SCHEDULE B 1 Information on Certain Shareholders of an S 2021

Understanding the K-1 Form

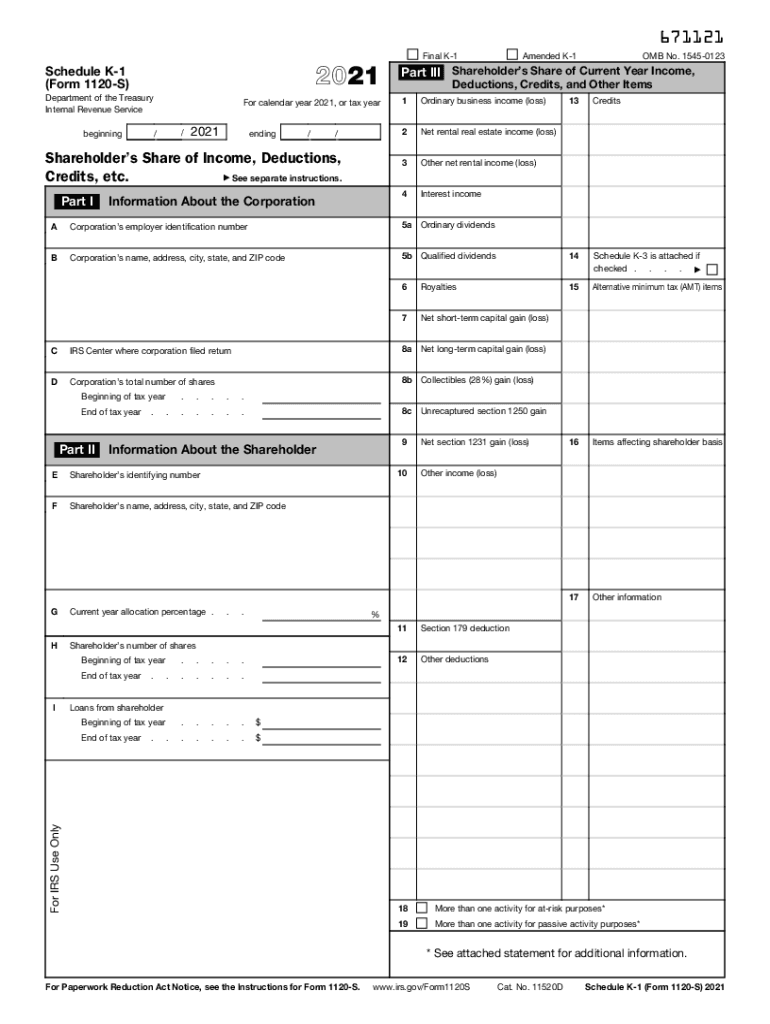

The K-1 form, also known as Schedule K-1, is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It is essential for individuals who are partners in a business or shareholders in an S corporation, as it details their share of the entity's income, losses, and other tax-related items. The information provided on the K-1 is crucial for accurately completing individual tax returns, particularly for those involved in pass-through entities.

Steps to Complete the K-1 Form

Completing the K-1 form involves several key steps:

- Gather necessary financial documents, including the entity's financial statements and any prior year K-1 forms.

- Fill out the top section of the form with the entity's name, address, and Employer Identification Number (EIN).

- Input the partner's or shareholder's information, including their share of income, deductions, and credits.

- Ensure all figures are accurate and correspond to the entity's financial records.

- Review the form for completeness and accuracy before submission.

IRS Guidelines for K-1 Forms

The Internal Revenue Service (IRS) has specific guidelines regarding the use and submission of K-1 forms. Each entity must issue a K-1 to its partners or shareholders by the tax filing deadline. The K-1 must accurately reflect the income and deductions allocated to each individual. Failure to comply with IRS guidelines can result in penalties, including fines for both the entity and the individuals receiving the form. It is crucial to follow these guidelines to ensure proper tax reporting and avoid complications.

Filing Deadlines for K-1 Forms

The deadlines for filing K-1 forms vary depending on the type of entity. For partnerships and S corporations, the K-1 must be issued to partners or shareholders by March 15 of each year, coinciding with the entity's tax return due date. Individuals receiving a K-1 must report the information on their tax returns by the standard April 15 deadline. It is important to be aware of these dates to ensure timely and accurate tax filings.

Legal Use of K-1 Forms

K-1 forms serve a legal purpose in tax reporting and compliance. They provide a transparent account of each partner's or shareholder's share of the entity's income and deductions, which is essential for accurate tax reporting. The information on the K-1 must be reported on the individual's tax return, and discrepancies can lead to audits or penalties. Therefore, it is vital to handle K-1 forms with care and ensure that all reported information is truthful and accurate.

Common Scenarios for K-1 Form Usage

Various taxpayer scenarios may require the use of a K-1 form. For instance, individuals who are partners in a limited liability company (LLC) or shareholders in an S corporation will receive a K-1 to report their share of income and deductions. Additionally, beneficiaries of estates or trusts may also receive a K-1, detailing their share of income generated by the estate or trust. Understanding these scenarios helps individuals recognize when they need to utilize the K-1 form in their tax filings.

Quick guide on how to complete schedule b 1 information on certain shareholders of an s

Complete SCHEDULE B 1 Information On Certain Shareholders Of An S seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely archive them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents efficiently without delays. Manage SCHEDULE B 1 Information On Certain Shareholders Of An S on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign SCHEDULE B 1 Information On Certain Shareholders Of An S with ease

- Find SCHEDULE B 1 Information On Certain Shareholders Of An S and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign SCHEDULE B 1 Information On Certain Shareholders Of An S and maintain excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b 1 information on certain shareholders of an s

Create this form in 5 minutes!

How to create an eSignature for the schedule b 1 information on certain shareholders of an s

The way to make an e-signature for your PDF document in the online mode

The way to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a K-1 form and who needs it?

A K-1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. Individuals or entities that receive a K-1 form typically include partners in a business or beneficiaries of a trust. Understanding what a K-1 form is essential for accurate tax reporting.

-

How do I obtain a K-1 form?

To obtain a K-1 form, you typically need to contact the partnership or entity that generates it. They are required to provide the K-1 form to each partner or stakeholder after the end of the tax year. Knowing how to obtain a K-1 form can help ensure you have the necessary documentation for your tax filings.

-

What information is included on a K-1 form?

A K-1 form includes detailed information about your share of a partnership's or corporation's income, losses, and distributions. It typically includes your proportionate share of the entity's taxable income, deductions, and credits. Familiarity with the information on a K-1 form helps partners accurately report their tax obligations.

-

Can I eSign a K-1 form using airSlate SignNow?

Yes, you can easily eSign a K-1 form using airSlate SignNow. Our platform supports the electronic signing of various documents, including tax forms like K-1. This convenience helps streamline the approval process and ensures efficiency in business communications.

-

Is there a cost associated with obtaining a K-1 form through airSlate SignNow?

While the K-1 form itself is provided by the partnership or entity at no charge, using airSlate SignNow for eSigning may involve a subscription fee. airSlate SignNow offers a cost-effective solution for businesses to manage their document signing needs efficiently. Explore our pricing plans to find the best option for your organization.

-

What are the benefits of using airSlate SignNow for eSigning documents like K-1 forms?

Using airSlate SignNow for eSigning K-1 forms offers numerous benefits, including speed, security, and ease of use. You can sign documents from anywhere, reducing the time spent on paperwork. Additionally, our platform provides secure storage and tracking for all your signed documents.

-

Does airSlate SignNow integrate with tax preparation software for K-1 forms?

Yes, airSlate SignNow offers integrations with various tax preparation software that can facilitate the completion and submission of K-1 forms. These integrations can streamline your workflow, ensuring that any form data is readily available when you need to prepare your taxes. Understanding how these integrations work can enhance your workflow efficiency.

Get more for SCHEDULE B 1 Information On Certain Shareholders Of An S

- Siding contract for contractor hawaii form

- Refrigeration contract for contractor hawaii form

- Drainage contract for contractor hawaii form

- Foundation contract for contractor hawaii form

- Plumbing contract for contractor hawaii form

- Brick mason contract for contractor hawaii form

- Roofing contract for contractor hawaii form

- Electrical contract for contractor hawaii form

Find out other SCHEDULE B 1 Information On Certain Shareholders Of An S

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now