1120s Form 2011

What is the 1120S Form

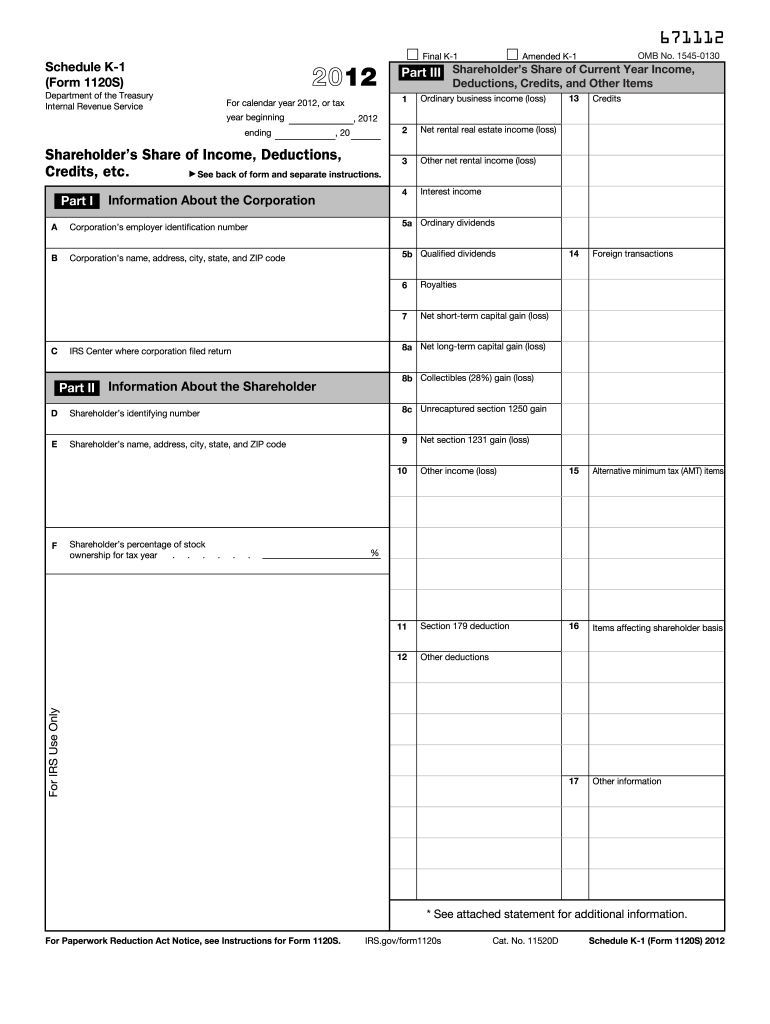

The 1120S Form is a tax return specifically designed for S corporations in the United States. This form allows S corporations to report income, deductions, and credits to the Internal Revenue Service (IRS). Unlike traditional corporations, S corporations pass their income, losses, deductions, and credits directly to shareholders, who then report these amounts on their personal tax returns. This structure helps avoid double taxation, making it an attractive option for many small businesses.

How to use the 1120S Form

Using the 1120S Form involves several steps to ensure accurate reporting of your S corporation's financial activities. First, gather all necessary financial records, including income statements, balance sheets, and any relevant deductions. Next, fill out the form by providing information about your business, such as its name, address, and Employer Identification Number (EIN). Be sure to report all income and expenses accurately, as this will affect the tax liability of both the corporation and its shareholders. Once completed, the form must be filed with the IRS, typically by March 15 of each year.

Steps to complete the 1120S Form

Completing the 1120S Form involves a systematic approach to ensure compliance and accuracy. Follow these steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements and expense records.

- Fill Out Basic Information: Provide your S corporation's name, address, and EIN at the top of the form.

- Report Income: List all income sources, including sales and interest income, on the appropriate lines.

- Deduct Expenses: Itemize all deductible expenses, such as salaries, rent, and utilities, to determine your taxable income.

- Calculate Tax Liability: Use the information provided to calculate the tax owed, if any, based on the corporation's income.

- Review and Sign: Ensure all information is accurate, then sign and date the form before submission.

Filing Deadlines / Important Dates

Filing the 1120S Form is subject to specific deadlines that S corporations must adhere to in order to avoid penalties. The standard deadline for filing is March 15 of each year, which is the fifteenth day of the third month following the end of the corporation's tax year. If March 15 falls on a weekend or holiday, the due date is extended to the next business day. Additionally, if an extension is needed, S corporations can file Form 7004 to request an automatic six-month extension, allowing them to file by September 15.

Legal use of the 1120S Form

The legal use of the 1120S Form is governed by IRS regulations, which stipulate that only eligible S corporations may file this form. To qualify, a corporation must meet specific criteria, such as having no more than one hundred shareholders and being a domestic corporation. It is crucial for businesses to comply with these regulations to maintain their S corporation status and avoid potential legal issues. Accurate completion and timely filing of the 1120S Form ensure that the corporation remains in good standing with the IRS.

Required Documents

To complete the 1120S Form accurately, certain documents are required. These typically include:

- Financial statements, including balance sheets and income statements

- Records of all income sources

- Documentation for all deductible expenses

- Shareholder information, including names and Social Security numbers

- Any prior year tax returns for reference

Quick guide on how to complete 2011 1120s form

Effortlessly prepare 1120s Form on any device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without any delays. Handle 1120s Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest way to modify and eSign 1120s Form with ease

- Obtain 1120s Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools available from airSlate SignNow specifically designed for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign 1120s Form while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 1120s form

Create this form in 5 minutes!

How to create an eSignature for the 2011 1120s form

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the 1120s Form and why is it important?

The 1120s Form is a critical tax document for S corporations in the United States. It reports the income, deductions, and credits of the corporation, and its timely submission is vital for compliance with IRS regulations. Understanding and properly filing the 1120s Form can help businesses avoid penalties and optimize their tax strategy.

-

How can airSlate SignNow help with the 1120s Form?

airSlate SignNow streamlines the process of preparing and eSigning your 1120s Form. With its user-friendly interface, you can easily upload, share, and get the necessary approvals on your tax documents. This not only saves time but also ensures that your 1120s Form is handled securely and efficiently.

-

What are the pricing options for airSlate SignNow for handling 1120s Forms?

airSlate SignNow offers several pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business needing basic features for the 1120s Form or a larger enterprise looking for advanced capabilities like API integrations, you can choose a plan that best fits your budget and requirements.

-

Is airSlate SignNow compliant with IRS regulations for the 1120s Form?

Yes, airSlate SignNow is designed to meet all necessary compliance measures for the eSigning of documents, including the 1120s Form. The platform uses advanced security protocols to safeguard sensitive information, ensuring your submissions comply with IRS rules while maintaining the integrity of your data.

-

What features does airSlate SignNow offer for eSigning the 1120s Form?

airSlate SignNow provides several features to make eSigning your 1120s Form simple and effective. Users can create templates, set signing order, and track document status in real-time. These features promote efficiency and transparency in your tax filing process.

-

Can I integrate airSlate SignNow with other software tools for managing the 1120s Form?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, allowing you to manage your 1120s Form more efficiently. By connecting your existing tools with airSlate SignNow, you can automate workflows and enhance your overall tax management process.

-

What are the benefits of using airSlate SignNow for the 1120s Form over traditional methods?

Using airSlate SignNow for your 1120s Form offers numerous benefits compared to traditional paper methods. It enhances speed, reduces the potential for errors, and allows for tracking and analytics. Overall, it streamlines the entire process, making tax filing less stressful for businesses.

Get more for 1120s Form

- Emergency action plan california form

- Stipend request form charles r drew university of medicine and cdrewu

- Exposure record sheet form

- Transcript official indiana form

- Fixed income securities kennesaw state university ksuweb kennesaw form

- Classroom innovation teacher grant application form richlandone

- Senior trip 2018 payment plan wall township public schools www2 wall k12 nj form

- Student listening form

Find out other 1120s Form

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History