Form 720 2014

What is the Form 720

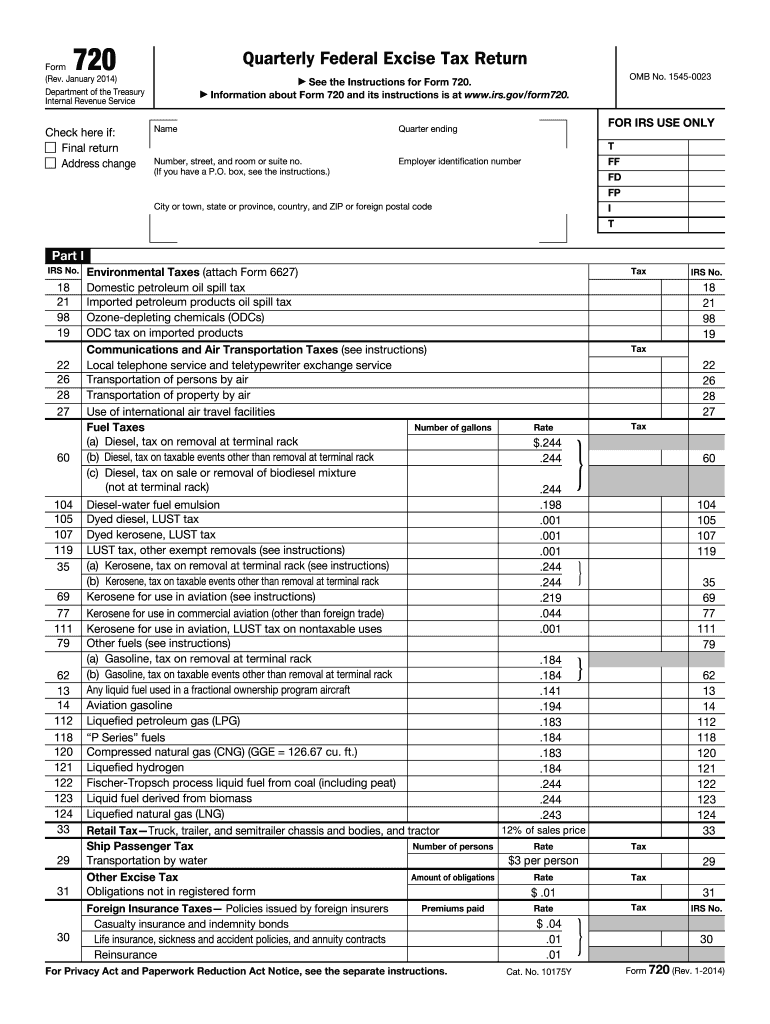

The Form 720 is a tax form used by businesses in the United States to report and pay certain federal excise taxes. This form is essential for entities that engage in activities subject to excise tax, such as the sale of specific goods or services. It is important to understand that the Form 720 encompasses various tax liabilities, including those related to environmental taxes, communications taxes, and fuel taxes. Proper completion and timely submission of this form ensure compliance with IRS regulations.

How to use the Form 720

Using the Form 720 involves several steps. First, businesses must identify the specific excise taxes they are liable for. Once the applicable taxes are determined, the next step is to accurately fill out the form, detailing the amounts due for each tax category. After completing the form, businesses can submit it either electronically or via mail, depending on their preference and IRS guidelines. Maintaining accurate records of all transactions related to the excise taxes reported on the Form 720 is also crucial for future reference and potential audits.

Steps to complete the Form 720

Completing the Form 720 requires careful attention to detail. Follow these steps for accurate submission:

- Gather all necessary information regarding your business and the specific excise taxes applicable to your operations.

- Download the latest version of the Form 720 from the IRS website or use an approved e-filing software.

- Fill out the form, ensuring that all fields are completed accurately, including business details and tax amounts.

- Review the completed form for any errors or omissions.

- Submit the form electronically through an approved e-filing system or print and mail it to the appropriate IRS address.

Legal use of the Form 720

The legal use of the Form 720 is governed by IRS regulations. It is essential for businesses to ensure that they are using the correct version of the form and that it is filled out in compliance with federal tax laws. Failure to comply with these regulations can result in penalties or fines. Additionally, businesses must keep records of submitted forms and any supporting documentation for at least three years, as required by IRS guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 are crucial for compliance. Generally, the form must be filed quarterly, with specific due dates for each quarter. For example, the due date for the first quarter is typically April 30, while the second quarter is due by July 31. It is important for businesses to be aware of these deadlines to avoid late fees or penalties. Marking these dates on a calendar can help ensure timely submissions.

Required Documents

When completing the Form 720, certain documents may be required to support the information reported. These may include:

- Financial records detailing sales and transactions subject to excise tax.

- Invoices or receipts for purchases related to taxable goods or services.

- Any prior year tax returns that may provide context or necessary information.

Having these documents readily available can facilitate accurate completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete 2014 form 720

Effortlessly Prepare Form 720 on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Handle Form 720 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and eSign Form 720 with Ease

- Find Form 720 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 720 and ensure excellent communication throughout the entire process of preparing your forms with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 720

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 720

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 720 and why do I need it?

Form 720 is a tax form used by businesses to report and pay federal excise taxes. It is essential for compliance with IRS regulations and to avoid potential penalties. Using airSlate SignNow simplifies the process of signing and submitting Form 720, ensuring that your documents are securely eSigned and filed on time.

-

How can airSlate SignNow help me with Form 720?

airSlate SignNow provides an intuitive platform for businesses to easily create, eSign, and manage Form 720 and other important documents. With our user-friendly interface, you can streamline the signing process and ensure that your Form 720 is accurately completed and submitted without hassle.

-

What are the pricing options for using airSlate SignNow for Form 720?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage Form 720 and other documents efficiently. Our pricing is designed to be cost-effective, allowing you to choose a plan that fits your budget while providing all the features you need to handle Form 720 seamlessly.

-

Can I integrate airSlate SignNow with my existing software for Form 720 management?

Yes, airSlate SignNow easily integrates with various software applications, enhancing your workflow for managing Form 720. Whether you use CRM systems, document management software, or accounting tools, our integrations help streamline the process of eSigning and submitting your Form 720.

-

Is airSlate SignNow secure for handling sensitive documents like Form 720?

Absolutely! airSlate SignNow prioritizes security and compliance, implementing advanced encryption and data protection measures for all documents, including Form 720. You can trust our platform to keep your sensitive tax information secure while allowing for easy access and eSigning.

-

What features does airSlate SignNow offer for completing Form 720?

airSlate SignNow offers a range of features designed to simplify the completion of Form 720, including customizable templates, bulk sending, and real-time tracking of document status. These tools help ensure that your Form 720 is prepared accurately and efficiently.

-

How does airSlate SignNow enhance collaboration for Form 720 submissions?

With airSlate SignNow, collaboration on Form 720 submissions is made easy. You can invite team members to review and eSign the form, track changes, and communicate directly within the platform, ensuring that everyone is on the same page and your Form 720 is completed correctly.

Get more for Form 720

- Westpac kiwisaver scheme switch form

- How much is the inz fee form

- Performance agreement form

- Work capacity medical certificate v12a form

- Ir 344 employer monthly schedule amendments rgmaccountants co form

- 90 day notice to termination of tenancy form

- First aid certificate format pdf

- Client consultation form spa beauty nz

Find out other Form 720

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement