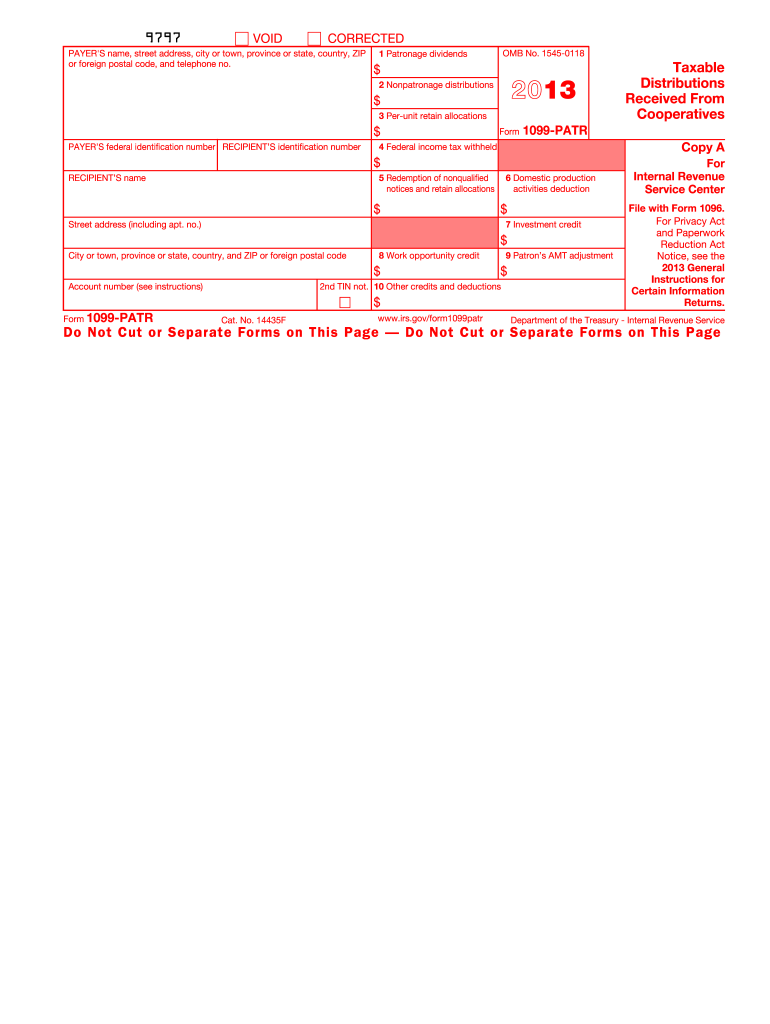

Irs Form 1099 Printable 2013

What is the IRS Form 1099 Printable

The IRS Form 1099 is a series of tax forms used to report various types of income other than wages, salaries, and tips. The printable version of this form allows individuals and businesses to document payments made throughout the year. Common uses include reporting income from self-employment, rental properties, and interest payments. The form is essential for ensuring accurate tax reporting and compliance with IRS regulations, making it a vital tool for both payers and recipients.

How to Use the IRS Form 1099 Printable

Using the IRS Form 1099 printable involves several steps to ensure accurate reporting. First, determine the type of income being reported, as there are various variants of the 1099 form, such as 1099-MISC for miscellaneous income and 1099-INT for interest income. Next, gather all necessary information, including the recipient's name, address, and taxpayer identification number. Accurate record-keeping is crucial to avoid discrepancies. Once the form is filled out, it must be provided to the recipient and submitted to the IRS by the required deadlines.

Steps to Complete the IRS Form 1099 Printable

Completing the IRS Form 1099 printable involves a series of straightforward steps:

- Identify the correct version of the 1099 form based on the type of income.

- Gather essential information, including payer and recipient details.

- Fill in the appropriate boxes, ensuring accuracy in amounts and identification numbers.

- Review the completed form for any errors or omissions.

- Provide a copy to the recipient and submit the form to the IRS by the deadline.

Legal Use of the IRS Form 1099 Printable

The IRS Form 1099 printable serves as a legal document that reports income for tax purposes. It is important to use this form accurately to comply with federal tax laws. Failure to report income correctly can lead to penalties and interest charges. Additionally, the form must be provided to the recipient in a timely manner, ensuring they can report their income accurately on their tax returns. Understanding the legal implications of the 1099 form is essential for both payers and recipients.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1099 printable vary depending on the specific type of 1099 being submitted. Generally, forms must be provided to recipients by January 31 of the year following the tax year. The deadline for submitting the forms to the IRS is typically February 28 for paper filings and March 31 for electronic submissions. It is essential to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Who Issues the Form

The IRS Form 1099 printable is typically issued by businesses, financial institutions, or individuals who make payments to others. This includes employers reporting payments to independent contractors, banks reporting interest payments, and landlords reporting rental income. Each issuer is responsible for accurately completing the form and providing it to the recipient and the IRS, ensuring proper tax reporting.

Quick guide on how to complete irs form 1099 printable 2013

Effortlessly prepare Irs Form 1099 Printable on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form 1099 Printable on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Irs Form 1099 Printable without hassle

- Obtain Irs Form 1099 Printable and then click Get Form to begin.

- Make use of the tools we provide to fill in your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Irs Form 1099 Printable and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1099 printable 2013

Create this form in 5 minutes!

How to create an eSignature for the irs form 1099 printable 2013

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Irs Form 1099 Printable and why is it important?

The Irs Form 1099 Printable is a tax document used to report various types of income other than wages, salaries, or tips. This form is crucial for freelancers and independent contractors, as it helps the IRS track income for tax purposes. Understanding how to properly fill out and use the Irs Form 1099 Printable is essential for maintaining tax compliance.

-

How can I obtain an Irs Form 1099 Printable through airSlate SignNow?

You can access the Irs Form 1099 Printable directly from the airSlate SignNow platform. With our user-friendly interface, you can easily fill out, eSign, and send the form to recipients. This streamlined process simplifies managing your tax documents efficiently.

-

Is the Irs Form 1099 Printable on airSlate SignNow customizable?

Yes, the Irs Form 1099 Printable available on airSlate SignNow is customizable. You can add specific information relevant to your transactions and tailor the form to meet your business needs. This feature ensures that all necessary details are included before submission.

-

What is the cost associated with using airSlate SignNow for Irs Form 1099 Printable?

airSlate SignNow offers various pricing plans, allowing you to choose one that best fits your needs. The cost-effective solutions include tools for managing the Irs Form 1099 Printable and other documents seamlessly. For precise pricing, you can visit our website and explore the options.

-

Can I electronically sign the Irs Form 1099 Printable on airSlate SignNow?

Absolutely! airSlate SignNow allows you to electronically sign the Irs Form 1099 Printable with ease. Our platform ensures that all signatures are compliant with legal standards, making your tax documentation process both secure and efficient.

-

Does airSlate SignNow integrate with accounting software for Irs Form 1099 Printable?

Yes, airSlate SignNow integrates seamlessly with various accounting software applications. This integration allows you to manage your Irs Form 1099 Printable alongside your financial records, ensuring accuracy and efficiency in your tax filing process.

-

What are the benefits of using airSlate SignNow for the Irs Form 1099 Printable?

Using airSlate SignNow for the Irs Form 1099 Printable offers numerous benefits, including ease of use, security, and time savings. You can quickly fill out and send forms while ensuring compliance with IRS requirements. Additionally, our solution enhances collaboration with clients and vendors through eSigning functionalities.

Get more for Irs Form 1099 Printable

- Byram healthcare fax number form

- American fidelity company bn claim form

- Neurology immunoglobulin referral form

- Craigslist amarillo tx jobs apartments for sale services form

- The delphi and nominal group technique in health service form

- Disc injury in hernando call morton chiropractic clinic form

- Client emergency contact form

- 2013 2019 form cg 20 15 fill online printable fillable blank

Find out other Irs Form 1099 Printable

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online