Form 1120 S 2013

What is the Form 1120 S

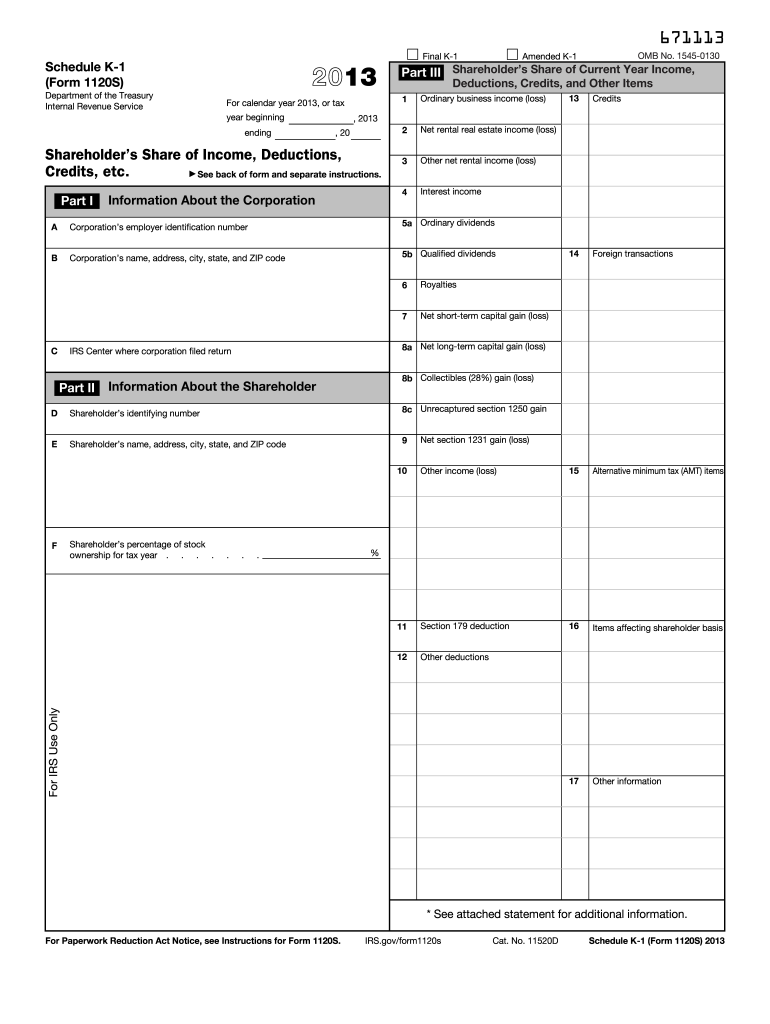

The Form 1120 S is a tax document used by S corporations in the United States to report income, deductions, and credits. This form is essential for S corporations, which are special types of corporations that pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. By filing Form 1120 S, these corporations can avoid double taxation, as the income is only taxed at the shareholder level. Understanding the structure and purpose of this form is crucial for compliance with IRS regulations.

Steps to complete the Form 1120 S

Completing the Form 1120 S involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by entering your corporation's identifying information, such as the name, address, and Employer Identification Number (EIN). Then, report the corporation's income and expenses in the appropriate sections, ensuring all figures are accurate. It's also important to include any applicable credits and deductions. Finally, review the completed form for errors before submitting it to the IRS.

Legal use of the Form 1120 S

The legal use of Form 1120 S is governed by IRS regulations, which dictate how S corporations must report their income and expenses. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Additionally, the signatures of the corporation's officers are required to certify the information provided. Compliance with these legal requirements ensures that the form is recognized by the IRS and can help avoid potential penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120 S are critical for S corporations to avoid penalties. Generally, the form must be filed by the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations can file for an extension using Form 7004, which grants an additional six months to file, but any taxes owed must still be paid by the original deadline.

Key elements of the Form 1120 S

Form 1120 S contains several key elements that are essential for accurate reporting. These include the corporation's identifying information, income and deductions, tax credits, and the distribution of income to shareholders. The form also requires a balance sheet and a statement of retained earnings. Each section is designed to capture specific financial data that the IRS uses to assess the corporation's tax obligations. Understanding these elements is vital for ensuring that the form is completed correctly and comprehensively.

Examples of using the Form 1120 S

Examples of using Form 1120 S can illustrate its application in various business scenarios. For instance, an S corporation that generates revenue from product sales must report its total income on the form, along with any associated costs of goods sold. Another example includes an S corporation that incurs business expenses, such as salaries and rent, which can be deducted from its taxable income. These examples demonstrate how the form is used to reflect the financial activities of the corporation and ensure proper tax reporting.

Form Submission Methods (Online / Mail / In-Person)

Form 1120 S can be submitted through various methods, providing flexibility for S corporations. The form can be filed electronically using IRS-approved software, which often streamlines the process and reduces the likelihood of errors. Alternatively, corporations can mail a paper copy of the form to the appropriate IRS address based on their location. In-person submissions are generally not accepted for this form, as the IRS encourages electronic filing for efficiency and security. Each submission method has its own requirements and processing times, so it's important to choose the one that best fits the corporation's needs.

Quick guide on how to complete 2013 form 1120 s

Effortlessly prepare Form 1120 S on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1120 S on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to modify and electronically sign Form 1120 S with ease

- Locate Form 1120 S and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 1120 S to ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 1120 s

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1120 s

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is Form 1120 S?

Form 1120 S is the tax form used by S corporations in the United States to report income, deductions, and credits. This form is essential for S corporations to maintain their tax status and accurately report to the IRS. Understanding how to complete Form 1120 S is crucial for any business owner operating as an S corporation.

-

How can airSlate SignNow help with Form 1120 S?

airSlate SignNow simplifies the process of signing and sending Form 1120 S electronically. With our user-friendly features, users can easily gather signatures from stakeholders without the hassle of printing or scanning documents. This not only saves time but also ensures compliance with IRS requirements for electronic signatures.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet diverse business needs. Customers can choose from several tiers, ensuring they get the right features for efficiently managing documents like Form 1120 S. Each plan provides value with tools designed to streamline document workflows and enhance productivity.

-

What features does airSlate SignNow offer for managing Form 1120 S?

airSlate SignNow provides robust features for managing Form 1120 S, including eSignature capabilities, document templates, and advanced security options. Users can set reminders for signatures, track the status of their forms, and store documents securely in the cloud. These features enhance overall efficiency and compliance during tax season.

-

Is airSlate SignNow secure for sensitive forms like Form 1120 S?

Yes, airSlate SignNow prioritizes security, ensuring that sensitive documents like Form 1120 S are protected. Our platform utilizes advanced encryption and complies with industry standards for data protection. You can confidently send and sign documents, knowing that your information remains secure.

-

Can I integrate airSlate SignNow with other software for Form 1120 S processing?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software, making it easy to manage Form 1120 S alongside your other business processes. This connectivity helps streamline your workflow and ensures that all data related to your S corporation's tax filings is effectively organized.

-

What are the benefits of using airSlate SignNow for Form 1120 S?

Using airSlate SignNow for Form 1120 S offers several benefits, including increased efficiency, reduced paperwork, and faster turnaround times. The ability to electronically sign and manage documents allows businesses to stay organized and meet deadlines more effectively. Additionally, our platform's cost-effective solutions can help you save on operational expenses.

Get more for Form 1120 S

Find out other Form 1120 S

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast