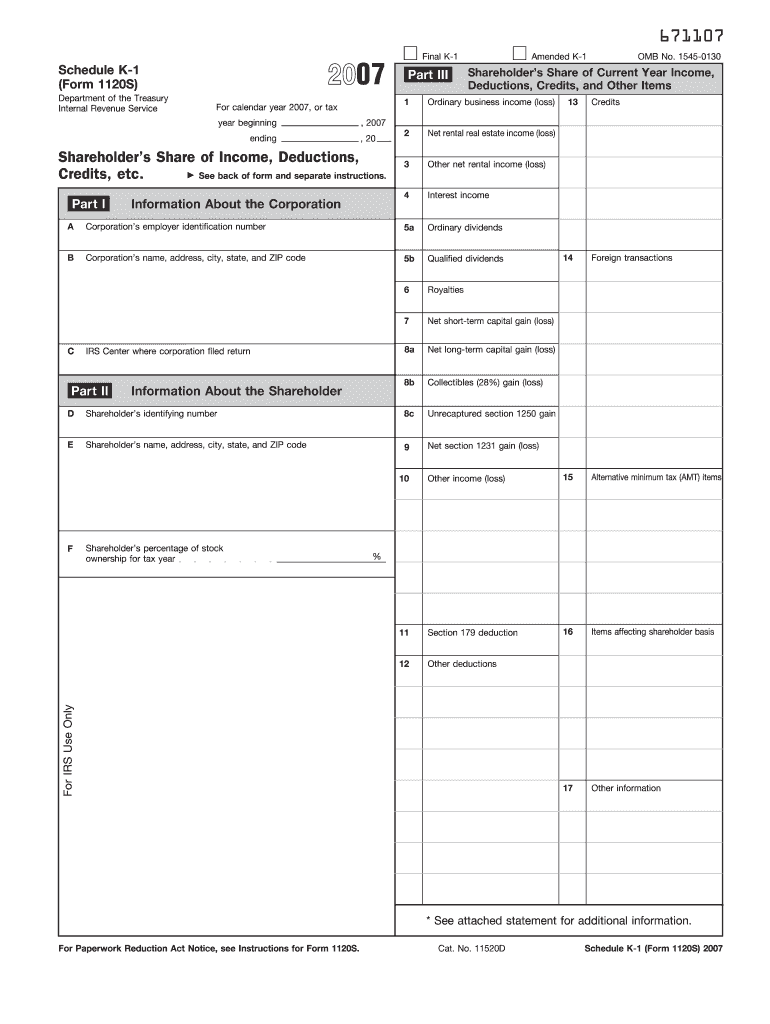

Form 1120s K1 2007

What is the Form 1120S K-1?

The Form 1120S K-1 is a tax document used by S corporations to report income, deductions, and credits to shareholders. Each shareholder receives a K-1 that details their share of the corporation's income, which they must report on their personal tax returns. This form ensures that income is taxed at the individual level rather than at the corporate level, aligning with the pass-through taxation structure of S corporations.

How to Use the Form 1120S K-1

To effectively use the Form 1120S K-1, shareholders should carefully review the information provided. The K-1 includes details such as the shareholder's share of income, losses, and other tax attributes. Shareholders must report these figures on their personal tax returns, typically using Form 1040. It is crucial to ensure that the amounts reported on the K-1 match the entries on the tax return to avoid discrepancies that could trigger an audit.

Steps to Complete the Form 1120S K-1

Completing the Form 1120S K-1 involves several steps:

- Gather necessary financial information from the S corporation's accounting records.

- Calculate the shareholder's share of the corporation's income, deductions, and credits.

- Fill out the K-1 form accurately, ensuring all amounts are correct and correspond to the shareholder's ownership percentage.

- Distribute the completed K-1 forms to all shareholders by the IRS deadline.

Legal Use of the Form 1120S K-1

The Form 1120S K-1 is legally binding and must be completed in accordance with IRS regulations. Accurate reporting is essential, as incorrect information can lead to penalties for both the corporation and the shareholders. Shareholders should retain copies of their K-1 forms for their records and ensure they are reported on their tax returns to maintain compliance with tax laws.

Filing Deadlines / Important Dates

For S corporations, the Form 1120S must be filed by March 15th of each year. Shareholders typically receive their K-1 forms shortly after the corporation files its return. It is important for shareholders to be aware of these deadlines to ensure they file their personal tax returns accurately and on time.

Who Issues the Form 1120S K-1

The Form 1120S K-1 is issued by S corporations to their shareholders. The corporation is responsible for preparing and distributing the K-1 forms, ensuring that each shareholder receives the necessary documentation to report their income on their personal tax returns. This process is crucial for maintaining proper tax compliance and transparency among shareholders.

Quick guide on how to complete 2007 form 1120s k1

Complete Form 1120s K1 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Form 1120s K1 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 1120s K1 with ease

- Find Form 1120s K1 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Form 1120s K1 and maintain excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2007 form 1120s k1

Create this form in 5 minutes!

How to create an eSignature for the 2007 form 1120s k1

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 1120s K1 and why is it important?

Form 1120s K1 is a tax document that reports each shareholder's share of income, deductions, and credits from an S corporation. It's crucial for accurate tax reporting, ensuring that all income is properly reported to the IRS. Completing Form 1120s K1 correctly can help shareholders avoid penalties and ensure compliance with tax laws.

-

How can airSlate SignNow simplify the process of handling Form 1120s K1?

airSlate SignNow streamlines the process of sending and eSigning Form 1120s K1 by providing a user-friendly platform. Our solution allows businesses to prepare, manage, and securely send necessary tax documents with ease. This simplifies the workflow for accountants and business owners alike, saving time and reducing errors.

-

What features does airSlate SignNow offer for managing Form 1120s K1?

airSlate SignNow offers features like customizable templates, automated reminders, and secure eSignature options specifically for Form 1120s K1. These features enhance efficiency and ensure that all necessary documents are completed accurately and promptly. By utilizing these tools, users can streamline their tax preparation processes.

-

Is there a cost associated with using airSlate SignNow for Form 1120s K1?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to essential features for managing Form 1120s K1 and other documents, ensuring that businesses of all sizes can find an affordable option. You can review our pricing page for detailed information on each plan.

-

Can airSlate SignNow integrate with accounting software for Form 1120s K1?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing users to easily import and manage Form 1120s K1. By integrating with your current systems, you can eliminate duplicate data entry and streamline the tax preparation process, making it more efficient.

-

How secure is the transmission of Form 1120s K1 through airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure data transmission protocols to protect your sensitive information, including Form 1120s K1. Rest assured, your documents are safe from unauthorized access and are handled with the utmost care.

-

What benefits can I expect from using airSlate SignNow for Form 1120s K1?

By using airSlate SignNow for Form 1120s K1, you can expect increased efficiency, reduced turnaround time, and improved accuracy in your tax document handling. Our platform empowers you to manage documents electronically, thus minimizing paper usage and enhancing collaboration among stakeholders. This modern approach to document management helps businesses save time and resources.

Get more for Form 1120s K1

Find out other Form 1120s K1

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document