1065 Form 2014

What is the 1065 Form

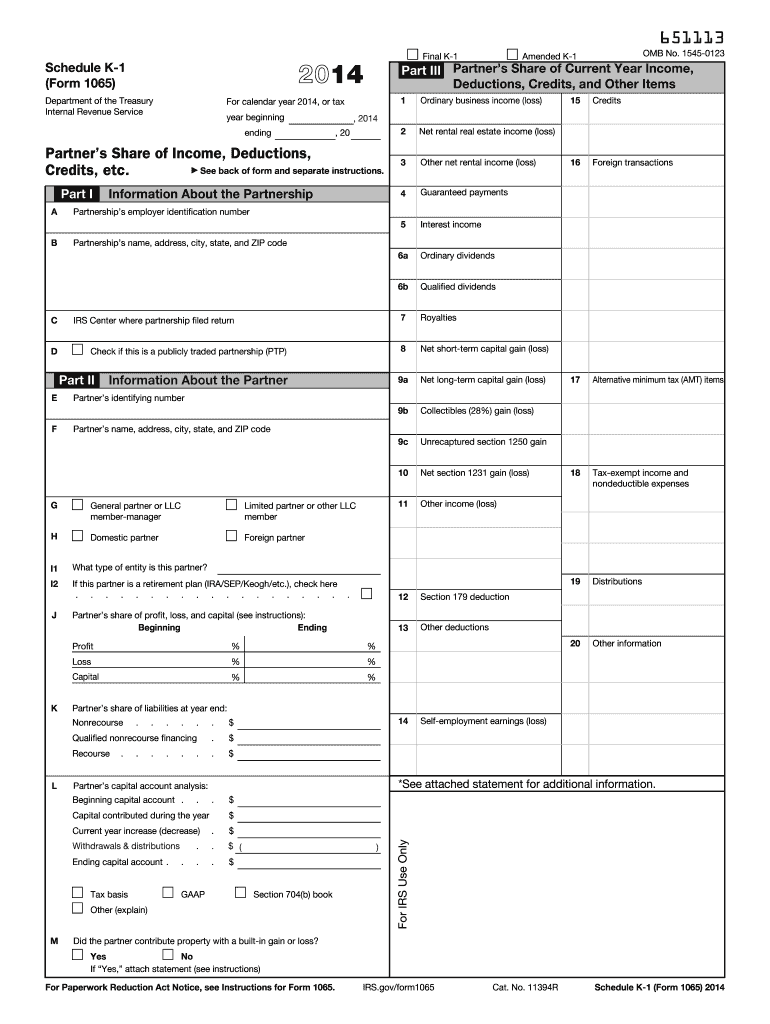

The 1065 Form is a U.S. tax document used by partnerships to report income, deductions, gains, losses, and other important financial information. Unlike individual tax returns, the 1065 Form does not calculate tax liability for the partnership itself; instead, it provides the IRS with a comprehensive overview of the partnership's financial activities. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits, allowing them to report this information on their individual tax returns.

Steps to complete the 1065 Form

Completing the 1065 Form involves several key steps to ensure accuracy and compliance with IRS regulations. Here’s a simplified process:

- Gather financial records: Collect all relevant financial documents, including income statements, expense reports, and records of capital contributions.

- Fill out the form: Enter the partnership's income, deductions, and other required information in the appropriate sections of the 1065 Form.

- Prepare Schedule K-1: For each partner, complete a Schedule K-1, detailing their share of the partnership's financials.

- Review for accuracy: Double-check all entries for errors or omissions to avoid penalties.

- File the form: Submit the completed 1065 Form and all Schedule K-1s to the IRS by the deadline.

How to obtain the 1065 Form

The 1065 Form can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be printed and filled out manually or completed digitally. Additionally, many tax preparation software programs include the 1065 Form, allowing for easier completion and e-filing. Ensure that you are using the most current version of the form to comply with IRS requirements.

Legal use of the 1065 Form

The legal use of the 1065 Form is essential for partnerships to accurately report their financial activities to the IRS. Filing this form is required by law for all partnerships, and failure to do so can result in penalties. The information provided on the form must be truthful and complete, as it can be subject to audits. By using the 1065 Form correctly, partnerships can ensure compliance with federal tax laws and maintain their legal standing.

Filing Deadlines / Important Dates

The deadline for filing the 1065 Form is typically March 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Partnerships may request a six-month extension by filing Form 7004, which allows additional time to complete and submit the 1065 Form. It is crucial to adhere to these deadlines to avoid late filing penalties.

Key elements of the 1065 Form

The 1065 Form consists of several key sections that must be completed accurately. These include:

- Partnership Information: Basic details about the partnership, including name, address, and Employer Identification Number (EIN).

- Income Section: Reporting total income earned by the partnership during the tax year.

- Deductions Section: Listing allowable deductions that can reduce the partnership's taxable income.

- Schedule K-1: Individual partner information detailing each partner's share of income, deductions, and credits.

Quick guide on how to complete 1065 2014 form

Prepare 1065 Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Handle 1065 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1065 Form effortlessly

- Locate 1065 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Adjust and eSign 1065 Form and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1065 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 1065 2014 form

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is a 1065 Form and why is it important?

The 1065 Form is a tax document used by partnerships to report income, deductions, and credits to the IRS. It is important for ensuring compliance with federal tax regulations and accurately presenting the partnership's financial activities. Filing the 1065 Form enables partners to report their share of the partnership's income on their individual tax returns.

-

How can airSlate SignNow help with the 1065 Form?

airSlate SignNow simplifies the process of completing and eSigning the 1065 Form by providing an easy-to-use, cost-effective digital platform. Users can easily upload, fill out, and send this important tax document for signature, ensuring a smooth workflow for businesses. This efficiency reduces headaches associated with paper documentation.

-

What are the benefits of using airSlate SignNow for the 1065 Form?

Using airSlate SignNow for the 1065 Form offers several benefits, including enhanced security, ease of collaboration, and time savings. The platform's features allow multiple partners to review and sign the document seamlessly. Additionally, electronic signatures are legally binding, streamlining your tax filing process.

-

Is there a cost associated with using airSlate SignNow for the 1065 Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. Users can choose a plan that fits their budget while gaining access to features that simplify the eSigning process for documents like the 1065 Form. The cost is often considered a worthwhile investment for the efficiency it provides.

-

Can I integrate airSlate SignNow with other software for filing the 1065 Form?

Absolutely! airSlate SignNow provides integration options with various business tools and accounting software, making it easier to manage the 1065 Form and other important documents. These integrations enhance workflow efficiency, allowing for a seamless transfer of information across platforms.

-

How secure is airSlate SignNow when handling the 1065 Form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards. This ensures that your 1065 Form and any sensitive financial data are protected during the signing process. You can confidently manage your documents without worrying about data bsignNowes.

-

What features does airSlate SignNow offer for completing the 1065 Form?

airSlate SignNow offers numerous features that aid in completing the 1065 Form, including customizable templates, in-app editing, and the ability to track document status. Users can also utilize reminders and notifications, ensuring that no step is overlooked during the signing process. These features make managing tax documents more efficient.

Get more for 1065 Form

Find out other 1065 Form

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online