Form 720 Rev March 2024

What is the Form 720 Rev March

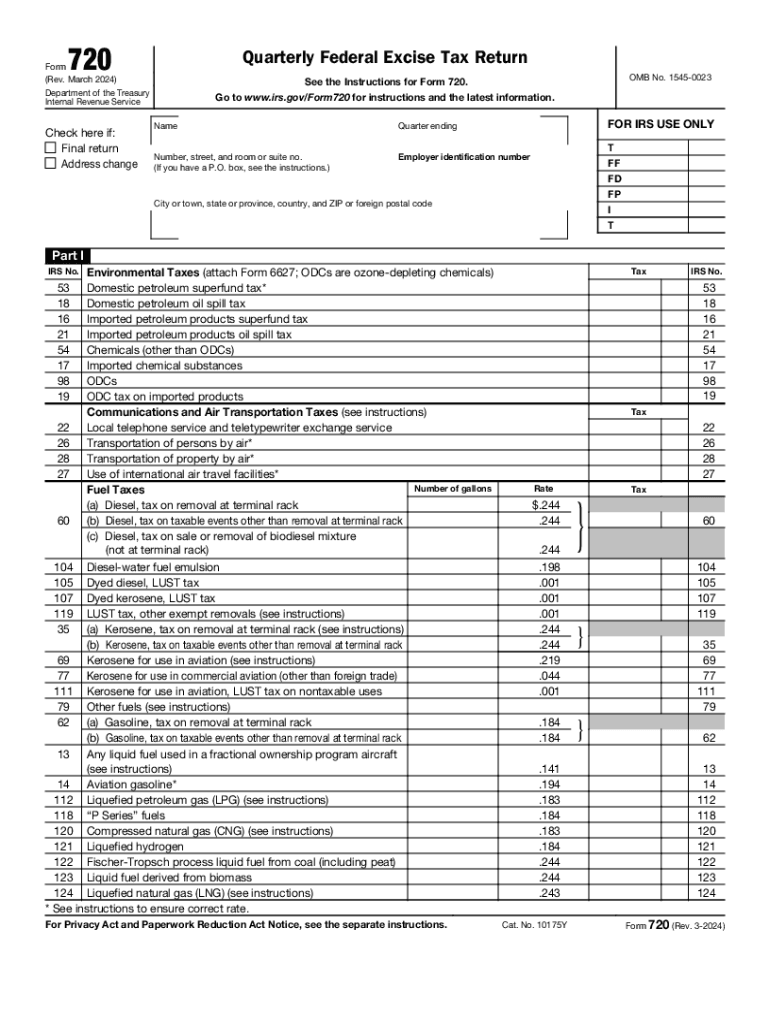

The Form 720, also known as the Quarterly Federal Excise Tax Return, is used by businesses to report and pay federal excise taxes. This form is essential for entities that engage in specific activities, such as manufacturing or importing certain goods, or providing specific services that are subject to excise tax. The form must be filed quarterly, and it includes various tax categories, such as environmental taxes, communications taxes, and fuel taxes.

How to use the Form 720 Rev March

To effectively use Form 720, businesses should first identify the applicable excise taxes relevant to their operations. Each section of the form corresponds to different types of excise taxes. After determining the applicable taxes, businesses need to accurately report their taxable activities and calculate the total taxes owed. It's crucial to ensure that all information is correct to avoid penalties. Once completed, the form can be submitted electronically or by mail, depending on the preference of the filer.

Steps to complete the Form 720 Rev March

Completing Form 720 involves several key steps:

- Gather necessary information, including business details and tax identification numbers.

- Identify the specific excise taxes applicable to your business activities.

- Fill out the form by entering the required data in the appropriate sections.

- Calculate the total excise tax owed based on the reported activities.

- Review the completed form for accuracy before submission.

Once all steps are completed, the form can be filed electronically or mailed to the IRS.

Filing Deadlines / Important Dates

Form 720 must be filed quarterly, with specific due dates that are critical for compliance. Generally, the deadlines for filing are:

- For the first quarter (January to March): Due by April 30.

- For the second quarter (April to June): Due by July 31.

- For the third quarter (July to September): Due by October 31.

- For the fourth quarter (October to December): Due by January 31 of the following year.

It is important to adhere to these deadlines to avoid penalties and interest on late payments.

Who Issues the Form

The Form 720 is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides guidelines and instructions for completing the form, ensuring that businesses understand their obligations regarding federal excise taxes.

Penalties for Non-Compliance

Failure to file Form 720 on time or accurately can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate quickly. Additionally, underreporting excise taxes can lead to further penalties and interest on unpaid amounts. It is crucial for businesses to understand the importance of compliance to avoid these financial repercussions.

Quick guide on how to complete form 720 rev march

Complete Form 720 Rev March effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with everything you need to create, edit, and eSign your documents promptly without interruptions. Manage Form 720 Rev March across any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven task today.

How to modify and eSign Form 720 Rev March seamlessly

- Find Form 720 Rev March and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight essential sections of the documents or mask sensitive information with tools specifically available through airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 720 Rev March and ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 720 rev march

Create this form in 5 minutes!

How to create an eSignature for the form 720 rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 720?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The '720' refers to the streamlined process that airSlate SignNow offers, enabling users to complete transactions quickly and efficiently. With its user-friendly interface, businesses can enhance their workflow and save time.

-

How much does airSlate SignNow cost for users looking for a 720 solution?

The pricing for airSlate SignNow is competitive and designed to fit various business needs. For users interested in the '720' plan, there are flexible subscription options that provide access to essential features at an affordable rate. This ensures that businesses can leverage the benefits of eSigning without breaking the bank.

-

What features does airSlate SignNow offer that support the 720 process?

airSlate SignNow includes a range of features that enhance the 720 process, such as customizable templates, real-time tracking, and secure cloud storage. These features allow users to manage their documents efficiently and ensure that all signatures are collected promptly. Additionally, the platform supports various file formats, making it versatile for different business needs.

-

How can airSlate SignNow improve my business's efficiency with the 720 approach?

By adopting airSlate SignNow, businesses can signNowly improve their efficiency through the 720 approach, which emphasizes speed and simplicity. The platform automates many manual processes, reducing the time spent on document management. This allows teams to focus on core activities while ensuring that contracts and agreements are executed swiftly.

-

What integrations does airSlate SignNow offer for a seamless 720 experience?

airSlate SignNow integrates seamlessly with various applications, enhancing the 720 experience for users. Popular integrations include CRM systems, cloud storage services, and productivity tools, allowing businesses to streamline their workflows. These integrations ensure that users can manage their documents within their existing software ecosystem.

-

Is airSlate SignNow secure for handling sensitive documents in the 720 process?

Yes, airSlate SignNow prioritizes security, making it a reliable choice for handling sensitive documents in the 720 process. The platform employs advanced encryption and complies with industry standards to protect user data. This ensures that all transactions are secure, giving businesses peace of mind when sending and signing documents.

-

Can I customize my documents using airSlate SignNow for the 720 workflow?

Absolutely! airSlate SignNow allows users to customize their documents to fit the 720 workflow perfectly. You can create templates, add branding elements, and specify fields for signatures and information. This customization ensures that your documents reflect your business's identity while maintaining professionalism.

Get more for Form 720 Rev March

Find out other Form 720 Rev March

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast