1065 K 1 Form 2012

What is the 1065 K-1 Form

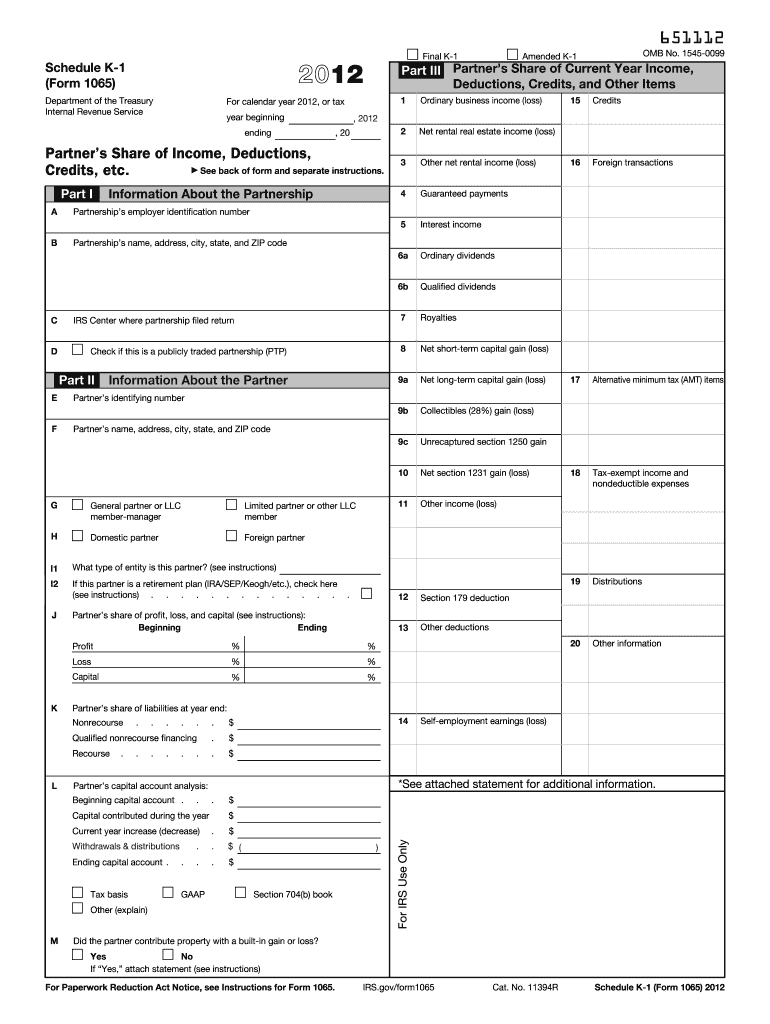

The 1065 K-1 Form is a tax document used in the United States by partnerships to report income, deductions, and credits to individual partners. It provides each partner with a detailed account of their share of the partnership’s income, losses, and other tax-related items. This form is essential for partners to accurately report their earnings on their individual tax returns, ensuring compliance with IRS regulations. The information on the K-1 is derived from the partnership's Form 1065, which is filed annually by the partnership itself.

How to use the 1065 K-1 Form

To use the 1065 K-1 Form, partners must first receive their K-1 from the partnership. Once received, partners should review the form for accuracy, ensuring that the reported income, deductions, and credits match their expectations based on the partnership's performance. The information on the K-1 should then be transferred to the partner's individual tax return, typically on Schedule E of Form 1040. It is crucial to retain a copy of the K-1 for personal records and future reference, as it may be needed for audits or other tax-related inquiries.

Steps to complete the 1065 K-1 Form

Completing the 1065 K-1 Form involves several steps:

- Gather necessary information: Collect all relevant financial data from the partnership, including income, deductions, and credits.

- Fill out the form: Enter the partnership's details, including its name, address, and Employer Identification Number (EIN). Then, input the partner’s share of income, losses, and other items as reported by the partnership.

- Review for accuracy: Ensure all entries are correct and reflect the partnership’s financial performance accurately.

- Submit to the IRS: Partners do not submit the K-1 to the IRS directly. Instead, they use the information to complete their personal tax returns.

Legal use of the 1065 K-1 Form

The 1065 K-1 Form is legally binding and must be completed accurately to comply with IRS regulations. Each partner is responsible for the information reported on their K-1, and any discrepancies can lead to penalties or audits. It is essential for partnerships to provide K-1 forms to partners by the IRS deadline, ensuring that partners can file their tax returns on time. Failure to provide accurate K-1s can result in legal ramifications for both the partnership and its partners.

Filing Deadlines / Important Dates

The filing deadlines for the 1065 K-1 Form are closely tied to the partnership's Form 1065 submission. Partnerships must file Form 1065 by March 15 for calendar year filers. K-1 forms should be distributed to partners by this date to allow adequate time for partners to complete their individual tax returns. If the partnership files for an extension, partners should still receive their K-1s by the extended deadline, which is typically September 15.

Who Issues the Form

The 1065 K-1 Form is issued by partnerships to their partners. The partnership is responsible for preparing and distributing the K-1s, ensuring that each partner receives accurate information regarding their share of the partnership’s income and expenses. This form is crucial for the partners to report their earnings correctly on their individual tax returns, making it an essential part of the partnership's tax reporting process.

Quick guide on how to complete 1065 k 1 2012 form

Handle 1065 K 1 Form effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, enabling you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage 1065 K 1 Form on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign 1065 K 1 Form with ease

- Find 1065 K 1 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize crucial parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign 1065 K 1 Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1065 k 1 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 1065 k 1 2012 form

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is a 1065 K 1 Form and why is it important?

The 1065 K 1 Form is a tax document used to report income, deductions, and credits from partnerships to individual partners. It is crucial for partners to accurately report their share of the partnership's income on their personal tax returns. Understanding how to fill out and use the 1065 K 1 Form can ensure compliance with IRS requirements and help partners avoid potential penalties.

-

How can airSlate SignNow simplify the process of signing the 1065 K 1 Form?

airSlate SignNow provides an intuitive platform that allows users to easily eSign the 1065 K 1 Form online. With customizable templates and a straightforward signing process, you can streamline document management and ensure that all partners can quickly sign and return their forms. This reduces delays and enhances efficiency in tax preparation.

-

What features does airSlate SignNow offer for managing the 1065 K 1 Form?

airSlate SignNow offers features such as document templates, real-time tracking, and secure storage, making it ideal for managing the 1065 K 1 Form. Its electronic signature capabilities ensure that each partner can sign from anywhere, while cloud storage keeps your documents safe and accessible. These features help simplify the complexities of partnership taxation.

-

Is there a cost associated with using airSlate SignNow for the 1065 K 1 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for processing the 1065 K 1 Form. Whether you're a small business or a large partnership, you can choose a plan that best suits your volume of documents and signing frequency. Check our pricing page for details on features included in each plan.

-

Can I integrate airSlate SignNow with other tools for managing the 1065 K 1 Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and document management software, allowing for efficient handling of the 1065 K 1 Form. By connecting your existing tools, you can streamline workflows and minimize manual data entry, making tax season less stressful.

-

How secure is the airSlate SignNow platform for handling sensitive documents like the 1065 K 1 Form?

Security is a top priority at airSlate SignNow. The platform uses bank-level encryption and complies with industry standards to protect sensitive documents like the 1065 K 1 Form. You can trust that your data is safe while using our eSignature solution.

-

What benefits does electronic signing provide for the 1065 K 1 Form?

Using electronic signatures for the 1065 K 1 Form offers numerous benefits, including speed, convenience, and reduced paper usage. With airSlate SignNow, partners can sign from any device, anywhere, which accelerates the document turnaround time. This not only enhances productivity but also supports environmentally-friendly practices.

Get more for 1065 K 1 Form

Find out other 1065 K 1 Form

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile