Schedule K 1 Form 1120 S Shareholders Share of Income, Deductions, Credits, Etc 2020

What is the Schedule K-1 Form 1120-S?

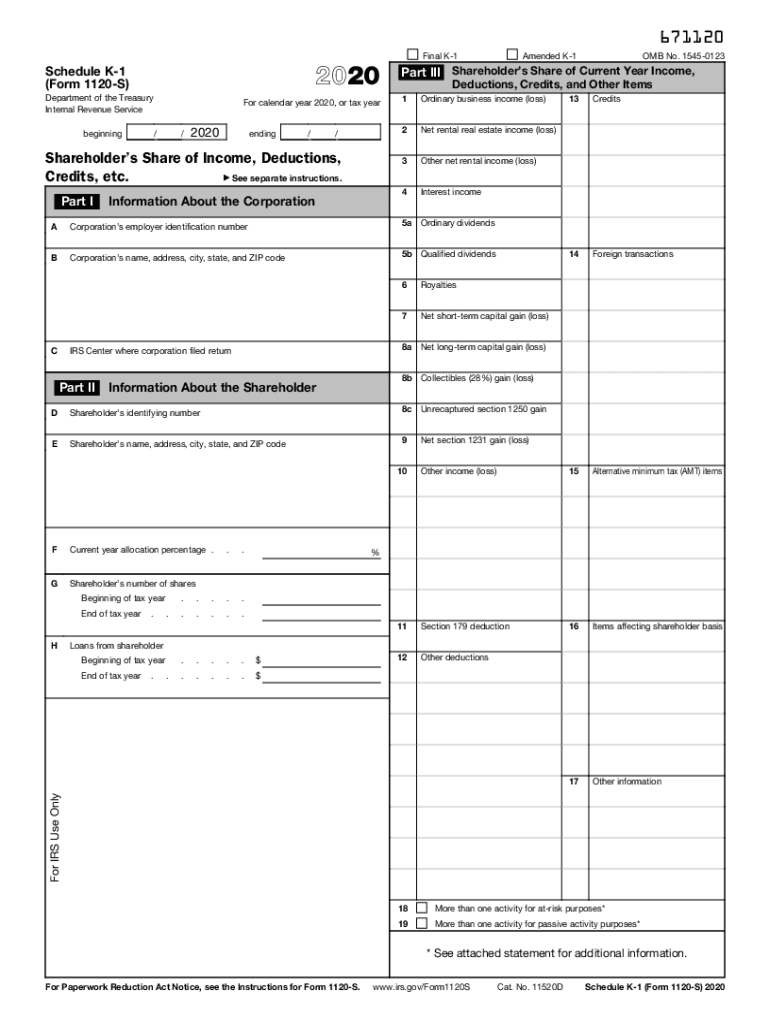

The Schedule K-1 Form 1120-S is a tax document used by S corporations to report each shareholder's share of income, deductions, credits, and other tax-related items. This form is essential for shareholders to accurately report their income on their individual tax returns. Each shareholder receives a K-1, detailing their portion of the corporation's income and expenses, which they must include when filing their personal taxes. Understanding the details of this form is crucial for compliance with IRS regulations.

Steps to Complete the Schedule K-1 Form 1120-S

Completing the Schedule K-1 Form 1120-S involves several key steps:

- Gather necessary financial information from the S corporation, including income, deductions, and credits.

- Fill out the shareholder's information, including name, address, and taxpayer identification number.

- Report the shareholder's share of income, deductions, and credits in the appropriate sections of the form.

- Ensure all calculations are accurate and in compliance with IRS guidelines.

- Provide a copy of the completed K-1 to the shareholder and retain a copy for the corporation's records.

How to Obtain the Schedule K-1 Form 1120-S

Shareholders can obtain the Schedule K-1 Form 1120-S directly from the S corporation. The corporation is responsible for preparing and distributing the form to each shareholder after the end of the tax year. If a shareholder does not receive their K-1, they should contact the corporation's financial department to request a copy. Additionally, the IRS provides the form on its official website, where it can be downloaded for reference.

Legal Use of the Schedule K-1 Form 1120-S

The Schedule K-1 Form 1120-S is legally binding and must be completed accurately to reflect the shareholder's financial interests in the S corporation. It is essential for shareholders to use the information from the K-1 when filing their personal tax returns to avoid discrepancies with the IRS. Misreporting or failing to report income from the K-1 can lead to penalties or audits, making it vital for shareholders to understand their obligations regarding this form.

IRS Guidelines for Schedule K-1 Form 1120-S

The IRS has specific guidelines regarding the completion and submission of the Schedule K-1 Form 1120-S. These guidelines include:

- Timely distribution of the K-1 to shareholders, typically by March 15 of the following tax year.

- Accurate reporting of all income, deductions, and credits to ensure compliance with tax laws.

- Providing shareholders with clear instructions on how to report the K-1 information on their individual tax returns.

Filing Deadlines for Schedule K-1 Form 1120-S

Filing deadlines for the Schedule K-1 Form 1120-S are critical for compliance. The S corporation must provide the completed K-1 to shareholders by March 15 of the year following the tax year. Shareholders must then report the K-1 information on their personal tax returns, which are typically due by April 15. Understanding these deadlines helps ensure that all parties meet their tax obligations on time.

Quick guide on how to complete 2020 schedule k 1 form 1120 s shareholders share of income deductions credits etc

Accomplish Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc with ease

- Obtain Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule k 1 form 1120 s shareholders share of income deductions credits etc

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule k 1 form 1120 s shareholders share of income deductions credits etc

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is a federal K 1?

A federal K 1 is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about an individual's share of income from these entities, which is essential for accurate tax filing.

-

How can airSlate SignNow assist with federal K 1 documents?

airSlate SignNow streamlines the process of sending and eSigning federal K 1 documents, making it easier to manage essential tax paperwork. With its user-friendly interface, users can securely send, sign, and store these documents electronically, minimizing the risk of errors and delays.

-

Is there a cost associated with using airSlate SignNow for federal K 1 forms?

Yes, airSlate SignNow offers several pricing plans tailored to meet different business needs. These plans provide access to all features required to manage federal K 1 forms efficiently, ensuring you get great value for your investment.

-

What features does airSlate SignNow offer for handling federal K 1 documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and tracking capabilities, all of which enhance the management of federal K 1 documents. These tools help ensure that you maintain compliance and keep your tax documents organized.

-

Can I integrate airSlate SignNow with other accounting software for federal K 1 management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to automate the flow of information related to federal K 1 forms. This integration helps streamline your workflow and reduce manual entry errors.

-

How does airSlate SignNow ensure the security of federal K 1 documents?

airSlate SignNow prioritizes security with features like encrypted data transmission, secure cloud storage, and multi-factor authentication. These measures ensure that your federal K 1 documents are protected against unauthorized access and data bsignNowes.

-

What benefits can I expect from using airSlate SignNow for federal K 1 eSigning?

Using airSlate SignNow for federal K 1 eSigning offers numerous benefits, including faster turnaround times and enhanced document tracking. Additionally, electronic signatures are legally binding and simplify the entire process, making it more efficient for both parties involved.

Get more for Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc

- School bus discipline forms

- Brunswick stew order form richmond shag club

- Reinstatement application office of the risd registrar form

- Printable tree removal contract template form

- Student data change form acc

- Air force after action report template form

- Supply order form eu enagic

- Wwwpdffillercom418145545 70mm bay order formfillable online 70mm bay order form fax back to 01656 746

Find out other Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast