1065 Form 2016

What is the 1065 Form

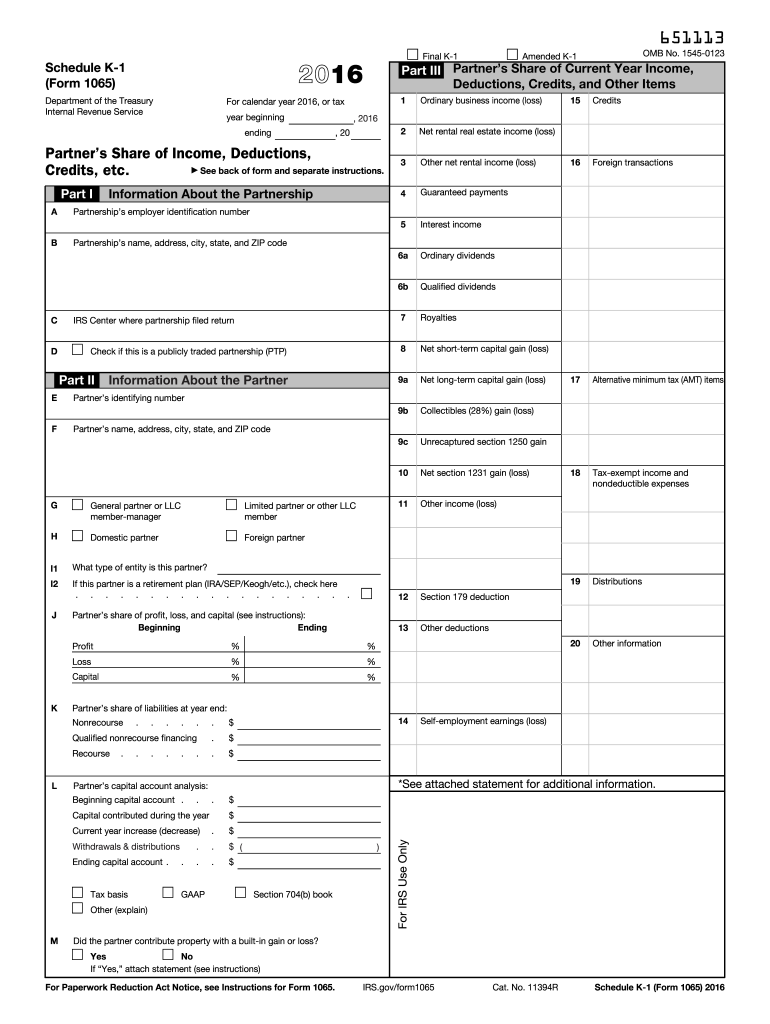

The 1065 Form is a tax document used by partnerships in the United States to report income, deductions, gains, and losses from the partnership's operations. It is essential for partnerships, including limited liability companies (LLCs) that choose to be taxed as partnerships. The form provides the Internal Revenue Service (IRS) with a comprehensive overview of the partnership's financial activities over the tax year.

Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits. This information is crucial for partners when they file their individual tax returns, as it impacts their overall tax liability.

How to use the 1065 Form

Using the 1065 Form involves several steps that ensure accurate reporting of the partnership's financial activities. First, gather all necessary financial records, including income statements, expense receipts, and prior year tax returns. This documentation will help in accurately filling out the form.

Next, complete the 1065 Form by entering the partnership's name, address, and Employer Identification Number (EIN). Then, report the partnership's income, deductions, and other relevant financial information. After completing the form, ensure all partners review the information for accuracy before submission.

Steps to complete the 1065 Form

Completing the 1065 Form can be broken down into clear steps:

- Gather all financial documents, including income and expense records.

- Fill in the partnership's basic information, such as name, address, and EIN.

- Report total income, including sales and other revenue sources.

- Detail deductions, including operating expenses, salaries, and other costs.

- Calculate the partnership's total income or loss.

- Complete the Schedule K-1 for each partner, detailing their share of income and deductions.

- Review the entire form for accuracy and completeness.

- Submit the form to the IRS by the specified deadline.

Legal use of the 1065 Form

The 1065 Form serves a legal purpose by ensuring that partnerships comply with federal tax laws. It is a requirement under the Internal Revenue Code for partnerships to report their income and expenses accurately. Failure to file the form or providing inaccurate information can lead to penalties and interest charges from the IRS.

Additionally, the form must be signed by a partner or authorized representative, validating the information provided. This legal requirement emphasizes the importance of maintaining accurate records and ensuring compliance with tax regulations.

Filing Deadlines / Important Dates

The deadline for filing the 1065 Form is typically March 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Partnerships can request a six-month extension, allowing them to file by September 15.

It is crucial for partnerships to adhere to these deadlines to avoid penalties and ensure timely processing of their tax information.

Penalties for Non-Compliance

Partnerships that fail to file the 1065 Form on time or provide inaccurate information may face significant penalties. The IRS imposes a penalty for each month the return is late, up to a maximum of twelve months. Additionally, inaccuracies in the form can lead to further penalties, including interest on any unpaid taxes.

To mitigate these risks, partnerships should ensure timely and accurate filing of the 1065 Form, along with all required schedules and documentation.

Quick guide on how to complete 1065 2016 form

Manage 1065 Form seamlessly on any device

Digital document management has become preferred among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle 1065 Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign 1065 Form with ease

- Locate 1065 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign 1065 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1065 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1065 2016 form

How to make an eSignature for the 1065 2016 Form in the online mode

How to generate an electronic signature for your 1065 2016 Form in Google Chrome

How to generate an electronic signature for putting it on the 1065 2016 Form in Gmail

How to make an electronic signature for the 1065 2016 Form from your smartphone

How to create an eSignature for the 1065 2016 Form on iOS devices

How to generate an eSignature for the 1065 2016 Form on Android

People also ask

-

What is the 1065 Form used for?

The 1065 Form is a tax return filed by partnerships in the United States to report income, deductions, gains, and losses. It provides essential information about the partnership's financial activities, which is crucial for tax reporting. Using airSlate SignNow, you can easily eSign and send your 1065 Form securely, ensuring compliance and accuracy.

-

How can airSlate SignNow help with filing the 1065 Form?

airSlate SignNow simplifies the process of filling out and submitting the 1065 Form by allowing users to easily fill, sign, and send documents electronically. With our platform, you can streamline collaboration among partners, ensuring that all necessary signatures are collected quickly and efficiently. This reduces the risk of errors and helps maintain compliance with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for the 1065 Form?

Yes, while airSlate SignNow offers a variety of pricing plans, the cost is competitive and offers great value for businesses needing to eSign documents, including the 1065 Form. You can choose from several subscription options based on your usage needs. Additionally, we provide a free trial to help you explore our features before making a commitment.

-

What features does airSlate SignNow offer for handling the 1065 Form?

airSlate SignNow offers a range of features that enhance the eSigning process for the 1065 Form, including customizable templates, bulk sending, and real-time tracking. These features ensure that your documents are handled swiftly and securely, making it easier to manage your partnership's filings. Plus, our user-friendly interface allows for seamless navigation and document management.

-

Are there integrations available for managing the 1065 Form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, making it easier to manage your 1065 Form alongside your other business tools. Whether you use accounting software or document management systems, our integrations help streamline your workflow and enhance productivity. This connectivity allows for efficient data transfer and saves you time.

-

Can I access the 1065 Form on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be accessible on mobile devices, allowing you to manage and eSign your 1065 Form from anywhere. With our mobile app, you can easily fill out your forms, collect signatures, and track document status on the go. This flexibility is perfect for busy professionals who need to manage their tax documentation anytime, anywhere.

-

What security measures does airSlate SignNow take for the 1065 Form?

Security is a top priority at airSlate SignNow. We employ robust encryption and secure cloud storage to protect your 1065 Form and other sensitive documents. Additionally, our platform complies with industry standards and regulations, ensuring that your data remains confidential and secure throughout the eSigning process.

Get more for 1065 Form

- Psb 01 form

- Form psb 14 texas department of publice safety

- Psb 44 critical infrastructure attestation form

- Psb 55b dps texas form

- Psb 38a form

- Offsite storage waiver board of pharmacy state of california pharmacy ca form

- His needs her needs pdf form

- Certificate of insurance application hiainsurance com au form

Find out other 1065 Form

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe