Form 720 Rev June Quarterly Federal Excise Tax Return 2021

What is the Form 720 Rev June Quarterly Federal Excise Tax Return

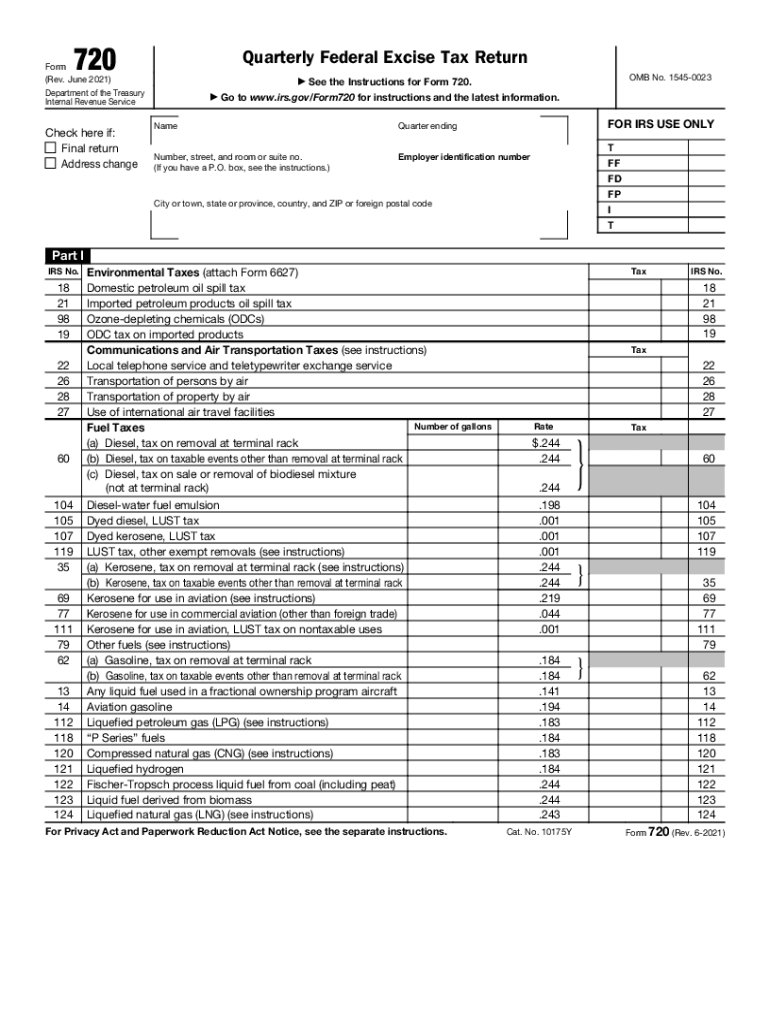

The Form 720, officially known as the Quarterly Federal Excise Tax Return, is a document used by businesses to report and pay federal excise taxes. These taxes can apply to various goods and services, including fuel, air transportation, and certain types of communication services. The form is required to be filed quarterly, which means businesses must keep track of their taxable activities throughout the year to ensure compliance with IRS regulations.

How to use the Form 720 Rev June Quarterly Federal Excise Tax Return

Using the Form 720 involves several steps that ensure accurate reporting of excise taxes. First, businesses need to determine the specific excise taxes applicable to their operations. Next, they must gather relevant financial data for the quarter, including sales figures and any applicable exemptions. Once the necessary information is compiled, the business can complete the form, detailing the taxable amounts and calculating the total tax owed. After completing the form, it must be submitted to the IRS by the specified deadline.

Steps to complete the Form 720 Rev June Quarterly Federal Excise Tax Return

Completing the Form 720 requires careful attention to detail. Here are the key steps:

- Identify the applicable excise taxes based on your business activities.

- Gather financial records for the quarter, including sales and tax-exempt transactions.

- Fill out the form, ensuring all sections are completed accurately.

- Calculate the total excise tax owed based on reported figures.

- Review the form for any errors before submission.

- File the form with the IRS by the deadline, either electronically or via mail.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 are crucial for compliance. The form must be submitted quarterly, with specific due dates typically falling on the last day of the month following the end of each quarter. For example, for the first quarter ending March 31, the form is due by April 30. It is important for businesses to mark these dates on their calendars to avoid penalties for late filing.

Penalties for Non-Compliance

Failure to file the Form 720 on time can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, businesses may face interest charges on any unpaid excise taxes. It is essential for businesses to stay informed about their filing obligations to avoid these financial repercussions.

Legal use of the Form 720 Rev June Quarterly Federal Excise Tax Return

The legal use of the Form 720 is governed by IRS regulations. To ensure compliance, businesses must use the form to accurately report all taxable activities and pay the corresponding excise taxes. Electronic filing is permitted and often encouraged, as it can streamline the submission process and provide immediate confirmation of receipt. Adhering to legal requirements helps businesses maintain good standing with the IRS and avoid potential audits.

Quick guide on how to complete form 720 rev june 2021 quarterly federal excise tax return

Complete Form 720 Rev June Quarterly Federal Excise Tax Return effortlessly on any device

Virtual document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and electronically sign your documents quickly without any holdups. Manage Form 720 Rev June Quarterly Federal Excise Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest approach to modify and electronically sign Form 720 Rev June Quarterly Federal Excise Tax Return effortlessly

- Locate Form 720 Rev June Quarterly Federal Excise Tax Return and select Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically supplies for that purpose.

- Generate your signature using the Sign feature, which takes mere moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 720 Rev June Quarterly Federal Excise Tax Return and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 720 rev june 2021 quarterly federal excise tax return

Create this form in 5 minutes!

How to create an eSignature for the form 720 rev june 2021 quarterly federal excise tax return

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the pricing structure for airSlate SignNow 720?

The pricing for airSlate SignNow 720 is competitive and offers various plans to suit the needs of different businesses. Our pricing tiers include features that enable seamless eSigning for organizations of all sizes. You can choose from monthly or annual subscriptions based on your requirements.

-

What features does airSlate SignNow 720 offer?

airSlate SignNow 720 provides a range of powerful features, including customizable templates, in-person signing, and document merging. These tools enhance workflow efficiency and streamline the process of obtaining eSignatures. With 720, you can also track document status and send reminders to signers.

-

How can airSlate SignNow 720 benefit my business?

Implementing airSlate SignNow 720 can signNowly enhance your business operations by reducing the time spent on paperwork. This solution accelerates the signing process, improving overall productivity and reducing turnaround times. Additionally, it ensures security and compliance for all your important documents.

-

Are there integration options available with airSlate SignNow 720?

Yes, airSlate SignNow 720 offers seamless integrations with popular applications such as Google Drive, Microsoft Office, and Salesforce. These integrations help you streamline your workflow and manage your documents more effectively. By using 720, you can integrate eSigning into your existing systems with ease.

-

Is airSlate SignNow 720 compliant with legal standards?

Absolutely! airSlate SignNow 720 is compliant with global eSignature laws such as ESIGN and UETA in the US, as well as eIDAS in Europe. This means that documents signed through 720 are legally binding and recognized in court. You can confidently use our platform for all your signing needs.

-

Can I use airSlate SignNow 720 on mobile devices?

Yes, airSlate SignNow 720 is fully optimized for mobile devices, allowing you to send and sign documents on the go. Our user-friendly mobile app ensures that eSigning is accessible anytime, anywhere. This flexibility contributes to increased efficiency for remote or traveling teams.

-

How does airSlate SignNow 720 ensure document security?

airSlate SignNow 720 employs advanced encryption measures and secure data handling practices to protect your documents. We prioritize user security by offering features like password protection and two-factor authentication. With 720, you can trust that your sensitive information is safeguarded.

Get more for Form 720 Rev June Quarterly Federal Excise Tax Return

- Sellers information for appraiser provided to buyer alaska

- Legallife multistate guide and handbook for selling or buying real estate alaska form

- Subcontractors agreement alaska form

- Option to purchase addendum to residential lease lease or rent to own alaska form

- Alaska prenuptial premarital agreement with financial statements alaska form

- Alaska prenuptial premarital agreement without financial statements alaska form

- Amendment to prenuptial or premarital agreement alaska form

- Financial statements only in connection with prenuptial premarital agreement alaska form

Find out other Form 720 Rev June Quarterly Federal Excise Tax Return

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter