K1 Form 2008

What is the K1 Form

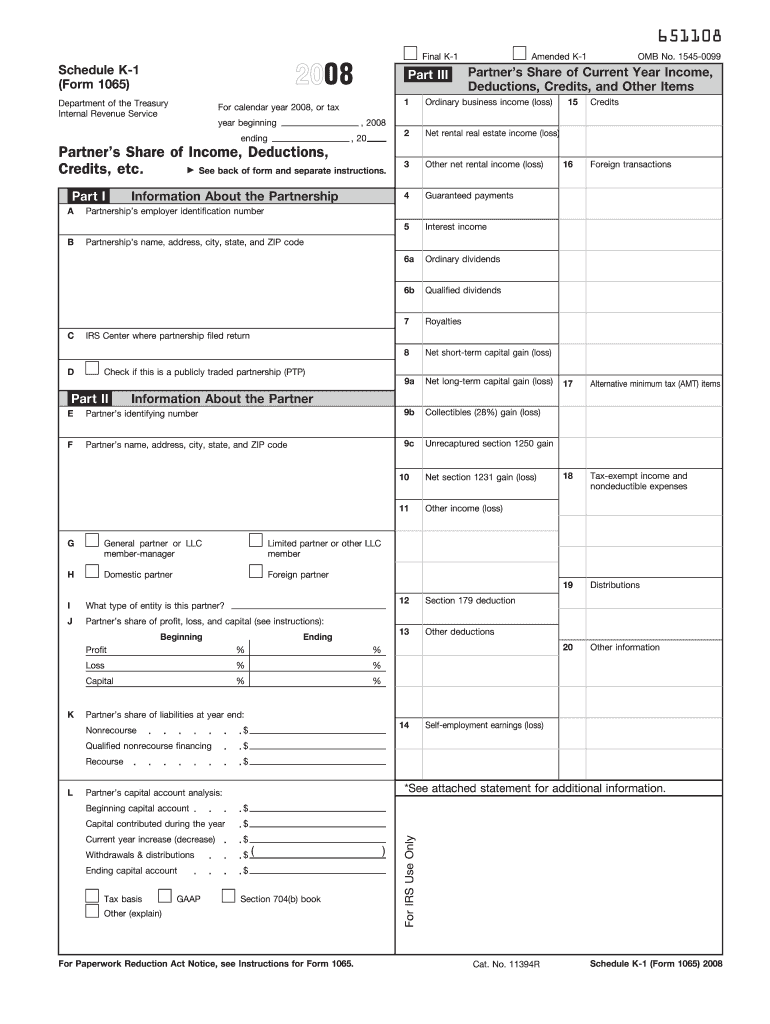

The K1 Form, officially known as Schedule K-1, is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of the entity's income, which is essential for individual tax returns. The K1 Form is typically issued annually and is crucial for ensuring accurate reporting of earnings and tax obligations.

How to use the K1 Form

Using the K1 Form involves several steps. First, individuals must receive their K1 from the entity they are involved with, such as a partnership or S corporation. Once received, the information on the K1 must be carefully reviewed. This includes checking the reported income, deductions, and credits. The next step is to incorporate this information into the individual's tax return, specifically on Form 1040. It is important to ensure that all figures are accurately transferred to avoid discrepancies with the IRS.

Steps to complete the K1 Form

Completing the K1 Form requires attention to detail. Here are the steps to follow:

- Gather necessary information about the partnership or S corporation, including its EIN and business address.

- Fill in the partner or shareholder's details, such as name, address, and tax identification number.

- Report the income, deductions, and credits as allocated to the individual based on the entity's operating agreement.

- Ensure all entries are accurate and complete before submission.

- Provide a copy of the K1 to the individual for their records and tax filing.

Legal use of the K1 Form

The K1 Form is legally recognized as a valid document for reporting income and tax liabilities. It must be completed in accordance with IRS guidelines to ensure compliance. Each partner or shareholder is responsible for accurately reporting the information on their individual tax returns. Failure to report K1 income can lead to penalties and interest from the IRS, making it essential to handle the form correctly.

Filing Deadlines / Important Dates

Filing deadlines for the K1 Form align with the tax return deadlines for partnerships and S corporations. Typically, partnerships must file their K1s by March 15 for the previous tax year. If an extension is filed, the deadline may be extended to September 15. It is crucial for partners and shareholders to receive their K1s on time to ensure they can accurately file their individual tax returns by the April 15 deadline.

Who Issues the Form

The K1 Form is issued by partnerships, S corporations, estates, and trusts. Each entity is responsible for preparing and distributing the K1 to its partners or shareholders. This form must be provided to individuals by the entity's filing deadline, allowing recipients to use the information for their personal tax filings. Accurate issuance is essential for compliance with IRS regulations.

Quick guide on how to complete 2008 k1 form

Effortlessly Prepare K1 Form on Any Device

Digital document management has grown increasingly popular among both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Manage K1 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Alter and Electronically Sign K1 Form with Ease

- Find K1 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or hide sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign K1 Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 k1 form

Create this form in 5 minutes!

How to create an eSignature for the 2008 k1 form

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is a K1 Form and why is it important?

A K1 Form, also known as Schedule K-1, is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. Understanding the K1 Form is essential for accurate tax reporting, as it provides detailed information on your share of the entity's income. This form ensures that you report your earnings correctly to the IRS, avoiding potential penalties.

-

How can airSlate SignNow help me manage my K1 Form?

With airSlate SignNow, you can easily create, send, and eSign your K1 Form digitally, streamlining the process signNowly. Our platform allows you to upload your K1 Form template, fill it out, and send it to your partners or stakeholders for their electronic signatures, all in one place. This eliminates the hassle of paper documents and speeds up the completion process.

-

Is airSlate SignNow cost-effective for managing multiple K1 Forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing multiple K1 Forms. Our subscription models are designed to fit your budget while providing unlimited eSigning capabilities, ensuring you can handle all your tax documents efficiently without overspending.

-

What features does airSlate SignNow offer for K1 Form eSigning?

airSlate SignNow includes a variety of features tailored for K1 Form eSigning, such as templates, bulk sending, and real-time tracking of document status. Our user-friendly interface makes it easy to navigate through the signing process, while advanced security measures ensure your K1 Forms are protected. Additionally, you can integrate with other tools to streamline your workflow.

-

Can I integrate airSlate SignNow with accounting software for K1 Forms?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, allowing you to manage your K1 Forms alongside your financial records. This integration simplifies the process of importing data and ensures that your K1 Forms are completed accurately with the necessary financial information. Enjoy a cohesive workflow by connecting your tools effortlessly.

-

How secure is airSlate SignNow for handling K1 Forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like K1 Forms. We use advanced encryption protocols to protect your data and ensure that all electronic signatures comply with legal standards. Rest assured that your K1 Forms are safe and secure throughout the signing process.

-

What type of support does airSlate SignNow provide for K1 Form users?

airSlate SignNow offers comprehensive support for users managing K1 Forms, including a rich knowledge base, instructional videos, and responsive customer service. Whether you have questions about eSigning or need assistance with document management, our dedicated support team is here to help you navigate any challenges you may encounter.

Get more for K1 Form

- Viking ship anatomy form

- Declarations acknowledgments and consents for natural form

- Facility report form

- Matching program form

- Electronic fund transfer authorization form florida lottery

- Application for initial credentialing advanced practice form

- Usa cycling waiver form

- Firefighter city of athens ohio form

Find out other K1 Form

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy