Part III Partners Share of Current Year Income, IRS Tax Forms 2022

Understanding Part III: Partner's Share of Current Year Income

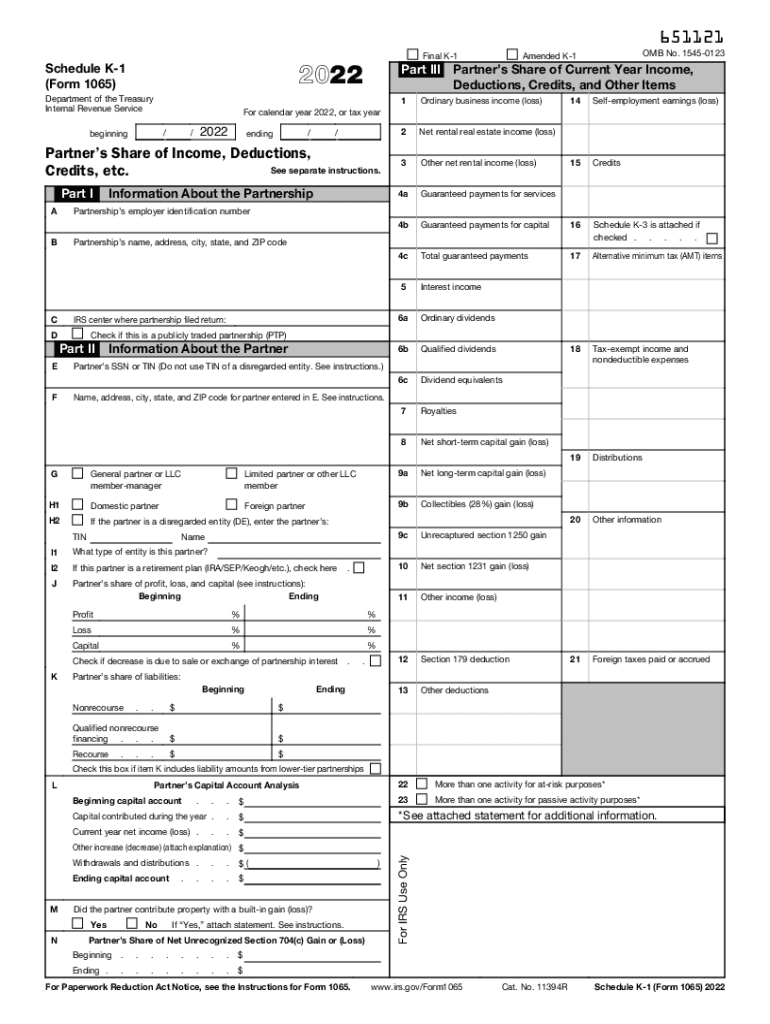

The Part III section of the 2022 Schedule K-1 form details each partner's share of the current year's income, deductions, and credits. This information is crucial for partners in a partnership, as it directly impacts their individual tax returns. The amounts reported in this section are derived from the partnership's overall income and are allocated based on each partner's ownership interest. Accurate reporting ensures compliance with IRS regulations and helps partners understand their tax obligations.

Steps to Complete Part III: Partner's Share of Current Year Income

Completing Part III of the 2022 Schedule K-1 requires careful attention to detail. Here are the steps to follow:

- Identify the total income of the partnership for the tax year.

- Determine each partner's percentage share based on the partnership agreement.

- Calculate the partner's allocated share of income by multiplying the total income by their ownership percentage.

- Report the calculated amount in the appropriate box of Part III on the Schedule K-1.

Ensure that all calculations are accurate to avoid discrepancies that could lead to penalties or audits.

IRS Guidelines for Reporting Part III Income

The IRS provides specific guidelines for reporting income on the Schedule K-1. It is essential to follow these rules to ensure compliance:

- Income must be reported in accordance with the partner's share as defined in the partnership agreement.

- All income types, including ordinary business income, rental income, and capital gains, should be accurately categorized.

- Partners must receive a copy of their Schedule K-1 by the due date of the partnership return.

Adhering to these guidelines helps avoid potential issues with the IRS and ensures that partners report their income correctly on their individual tax returns.

Filing Deadlines for Schedule K-1

Filing deadlines for the 2022 Schedule K-1 are aligned with the partnership's tax return due date. Typically, partnerships must file their Form 1065 by March 15, 2023, unless an extension is filed. Partners should receive their K-1 forms by this date to ensure timely filing of their personal tax returns. It is important to be aware of these deadlines to avoid penalties and interest for late filing.

Required Documents for Completing Schedule K-1

To accurately complete the 2022 Schedule K-1, several documents are necessary:

- The partnership agreement, which outlines the ownership percentages and profit-sharing arrangements.

- The partnership's financial statements, including income statements and balance sheets.

- Any prior year K-1 forms, which may provide context for current year allocations.

Gathering these documents in advance can streamline the completion process and ensure accuracy in reporting.

Penalties for Non-Compliance with Schedule K-1 Reporting

Failure to accurately report income on the Schedule K-1 can result in significant penalties. The IRS may impose fines for incorrect or late submissions. Additionally, partners who underreport income based on incorrect K-1 information may face audits, interest charges, and further penalties. It is crucial to ensure that all information is correct and submitted on time to avoid these consequences.

Quick guide on how to complete 2022 part iii partners share of current year income irs tax forms

Complete Part III Partners Share Of Current Year Income, IRS Tax Forms seamlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the desired form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents promptly without any delays. Manage Part III Partners Share Of Current Year Income, IRS Tax Forms on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Part III Partners Share Of Current Year Income, IRS Tax Forms effortlessly

- Find Part III Partners Share Of Current Year Income, IRS Tax Forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, such as email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Part III Partners Share Of Current Year Income, IRS Tax Forms and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 part iii partners share of current year income irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the 2022 schedule 1 form, and how does it relate to airSlate SignNow?

The 2022 schedule 1 form is used to report additional income and adjustments to income on your tax return. With airSlate SignNow, you can easily send, receive, and eSign your schedule 1 documents, making tax season smoother and more efficient.

-

How can airSlate SignNow help me with my 2022 schedule 1 submissions?

AirSlate SignNow provides a straightforward platform for eSigning your 2022 schedule 1 forms, ensuring a secure and timely submission. Our intuitive interface allows you to manage your documents seamlessly, reducing the risk of delays or errors.

-

What pricing plans does airSlate SignNow offer for eSigning forms like the 2022 schedule 1?

AirSlate SignNow offers flexible pricing plans designed to cater to different business needs, all while ensuring you can handle forms like the 2022 schedule 1 efficiently. With plans starting at an affordable rate, you get access to essential eSigning features that save you time and money.

-

Is it safe to eSign my 2022 schedule 1 documents with airSlate SignNow?

Absolutely! AirSlate SignNow employs robust security measures, including encryption and secure access, to protect your 2022 schedule 1 documents. You can trust that your sensitive information remains confidential and secure throughout the eSigning process.

-

What features does airSlate SignNow provide for managing the 2022 schedule 1 forms?

AirSlate SignNow offers various features tailored for managing your 2022 schedule 1 forms, such as an easy-to-use editor, customizable templates, and real-time notifications. These features streamline your workflow, allowing for smooth collaboration and faster processing of documentation.

-

Can I integrate airSlate SignNow with other applications to manage my 2022 schedule 1?

Yes, airSlate SignNow offers integrations with numerous applications, allowing you to manage your 2022 schedule 1 forms seamlessly. Whether you use accounting software or project management tools, our integrations enhance your productivity by connecting your workflows.

-

What benefits does airSlate SignNow offer for businesses handling their 2022 schedule 1?

Using airSlate SignNow for your 2022 schedule 1 provides numerous benefits, including faster response times, reduced paperwork, and improved accessibility. Our platform simplifies the eSigning process, enabling businesses to focus on their core activities rather than paperwork.

Get more for Part III Partners Share Of Current Year Income, IRS Tax Forms

- Mutual wills package with last wills and testaments for married couple with minor children ohio form

- Ohio legal form

- Will with no children 497322692 form

- Legal last will and testament form for married person with minor children ohio

- Ohio will form

- Legal last will and testament form for married person with adult and minor children from prior marriage ohio

- Legal last will and testament form for married person with adult and minor children ohio

- Mutual wills package with last wills and testaments for married couple with adult and minor children ohio form

Find out other Part III Partners Share Of Current Year Income, IRS Tax Forms

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe