Sc Form Number 1041 2019

What is the Sc Form Number 1041

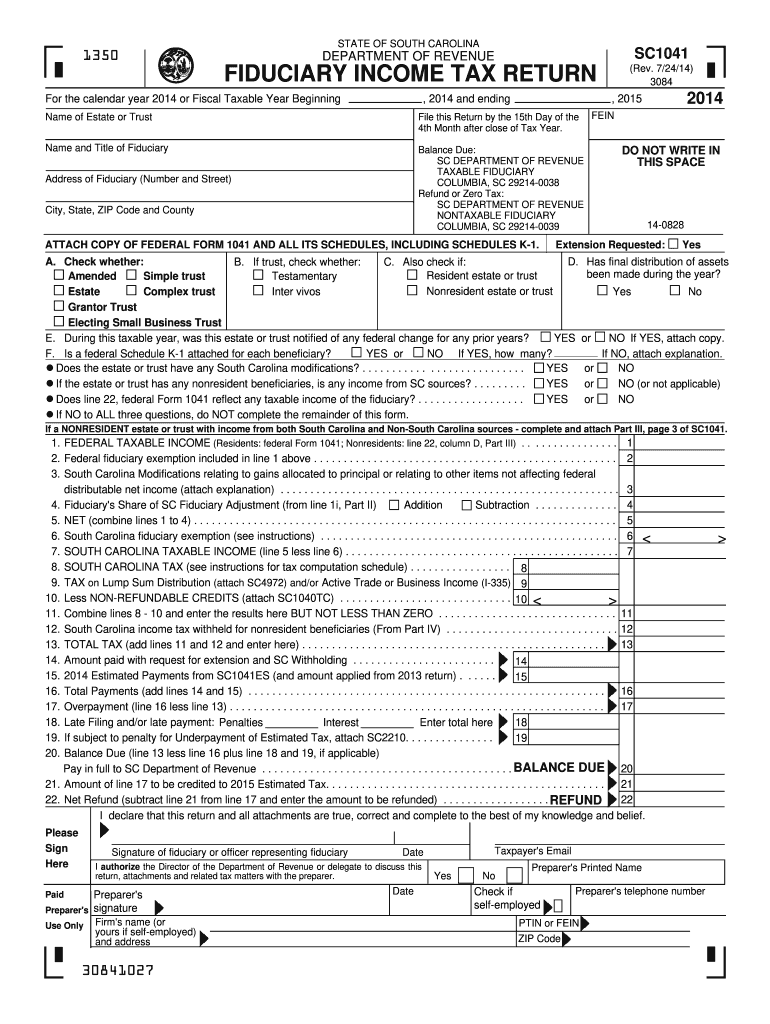

The Sc Form Number 1041 is a tax form used primarily for reporting income for estates and trusts in the United States. It is essential for fiduciaries to accurately report income, deductions, and credits related to the estate or trust. This form is typically filed annually, and it helps ensure compliance with federal tax regulations. Understanding its purpose is crucial for those managing estates or trusts, as it directly impacts tax liabilities and distributions to beneficiaries.

How to obtain the Sc Form Number 1041

To obtain the Sc Form Number 1041, individuals can visit the official IRS website, where the form is available for download in PDF format. Additionally, tax professionals and accountants can provide copies or assist in obtaining the form. It is advisable to ensure you have the most recent version of the form, as updates may occur annually to reflect changes in tax laws and regulations.

Steps to complete the Sc Form Number 1041

Completing the Sc Form Number 1041 involves several key steps:

- Gather all necessary financial documents related to the estate or trust, including income statements, expense records, and prior year tax returns.

- Fill out the identifying information at the top of the form, including the name and address of the estate or trust.

- Report income earned by the estate or trust in the appropriate sections, including interest, dividends, and capital gains.

- Deduct any allowable expenses, such as trustee fees and legal costs, to determine the net income.

- Complete the signature section, ensuring that the fiduciary or authorized representative signs the form.

Legal use of the Sc Form Number 1041

The legal use of the Sc Form Number 1041 is vital for compliance with tax laws governing estates and trusts. Filing this form accurately helps avoid penalties and ensures that beneficiaries receive their rightful distributions. The form must be filed by the due date, which is typically the 15th day of the fourth month following the close of the tax year. Understanding the legal implications of this form can safeguard fiduciaries from potential legal issues and financial penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Sc Form Number 1041 are crucial for compliance. Generally, the form is due on the 15th day of the fourth month after the end of the tax year. For estates and trusts operating on a calendar year, this means the form is typically due by April 15. Extensions may be available, but it is essential to file for an extension before the original due date to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The Sc Form Number 1041 can be submitted through various methods, including:

- Online: Some tax software platforms allow for electronic filing, which can expedite the process.

- Mail: The completed form can be sent to the appropriate IRS address based on the estate or trust's location.

- In-Person: While less common, individuals may also deliver the form directly to their local IRS office.

Quick guide on how to complete sc form number 1041 2014

Complete Sc Form Number 1041 effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can locate the appropriate form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without interruptions. Manage Sc Form Number 1041 on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Sc Form Number 1041 with ease

- Locate Sc Form Number 1041 and click on Get Form to commence.

- Utilize the tools we offer to submit your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Alter and eSign Sc Form Number 1041 and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc form number 1041 2014

Create this form in 5 minutes!

How to create an eSignature for the sc form number 1041 2014

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is Sc Form Number 1041?

Sc Form Number 1041 is a tax form used by estates and trusts in South Carolina to report income and calculate taxes owed. This form helps ensure compliance with state tax regulations and is essential for managing the financial aspects of an estate or trust.

-

How can airSlate SignNow assist with Sc Form Number 1041?

airSlate SignNow provides an efficient way to electronically sign and manage Sc Form Number 1041. With our user-friendly platform, you can easily prepare, send for signatures, and store your completed forms securely, streamlining the process.

-

What are the pricing options for using airSlate SignNow to manage Sc Form Number 1041?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for individuals and teams. Our flexible pricing ensures that you can effectively handle Sc Form Number 1041 without overspending.

-

What features does airSlate SignNow offer for Sc Form Number 1041?

airSlate SignNow includes features like electronic signatures, document templates, and cloud storage, specifically designed to simplify the management of documents like Sc Form Number 1041. These tools enhance productivity and ensure that all necessary signatures are collected efficiently.

-

Are there any integrations available for Sc Form Number 1041 with airSlate SignNow?

Yes, airSlate SignNow can seamlessly integrate with various platforms to enhance the process of handling Sc Form Number 1041. Our integrations with popular tools like Google Drive and Dropbox make it easy to access and share your documents securely.

-

What are the benefits of using airSlate SignNow for Sc Form Number 1041?

Using airSlate SignNow for Sc Form Number 1041 offers numerous benefits including time-saving efficiencies, increased security, and reduced paperwork. Our eSigning solution allows you to manage your tax documents quickly and conveniently while maintaining compliance.

-

Is airSlate SignNow compliant with regulations for Sc Form Number 1041?

Yes, airSlate SignNow is designed to meet industry standards for compliance, ensuring that your Sc Form Number 1041 is managed in accordance with legal requirements. Our platform allows for secure storage and transmission of sensitive information.

Get more for Sc Form Number 1041

- Oakland county sheriff s residential alarm registration rochesterhills form

- Worksheet momentum word problems chapter 8 momentum answer key form

- Nycers post retirement death benefit form

- How to fill out local traffic crash report ohio form

- Vanguard inherited ira application for nonspouse beneficiaries form

- Ecw form

- Members form

- Fee tail form

Find out other Sc Form Number 1041

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy