K Form 2014

What is the K Form

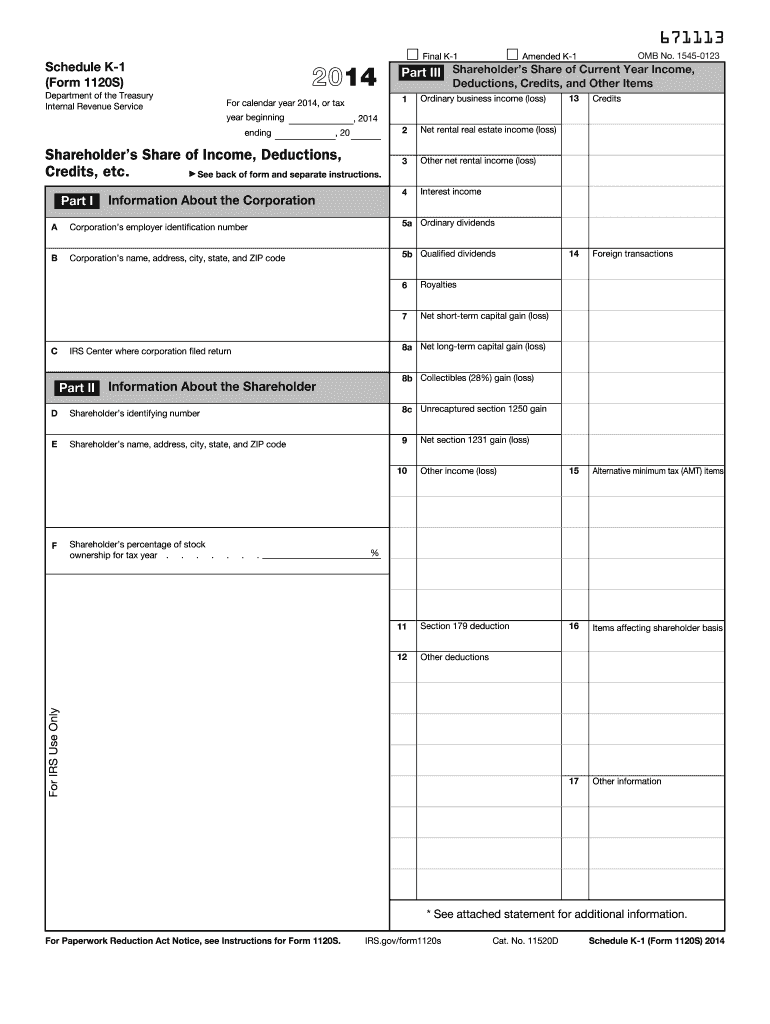

The K Form is a specific tax document utilized primarily by businesses and organizations in the United States. It is designed to report various financial activities, including income, deductions, and credits. Understanding the K Form is essential for accurate tax reporting and compliance with IRS regulations. This form may be required for different types of entities, including partnerships, corporations, and limited liability companies (LLCs).

How to use the K Form

Using the K Form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial information, including income statements and expense reports. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect your financial activities for the reporting period. After completing the form, review it for any errors or omissions before submitting it to the IRS or relevant state authorities.

Steps to complete the K Form

Completing the K Form requires a systematic approach to ensure accuracy. Follow these steps:

- Collect all relevant financial documents, such as income statements and previous tax returns.

- Fill out the identifying information at the top of the form, including the entity's name, address, and Employer Identification Number (EIN).

- Report income and deductions in the appropriate sections, ensuring that all figures are accurate.

- Include any necessary schedules or attachments that support the information reported on the K Form.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the K Form

The K Form is legally binding when completed and submitted in accordance with IRS regulations. It is crucial that all information reported is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be signed by an authorized representative of the entity, affirming that the information provided is correct to the best of their knowledge.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the K Form. These guidelines outline the required information, deadlines for submission, and any additional documentation that may be necessary. Familiarizing yourself with these guidelines is essential for ensuring compliance and avoiding potential issues with the IRS.

Filing Deadlines / Important Dates

Timely submission of the K Form is critical to avoid penalties. The filing deadlines vary depending on the type of entity and the specific tax year. Generally, the K Form must be filed by the 15th day of the third month following the end of the entity's tax year. It is advisable to check the IRS website or consult a tax professional for the most current deadlines.

Quick guide on how to complete 2014 k form

Easily prepare K Form on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage K Form on any platform with airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

The easiest way to modify and electronically sign K Form effortlessly

- Locate K Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Edit and eSign K Form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 k form

Create this form in 5 minutes!

How to create an eSignature for the 2014 k form

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the K Form in airSlate SignNow?

The K Form in airSlate SignNow is a customizable document template designed to streamline the eSigning process. It allows users to create, edit, and send documents efficiently while ensuring compliance and security. By utilizing the K Form, businesses can easily collect signatures and manage documents in one convenient platform.

-

How much does the K Form feature cost?

The K Form feature is included in various pricing plans offered by airSlate SignNow, catering to different business needs. Pricing is competitive and offers flexibility, whether you're a small business or a larger enterprise. Users can find a plan that suits their budget and take advantage of the K Form's powerful capabilities.

-

What are the key benefits of using the K Form?

Using the K Form in airSlate SignNow provides several benefits including time savings, enhanced document accuracy, and improved workflow efficiency. It simplifies the eSigning process, allowing for faster turnaround times and reduces manual errors. Additionally, it fosters a seamless user experience for both senders and signers.

-

Can I integrate the K Form with other applications?

Yes, the K Form can be integrated with a range of applications through airSlate SignNow's API and third-party connectors. This means you can connect it with your favorite CRM, cloud storage, or productivity tools, enhancing your business's overall efficiency. Easy integration allows for a smooth transition and better data management.

-

Is the K Form HIPAA compliant?

Yes, airSlate SignNow takes data privacy seriously, and the K Form can be configured to meet HIPAA compliance requirements. This is particularly important for healthcare providers who need to protect sensitive patient information while using eSignature solutions. Ensuring compliance helps build trust with clients and partners.

-

How secure is the K Form for document signing?

The K Form utilizes advanced encryption and security protocols to protect documents during the signing process. With features like two-factor authentication and audit trails, airSlate SignNow ensures that your documents are secure and access is controlled. This commitment to security makes the K Form a reliable choice for sensitive transactions.

-

Can I customize the K Form for my business needs?

Absolutely! The K Form is highly customizable, allowing businesses to tailor the document to their specific requirements. Users can add branding, adjust formatting, and include specific fields that best suit their process. This flexibility makes it a valuable tool for diverse industries and use cases.

Get more for K Form

- Instructions to form scc819 articles of incorporation of a virginia nonstock corporation

- Application form for uk visa to work study and for dependants

- Va dmv birth certificate form 112020

- Room tax municipality of anchorage form

- Vat431nb form and notes vat refund for diy housebuildings claim form and notes for new houses

- Form 503 assumed name certificate

- Kansas office of the secretary of state sos ks form

- Illinois articles of merger form

Find out other K Form

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online