Fillable Online in TEFAP MANUAL in Gov in Fax Email 2020

What is the K-1 Tax Form?

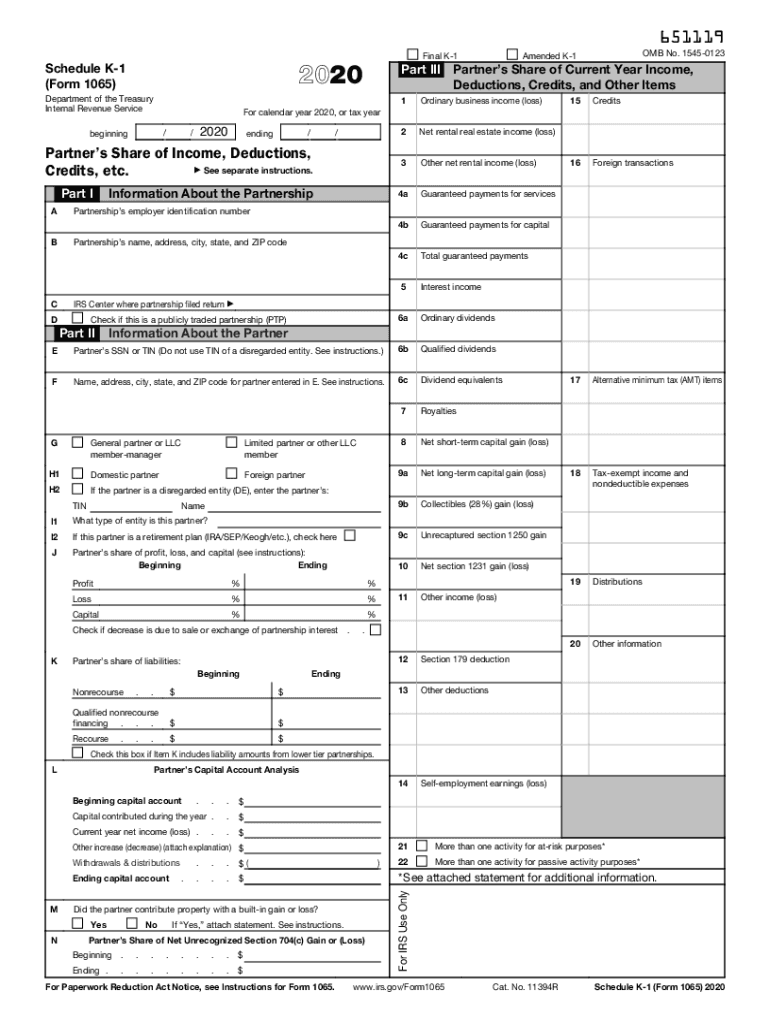

The K-1 tax form, specifically the IRS Schedule K-1, is a document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides detailed information about each partner's or shareholder's share of the entity's income, which is then reported on their personal tax returns. For partnerships, the K-1 is issued by Form 1065, while S corporations use it to report income on Form 1120S. Understanding the K-1 is crucial for accurate tax filing, as it helps taxpayers determine their tax liability based on their share of the entity's earnings.

Steps to Complete the K-1 Tax Form

Filling out the K-1 tax form involves several key steps:

- Gather necessary information: Collect details about the partnership or S corporation, including its tax identification number, income, deductions, and any credits.

- Fill out the form: Enter the entity's information in the designated sections, followed by each partner's or shareholder's share of income, losses, and other relevant details.

- Review for accuracy: Double-check all entries for completeness and correctness to avoid potential issues with the IRS.

- Distribute copies: Provide each partner or shareholder with their respective K-1 forms for their tax records.

Filing Deadlines for the K-1 Tax Form

The deadline for filing the K-1 tax form varies depending on the type of entity. For partnerships, the Form 1065, which includes the K-1s, must be filed by March 15. S corporations follow the same deadline. However, individual partners and shareholders should be aware that they need to report the information from their K-1s on their personal tax returns, which are due on April 15. Extensions may be available, but it is essential to file the K-1s on time to avoid penalties.

Required Documents for K-1 Tax Form Completion

To accurately complete the K-1 tax form, several documents are typically required:

- Partnership Agreement: This document outlines the terms of the partnership and each partner's share of profits and losses.

- Financial Statements: Access to the partnership's or S corporation's financial statements will provide necessary income and expense details.

- Tax Identification Number: The entity's EIN is essential for correctly filling out the K-1.

- Prior Year K-1 Forms: Reviewing previous years' forms can help ensure consistency in reporting income and deductions.

IRS Guidelines for K-1 Tax Form

The IRS provides specific guidelines regarding the K-1 tax form, emphasizing accurate reporting of income, deductions, and credits. Each entity must ensure that the information reported on the K-1 aligns with the entity's tax return. The IRS also requires that K-1s be issued to all partners or shareholders by the filing deadline. Failure to comply with these guidelines can lead to penalties for both the entity and the individual taxpayers.

Digital vs. Paper Version of K-1 Tax Form

Both digital and paper versions of the K-1 tax form are acceptable for filing. The digital version allows for easier completion and submission, often through tax software that can streamline the process. However, some taxpayers may prefer the traditional paper form for its tangible nature. Regardless of the format, it is essential to ensure that all information is accurately reported and that the form is filed by the appropriate deadlines.

Quick guide on how to complete fillable online in tefap manual ingov in fax email

Effortlessly Prepare Fillable Online In TEFAP MANUAL IN gov In Fax Email on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an optimal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Fillable Online In TEFAP MANUAL IN gov In Fax Email on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Fillable Online In TEFAP MANUAL IN gov In Fax Email effortlessly

- Obtain Fillable Online In TEFAP MANUAL IN gov In Fax Email and click on Get Form to begin.

- Employ the tools at your disposal to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, the hassle of searching for forms, or the need to reprint documents due to errors. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Fillable Online In TEFAP MANUAL IN gov In Fax Email to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online in tefap manual ingov in fax email

Create this form in 5 minutes!

How to create an eSignature for the fillable online in tefap manual ingov in fax email

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is a K 1 tax form and who needs it?

A K 1 tax form is a document that reports income, deductions, and credits from partnerships, S Corporations, and estates or trusts. It's essential for partners and shareholders to accurately report their share of tax attributes. If you are involved in a partnership or hold shares in an S Corporation, you will need this form for your tax returns.

-

How can airSlate SignNow help with K 1 tax form management?

airSlate SignNow streamlines the process of managing K 1 tax forms by allowing users to quickly send, eSign, and track documents securely. Our platform ensures that all necessary signatures are collected efficiently, minimizing delays in tax preparation. Enjoy a hassle-free way to handle your K 1 tax form with our easy-to-use interface.

-

Is there a cost associated with using airSlate SignNow for K 1 tax forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, providing flexibility based on your usage needs. Our service is designed to be a cost-effective solution for handling K 1 tax forms and other document management needs.

-

What features does airSlate SignNow offer for K 1 tax form processes?

airSlate SignNow provides various features such as customizable templates, document workflows, and secure eSignature capabilities for K 1 tax forms. Users can easily create, send, and receive completed forms within a single platform. The comprehensive features enhance productivity and ensure compliance with tax regulations.

-

Can airSlate SignNow integrate with accounting software for K 1 tax form processing?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, ensuring a smooth flow of data for K 1 tax form processing. This integration allows for automatic updates and easy access to important financial documents. By connecting your accounting tools with SignNow, you can streamline your tax preparation efforts.

-

How does airSlate SignNow ensure the security of K 1 tax forms?

Security is a top priority at airSlate SignNow. We use advanced encryption methods to protect K 1 tax forms and sensitive data during transmission and storage. Our platform also includes user authentication and audit trails to ensure that only authorized individuals can access and sign the documents.

-

What are the benefits of using airSlate SignNow for my K 1 tax form needs?

Using airSlate SignNow for your K 1 tax form needs simplifies the entire signing and management process. With our platform, you save time, reduce errors, and ensure compliance with tax regulations. Additionally, our user-friendly interface makes it accessible for all team members, regardless of technical expertise.

Get more for Fillable Online In TEFAP MANUAL IN gov In Fax Email

- About form 8863 education credits american opportunity1040 american opportunity and lifetime learning creditsinstructions for

- 1042 s form

- 2021 i 016 schedule h wisconsin homestead credit schedule h wisconsin homestead credit form

- Missouri sales form

- Docsliborgdoc11370032irs pub 4681 cancelled debts foreclosures repossessions form

- Form 940 624398316

- 2022 property tax credit chart form

- Internal revenue cumulative bulletin united states form

Find out other Fillable Online In TEFAP MANUAL IN gov In Fax Email

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online