1120 S Form 2009

What is the 1120 S Form

The 1120 S Form is a tax return form used by S corporations in the United States to report income, deductions, and credits. S corporations are special types of corporations that pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. This form allows S corporations to provide the IRS with a comprehensive overview of their financial activities for the tax year. By filing the 1120 S Form, S corporations ensure compliance with federal tax laws while allowing shareholders to report their share of income on their personal tax returns.

How to use the 1120 S Form

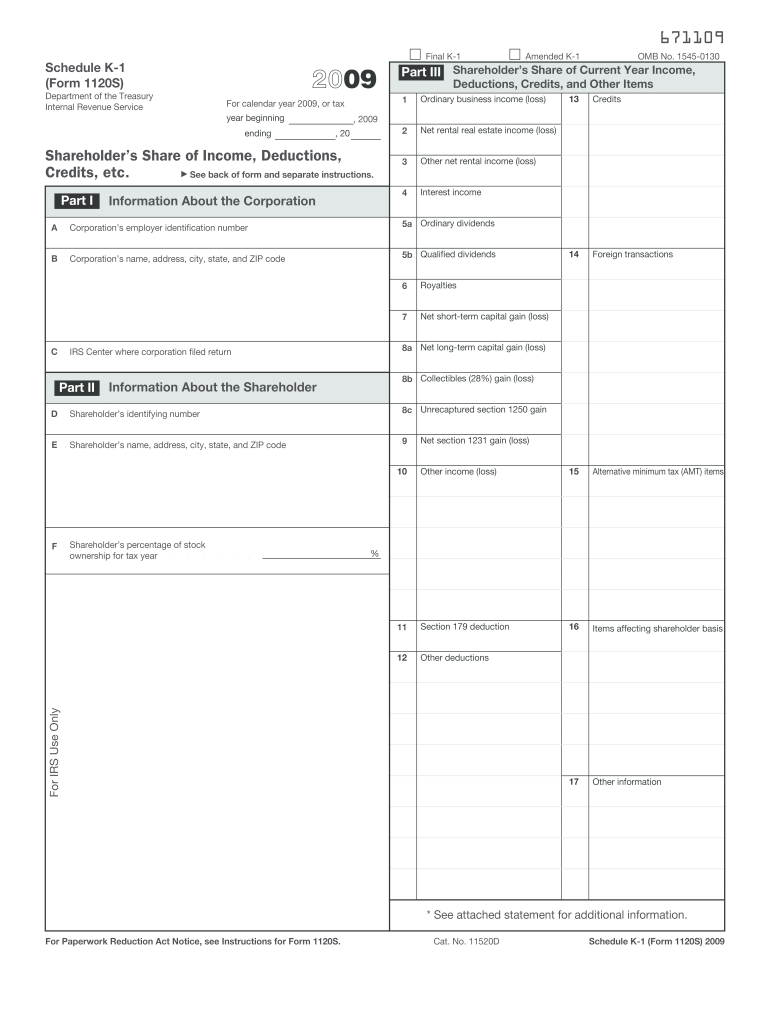

Using the 1120 S Form involves several steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, complete each section of the form accurately, ensuring that all income and expenses are reported. S corporations must also include a Schedule K-1 for each shareholder, detailing their share of income, deductions, and credits. Once completed, the form should be reviewed for accuracy before submission. It is crucial to keep a copy for your records and to ensure that all shareholders receive their K-1s for their personal tax filings.

Steps to complete the 1120 S Form

Completing the 1120 S Form requires careful attention to detail. Follow these steps:

- Gather financial records, including income statements and receipts for expenses.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report all income earned during the tax year on the appropriate lines.

- Detail all deductions, including salaries, rent, and other business expenses.

- Calculate the total income and deductions to determine the taxable income.

- Complete the Schedule K-1 for each shareholder, detailing their share of income and deductions.

- Review the form for accuracy and completeness.

Filing Deadlines / Important Dates

The deadline for filing the 1120 S Form is typically the fifteenth day of the third month after the end of the corporation's tax year. For most S corporations operating on a calendar year, this means the form is due on March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations can apply for an automatic six-month extension, but this does not extend the time to pay any taxes owed. It is important to keep track of these deadlines to avoid penalties.

Legal use of the 1120 S Form

The 1120 S Form is legally binding when filed correctly and on time. It must be completed in accordance with IRS guidelines to ensure compliance with federal tax laws. The information reported on this form is used by the IRS to assess the tax obligations of the S corporation and its shareholders. Failure to file the form or inaccuracies in reporting can result in penalties and interest on unpaid taxes. Therefore, it is essential to understand the legal implications of the information provided on the 1120 S Form.

Key elements of the 1120 S Form

Key elements of the 1120 S Form include:

- Income Reporting: All sources of income must be reported, including sales and interest income.

- Deductions: Eligible business expenses can be deducted to reduce taxable income.

- Shareholder Information: Each shareholder's K-1 must be included, detailing their share of income and deductions.

- Tax Computation: The form includes calculations to determine the corporation's tax liability.

Quick guide on how to complete 2009 1120 s form

Complete 1120 S Form effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers a perfect green alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle 1120 S Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based process today.

The easiest method to modify and eSign 1120 S Form without stress

- Obtain 1120 S Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you choose. Modify and eSign 1120 S Form and guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 1120 s form

Create this form in 5 minutes!

How to create an eSignature for the 2009 1120 s form

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is an 1120 S Form?

The 1120 S Form is a tax return filed by S corporations in the United States to report income, deductions, and credits. It is essential for S corporations to use this form to ensure compliance with IRS regulations. Properly completing the 1120 S Form can help maximize tax benefits for your business.

-

How can airSlate SignNow help with the 1120 S Form?

airSlate SignNow simplifies the process of sending and eSigning the 1120 S Form. With our easy-to-use platform, you can quickly prepare your documents, gather necessary signatures, and ensure secure storage. By streamlining these tasks, airSlate SignNow helps you focus on your business while ensuring compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, starting from a cost-effective basic plan. Each plan includes essential features like eSigning and document management, making it ideal for handling your 1120 S Form. You can choose a plan that fits your budget and requirements for optimal workflow.

-

Is airSlate SignNow secure for sending sensitive documents like the 1120 S Form?

Yes, airSlate SignNow prioritizes security and utilizes encryption to protect your documents, including the sensitive 1120 S Form. We comply with industry standards and regulations to ensure that your data remains safe and confidential throughout the signing process. You can trust us to handle your documents securely.

-

Can I integrate airSlate SignNow with my accounting software for the 1120 S Form?

Absolutely! airSlate SignNow offers integrations with various accounting software solutions, allowing you to seamlessly manage your 1120 S Form and related documents. This integration simplifies the process, ensuring that you can easily access and utilize your financial data for a more efficient experience.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including the 1120 S Form, allows for a streamlined workflow and improved efficiency. Our platform reduces paperwork and minimizes errors associated with manual signing processes. Additionally, the ability to access your documents anytime, anywhere, enhances convenience for your business.

-

How easy is it to eSign the 1120 S Form with airSlate SignNow?

eSigning the 1120 S Form with airSlate SignNow is incredibly straightforward. Our intuitive interface allows users to quickly upload their forms, add signers, and send for signatures within minutes. The entire process is designed to be user-friendly, ensuring that you can complete your tax documentation with ease.

Get more for 1120 S Form

- Walking with cavemen worksheet answers form

- Marketing project request form briarcliffedu

- Achieve 3000 tracking sheet form

- Marist college expense reportdocx form

- Medical information form california university of pennsylvania calu

- Personal data sheet example form

- Cfl intake form editeddocx

- Course registration form north carolina aampt state university ncat

Find out other 1120 S Form

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template