edit and eSign Form 720 Rev December Quarterly Federal Excise Tax Return with Ease

- Obtain Form 720 Rev December Quarterly Federal Excise Tax Return and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional hand-signed signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Form 720 Rev December Quarterly Federal Excise Tax Return to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 720 rev december 2022 quarterly federal excise tax return

Create this form in 5 minutes!

People also ask

-

What is the 2022 IRS form quarterly, and why is it important?

The 2022 IRS form quarterly refers to the quarterly tax forms that businesses must file to report their income and payroll taxes. These forms help ensure compliance with federal tax laws, and timely filing is essential to avoid penalties. Having a clear understanding of these forms can simplify your accounting processes.

-

How does airSlate SignNow assist with the 2022 IRS form quarterly filing?

airSlate SignNow provides tools to streamline document signing and management related to the 2022 IRS form quarterly. With our platform, you can easily send tax forms for eSignature, ensuring that all necessary signatures are captured efficiently. This helps you meet IRS deadlines with less hassle.

-

What are the pricing options for using airSlate SignNow for handling IRS forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs when managing the 2022 IRS form quarterly. Our plans include multiple tiers designed for different sizes and types of businesses, ensuring you get the features you need at a cost-effective rate. Explore our pricing page for detailed information.

-

Can I integrate airSlate SignNow with my accounting software for the 2022 IRS form quarterly?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage the 2022 IRS form quarterly. Integrations allow for automatic data transfer and simplified workflows, eliminating the need for manual entry. This enhances your document management and filing process.

-

What benefits does airSlate SignNow offer for businesses filing the 2022 IRS form quarterly?

Using airSlate SignNow for the 2022 IRS form quarterly simplifies the eSigning process and enhances collaboration within teams. Our secure platform ensures that your documents are safe while providing an easy-to-use interface that speeds up the filing process. This translates to increased efficiency in your tax preparation.

-

Is airSlate SignNow compliant with IRS regulations for the 2022 IRS form quarterly?

Absolutely, airSlate SignNow is designed to comply with all IRS regulations, including those relevant to the 2022 IRS form quarterly. Our platform adheres to industry standards for security and compliance, ensuring that your signed documents are valid and enforceable. You can rely on our solution for your tax documentation needs.

-

How can I ensure timely submission of the 2022 IRS form quarterly using airSlate SignNow?

To ensure timely submission of the 2022 IRS form quarterly, utilize airSlate SignNow's reminders and tracking features. These tools allow you to monitor the status of your documents and send out timely alerts to signers. By automating these processes, you can avoid last-minute rushes and ensure timely filing.

Get more for Form 720 Rev December Quarterly Federal Excise Tax Return

- Nevada family court form

- Notice to lessor exercising option to purchase nevada form

- Joint petition divorce form

- Nv joint form

- Assignment of lease and rent from borrower to lender nevada form

- Assignment of lease from lessor with notice of assignment nevada form

- Abandoned personal property 497320768 form

- Guaranty or guarantee of payment of rent nevada form

Find out other Form 720 Rev December Quarterly Federal Excise Tax Return

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF