540 Form 2019

What is the 540 Form

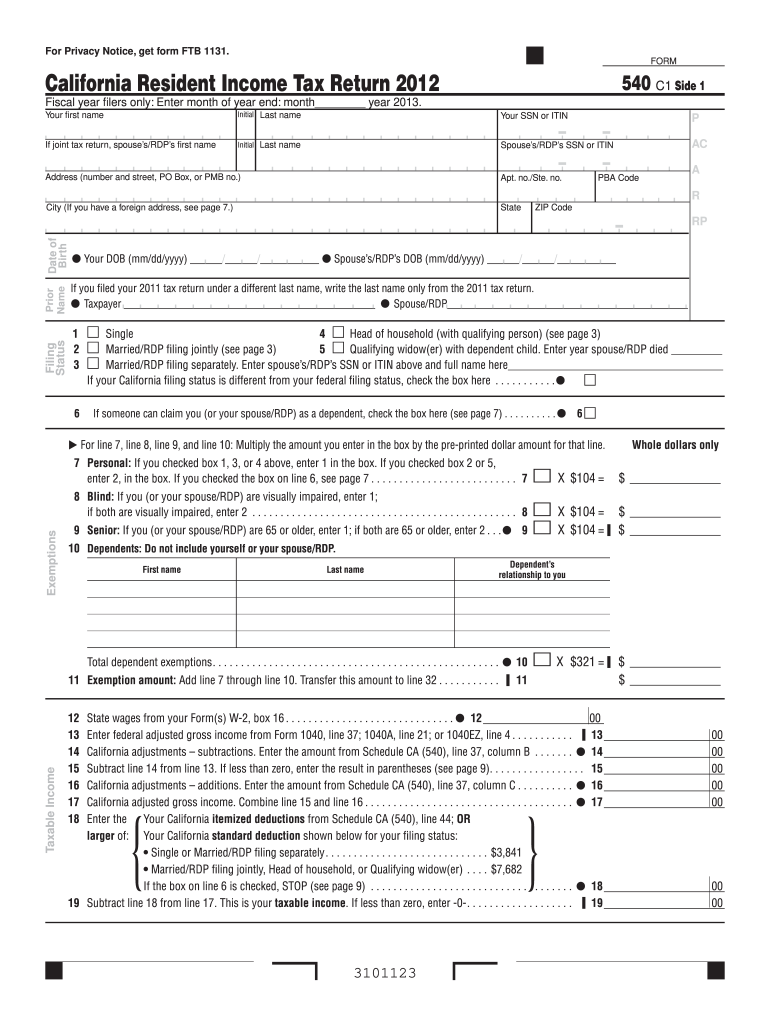

The 540 Form is a state income tax return used by residents of California to report their income and calculate their tax liability. This form is essential for individuals and households to ensure compliance with state tax laws. It captures various income types, deductions, and credits that may apply to the taxpayer's situation. Understanding the 540 Form is vital for accurate tax filing and to avoid potential penalties.

How to use the 540 Form

Using the 540 Form involves several steps to ensure accurate completion. Taxpayers should first gather all necessary documentation, including W-2s, 1099s, and any relevant receipts for deductions. Next, individuals must fill out the form by reporting their income, claiming applicable deductions, and calculating their tax owed or refund due. It is important to review the form for accuracy before submission to prevent issues with the California Franchise Tax Board.

Steps to complete the 540 Form

Completing the 540 Form can be broken down into clear steps:

- Gather all necessary financial documents, including income statements and deduction records.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim deductions and credits applicable to your situation, such as mortgage interest or education credits.

- Calculate your total tax liability and determine if you owe money or are due a refund.

- Review the completed form for accuracy and completeness.

- Submit the form either electronically or via mail to the appropriate tax authority.

Legal use of the 540 Form

The 540 Form is legally binding when completed and submitted in accordance with California tax laws. To ensure its legal standing, taxpayers must provide accurate information and adhere to filing deadlines. The form must be signed, either physically or digitally, to validate the submission. Compliance with all applicable regulations, including those related to eSignatures, is crucial for the form's acceptance by the California Franchise Tax Board.

Filing Deadlines / Important Dates

Filing deadlines for the 540 Form are critical for taxpayers to avoid penalties. Generally, the deadline for filing is April 15 of each year, unless it falls on a weekend or holiday, in which case the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file. Keeping track of these dates ensures compliance and helps avoid unnecessary fees.

Required Documents

To successfully complete the 540 Form, taxpayers need several key documents:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for deductions, including receipts for medical expenses or charitable contributions.

- Any prior year tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The 540 Form can be submitted through various methods to accommodate taxpayer preferences. Electronic filing is available through the California Franchise Tax Board's website, which is often the fastest option. Taxpayers may also choose to mail a paper form to the designated address or submit it in person at local tax offices. Each method has its own processing times and requirements, so it is important to choose the one that best fits individual needs.

Quick guide on how to complete 2012 540 form

Complete 540 Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers a fantastic environmentally friendly alternative to conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle 540 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign 540 Form with ease

- Obtain 540 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 540 Form and ensure excellent communication during every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 540 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 540 form

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 540 Form and why is it important?

The 540 Form is a state income tax return form used in California. It is essential for residents and part-time residents to report their income and calculate their tax liability. Filing this form accurately ensures compliance with state tax regulations and avoids potential penalties.

-

How can airSlate SignNow help me with my 540 Form?

airSlate SignNow streamlines the process of completing and eSigning your 540 Form. Our platform allows you to easily fill out the form electronically, sign it, and send it to the required parties securely. This enhances efficiency and ensures your tax documents are handled correctly.

-

Are there any costs associated with using airSlate SignNow for the 540 Form?

airSlate SignNow offers various pricing plans to suit different budget needs. Depending on your choice of plan, you may access additional features like advanced document management and integrations. Explore our pricing options to find the best fit for handling your 540 Form efficiently.

-

What features does airSlate SignNow offer for managing the 540 Form?

airSlate SignNow provides several features to optimize the management of your 540 Form, including customizable templates, secure cloud storage, and real-time tracking of document status. These features make it easy to manage your tax documents and ensure timely submissions.

-

Can I integrate airSlate SignNow with other applications for my 540 Form?

Yes, airSlate SignNow supports various integrations with popular applications like Google Drive and Microsoft Office. This allows you to import and export data easily, making the completion of your 540 Form more efficient and seamless.

-

Is airSlate SignNow user-friendly for completing the 540 Form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the 540 Form regardless of their tech-savviness. Our intuitive interface guides you through each step, ensuring a hassle-free experience.

-

What are the benefits of eSigning the 540 Form with airSlate SignNow?

eSigning your 540 Form with airSlate SignNow offers several benefits, including faster processing times and enhanced security. Electronic signatures are legally recognized and provide a convenient way to finalize your documents without the need for physical paperwork.

Get more for 540 Form

Find out other 540 Form

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template