Schedule D 2022

What is the Schedule D

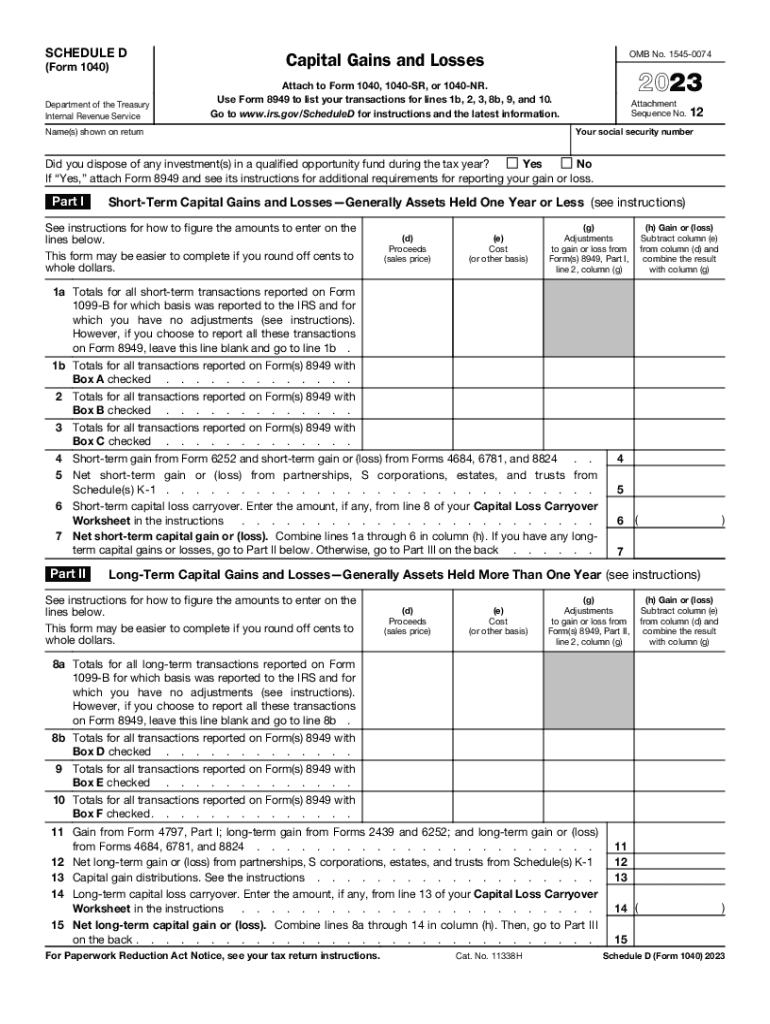

The Schedule D is a tax form used by individuals in the United States to report capital gains and losses from the sale of securities or other assets. This form is part of the IRS Form 1040 series and is essential for taxpayers who have sold investments during the tax year. By detailing the transactions, taxpayers can calculate their overall capital gain or loss, which directly impacts their taxable income. Understanding the Schedule D is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule D

To effectively use the Schedule D, taxpayers must first gather all relevant information regarding their capital gains and losses. This includes details about the sale of stocks, bonds, real estate, and other investments. The form consists of two main parts: Part I for reporting short-term capital gains and losses, and Part II for long-term capital gains and losses. Taxpayers should carefully enter the necessary information, including the date of acquisition, date of sale, proceeds from the sale, and the cost basis of the asset. Accurate completion of this form is vital for determining the correct tax liability.

Steps to complete the Schedule D

Completing the Schedule D involves several key steps:

- Gather all relevant documents, including transaction records and brokerage statements.

- Determine which assets were sold and categorize them as short-term or long-term based on the holding period.

- Fill out Part I for short-term transactions, listing each sale and calculating gains or losses.

- Complete Part II for long-term transactions, following the same process.

- Transfer the totals from Schedule D to the appropriate sections of Form 1040.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D, including instructions on reporting capital gains and losses. Taxpayers should refer to the IRS instructions for Schedule D to ensure compliance with all reporting requirements. Key points include understanding the difference between short-term and long-term capital gains, knowing how to calculate the cost basis, and being aware of any applicable tax rates. Adhering to these guidelines helps prevent errors and potential penalties during the tax filing process.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Schedule D. Generally, the deadline for submitting Form 1040, including Schedule D, is April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file on time to avoid penalties and interest on any taxes owed. Additionally, taxpayers should consider any extensions that may be available if they need more time to prepare their returns.

Required Documents

To complete the Schedule D accurately, taxpayers need several key documents, including:

- Brokerage statements detailing all transactions.

- Purchase records showing the cost basis of sold assets.

- Any relevant documentation for capital losses carried over from previous years.

- IRS Form 8949, which may be required for reporting individual transactions.

Having these documents organized and accessible will streamline the process of completing the Schedule D and ensure accurate reporting of capital gains and losses.

Quick guide on how to complete schedule d

Prepare Schedule D effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Schedule D on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Schedule D with ease

- Obtain Schedule D and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with features specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule D and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule d

Create this form in 5 minutes!

How to create an eSignature for the schedule d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 schedule d, and why do I need it?

The 1040 schedule d is a tax form used to report capital gains and losses for individuals filing their annual tax returns. If you have sold stocks, bonds, or other assets, completing the 1040 schedule d is essential to accurately report your financial activities and determine your taxable income.

-

How can airSlate SignNow help me with the 1040 schedule d?

airSlate SignNow can streamline the process of preparing and signing documents related to your 1040 schedule d. With our user-friendly platform, you can easily share, eSign, and manage documents required for your capital gains reporting, ensuring a seamless experience during tax season.

-

Is there a cost associated with using airSlate SignNow for my 1040 schedule d documents?

airSlate SignNow offers a variety of pricing plans designed to suit different business needs. Our cost-effective solution allows you to manage your documents related to the 1040 schedule d without breaking the bank, making it accessible for both individuals and businesses.

-

What features does airSlate SignNow provide to assist with my 1040 schedule d?

With airSlate SignNow, you benefit from features like customizable templates, eSignature capabilities, and secure document storage. These tools enhance the efficiency of preparing your 1040 schedule d, ensuring that everything you need is organized and easily accessible.

-

Can I integrate airSlate SignNow with other financial tools for my 1040 schedule d?

Yes, airSlate SignNow seamlessly integrates with various financial and accounting tools that can assist in managing your 1040 schedule d. This integration helps create a cohesive workflow, allowing you to import data and export documents effortlessly.

-

What security measures does airSlate SignNow have for my 1040 schedule d documents?

airSlate SignNow prioritizes the security of your documents, including those associated with your 1040 schedule d. We use advanced encryption and comply with industry standards to ensure your sensitive information remains protected throughout the document signing process.

-

How does eSigning work for my 1040 schedule d documents?

eSigning your 1040 schedule d documents with airSlate SignNow is simple and efficient. You can invite others to sign electronically, track the signing process in real time, and store all signed documents securely in the cloud, saving you both time and effort.

Get more for Schedule D

Find out other Schedule D

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors