K 1 Form 2010

What is the K-1 Form

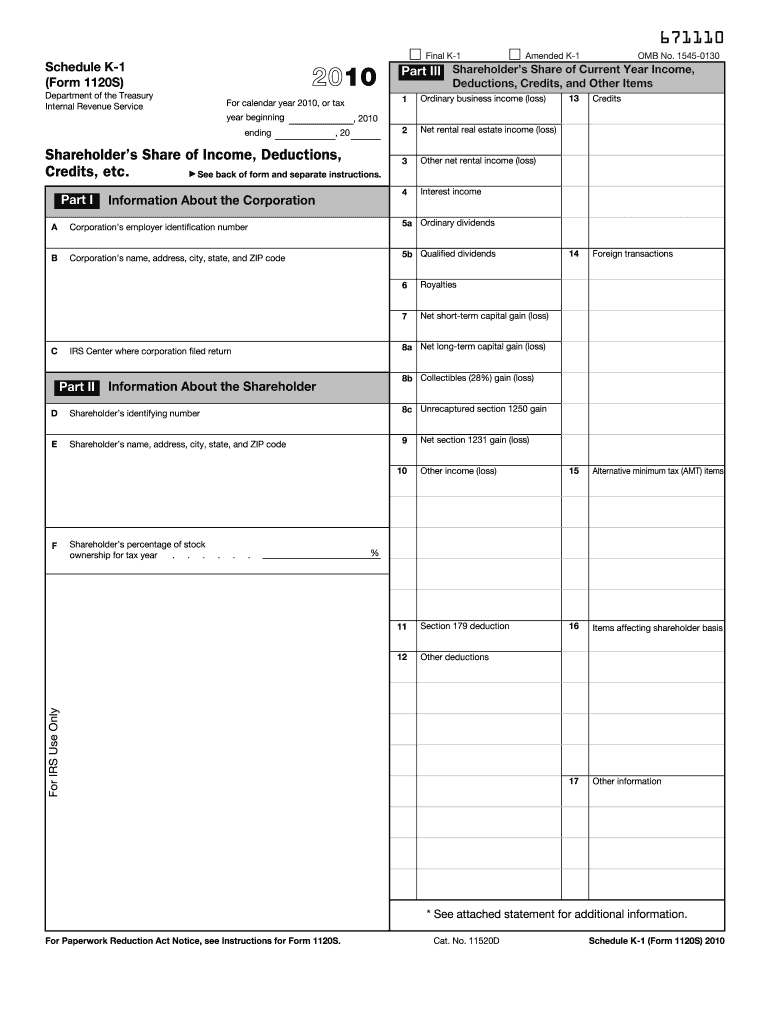

The K-1 Form is an essential tax document used primarily by partnerships, S corporations, estates, and trusts to report income, deductions, and credits to individual partners or shareholders. Each partner or shareholder receives a K-1 that details their share of the entity's income, loss, and other tax-related information. This form is crucial for ensuring that income is accurately reported on individual tax returns, as it helps taxpayers understand their tax obligations based on their share of the entity's financial activities.

How to use the K-1 Form

Using the K-1 Form involves several steps to ensure accurate reporting of income. First, recipients must review the information provided on the K-1 to confirm its accuracy. The income and deductions reported on the K-1 should be transferred to the appropriate sections of the individual tax return, typically on Form 1040. It is important to keep a copy of the K-1 for personal records, as it may be needed for future reference or audits. Taxpayers should also consult with a tax professional if they have questions about how to report the information correctly.

Steps to complete the K-1 Form

Completing the K-1 Form requires careful attention to detail. Here are the key steps:

- Gather necessary financial information from the partnership or S corporation.

- Fill out the entity's identifying information, including name, address, and Employer Identification Number (EIN).

- Report the income, deductions, and credits allocated to each partner or shareholder based on the entity's financial performance.

- Ensure all calculations are accurate and reflect the entity’s financial statements.

- Distribute the completed K-1 Forms to each partner or shareholder by the required deadline.

Legal use of the K-1 Form

The K-1 Form has legal significance as it ensures compliance with IRS regulations. Each entity must issue K-1 Forms to its partners or shareholders to report income accurately. Failure to provide a K-1 can result in penalties for the entity and complications for the individual taxpayer, including potential audits or discrepancies in reported income. It is essential for both the issuing entity and the recipients to maintain accurate records and comply with all relevant tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the K-1 Form are crucial for compliance. Typically, partnerships and S corporations must provide K-1 Forms to their partners or shareholders by March 15 of the following tax year. This allows individuals sufficient time to incorporate the information into their personal tax returns, which are generally due on April 15. It is important to be aware of these dates to avoid penalties and ensure timely filing.

Who Issues the Form

The K-1 Form is issued by partnerships, S corporations, estates, and trusts. Each entity is responsible for preparing and distributing K-1 Forms to their respective partners or beneficiaries. The accuracy of the information reported on the K-1 is the responsibility of the entity, and it is important for them to ensure that all financial data is correctly represented to avoid issues for the recipients during tax filing.

Quick guide on how to complete 2010 k 1 form

Effortlessly Prepare K 1 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly, without delays. Handle K 1 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign K 1 Form Seamlessly

- Find K 1 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign K 1 Form while ensuring excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 k 1 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 k 1 form

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a K 1 Form and why do I need it?

The K 1 Form is a tax document used to report income, deductions, and credits from partnerships and S corporations. It's essential for individuals who are partners or shareholders, as it ensures accurate tax reporting. Using airSlate SignNow, you can easily eSign and send your K 1 Form securely, streamlining the process.

-

How can airSlate SignNow help me manage my K 1 Form?

airSlate SignNow simplifies the management of your K 1 Form by allowing you to create, edit, and eSign documents online. With our user-friendly interface, you can quickly fill out necessary details and send the K 1 Form to other parties for their signatures. This eliminates the hassle of printing and mailing paper forms.

-

Is there a cost associated with using airSlate SignNow for my K 1 Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan provides access to features that help you manage your K 1 Form efficiently, with options for businesses of all sizes. You can choose a plan that fits your budget and document signing requirements.

-

Can I integrate airSlate SignNow with other software for my K 1 Form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and QuickBooks. This means you can easily sync your K 1 Form with other platforms, enhancing your workflow and ensuring that your documents are always up-to-date.

-

What features does airSlate SignNow offer for handling K 1 Forms?

airSlate SignNow provides a range of features for managing your K 1 Form, including customizable templates, in-app notifications, and audit trails. These tools help ensure that your K 1 Form is filled correctly and signed by all necessary parties without any delays.

-

Is airSlate SignNow secure for signing my K 1 Form?

Yes, airSlate SignNow prioritizes security with advanced encryption and authentication measures. When signing your K 1 Form, you can be confident that your information is protected against unauthorized access, ensuring your documents remain confidential.

-

How long does it take to complete a K 1 Form using airSlate SignNow?

Completing a K 1 Form with airSlate SignNow can take just a few minutes, depending on the complexity of the information required. Our intuitive interface allows you to fill in details quickly and send the K 1 Form for signatures without unnecessary delays.

Get more for K 1 Form

- 2019 form ftb 3519 payment for automatic extension for individuals 2019 form ftb 3519 payment for automatic extension for

- Fillable online 540 es form 1 at bottom of page sutter tax fax

- Form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 620

- 2019 form 3533 change of address for individuals 2019 form 3533 change of address for individuals

- Form rp 6704 a1 joint statement of school tax levy for the 2020 2021 fiscal year revised 720

- Form rp 425 e application for enhanced star exemption for the 2020 2021 school year revised 820

- Form st 810 new york state and local quarterly sales and use tax return for part quarterly filers revised 1120

- Form ct 300 mandatory first installment mfi of estimated

Find out other K 1 Form

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online