1120s K 1 Irs Form 2012

What is the 1120S K-1 IRS Form

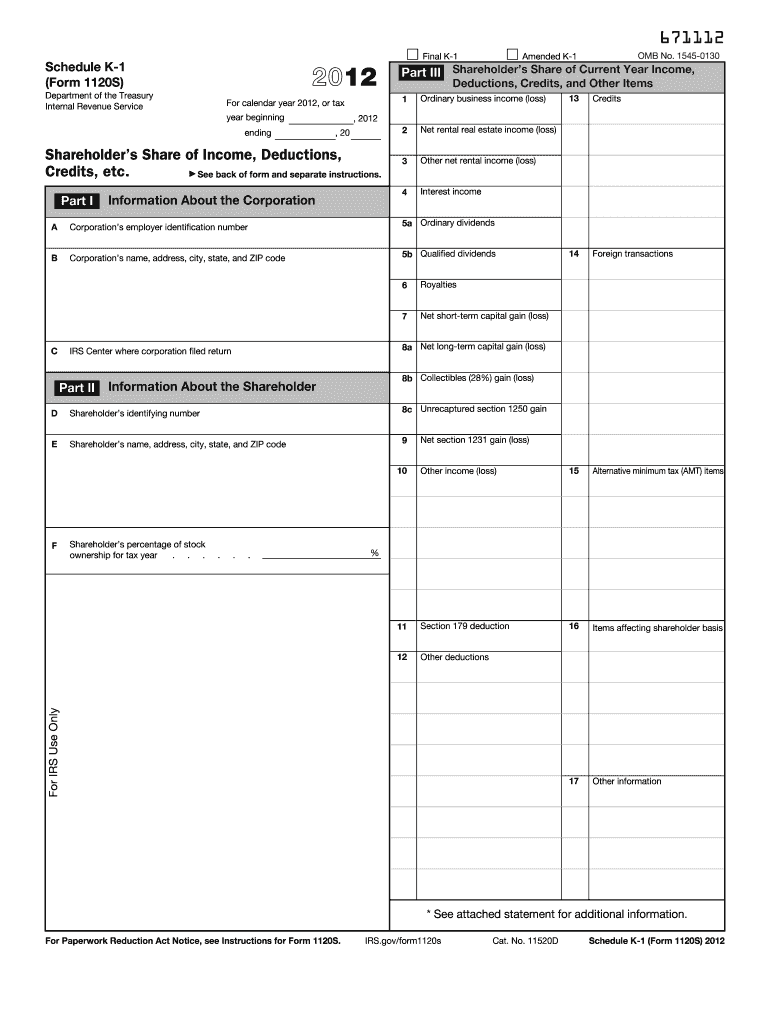

The 1120S K-1 IRS Form is a crucial document used by S corporations to report income, deductions, and credits to shareholders. Each shareholder receives a K-1, which details their share of the corporation's income, losses, and other tax-related information. This form is essential for shareholders when filing their individual income tax returns, as it helps them accurately report their portion of the corporation's financial activities.

How to Obtain the 1120S K-1 IRS Form

To obtain the 1120S K-1 IRS Form, shareholders can request it directly from the S corporation. The corporation is responsible for preparing and distributing the K-1 forms to all shareholders by the IRS deadline. Additionally, the form can be downloaded from the IRS website, ensuring that shareholders have access to the most current version. It is important for shareholders to ensure they receive their K-1 in a timely manner to meet their tax filing obligations.

Steps to Complete the 1120S K-1 IRS Form

Completing the 1120S K-1 IRS Form involves several key steps:

- Gather necessary information, including the shareholder's tax identification number and details about the S corporation.

- Report the shareholder's share of income, deductions, and credits as provided by the corporation.

- Ensure accuracy by cross-referencing the information with the corporation's financial statements.

- Review the completed form for any errors before submitting it with the individual tax return.

Legal Use of the 1120S K-1 IRS Form

The 1120S K-1 IRS Form is legally binding and must be used in compliance with IRS regulations. Shareholders are required to report the information from the K-1 on their personal tax returns. Failure to accurately report this information can lead to penalties and interest charges. It is essential for both the S corporation and the shareholders to understand the legal implications of the K-1 to ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1120S K-1 IRS Form are aligned with the S corporation's tax return deadlines. Typically, S corporations must file their tax returns by the fifteenth day of the third month after the end of their tax year. Shareholders should receive their K-1 forms by this deadline to ensure they can file their individual tax returns on time. It is crucial for both parties to be aware of these deadlines to avoid late filing penalties.

Penalties for Non-Compliance

Non-compliance with the requirements related to the 1120S K-1 IRS Form can result in significant penalties. Shareholders who fail to report income from their K-1 may face underpayment penalties, while S corporations that do not issue K-1 forms on time may incur fines from the IRS. Understanding these penalties emphasizes the importance of accurate and timely filing for both shareholders and corporations.

Quick guide on how to complete 1120s k 1 2012 irs form

Effortlessly prepare 1120s K 1 Irs Form on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage 1120s K 1 Irs Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign 1120s K 1 Irs Form with ease

- Obtain 1120s K 1 Irs Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign 1120s K 1 Irs Form to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120s k 1 2012 irs form

Create this form in 5 minutes!

How to create an eSignature for the 1120s k 1 2012 irs form

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is the 1120s K 1 IRS Form and why do I need it?

The 1120s K 1 IRS Form is used by S-Corporations to report income, deductions, and credits to their shareholders. Understanding this form is crucial for business owners to accurately file taxes and ensure compliance with IRS regulations. Utilizing airSlate SignNow can simplify the process of signing and sending this essential document.

-

How can airSlate SignNow help with completing the 1120s K 1 IRS Form?

airSlate SignNow provides an intuitive platform that allows users to complete, eSign, and send the 1120s K 1 IRS Form quickly and easily. Our features streamline document management, making it simpler for businesses to handle tax forms without the hassle of manual processes. This efficiency can save you time and reduce errors in your tax filings.

-

Is there a cost associated with using airSlate SignNow for the 1120s K 1 IRS Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for those focused on handling the 1120s K 1 IRS Form. We provide a cost-effective solution with transparent pricing and no hidden fees. This allows businesses to choose a plan that meets their requirements without overspending.

-

Can I integrate airSlate SignNow with other software I use for accounting?

Absolutely! airSlate SignNow is designed to integrate seamlessly with numerous accounting and financial software programs, making it easy to manage the 1120s K 1 IRS Form alongside your other financial documents. This integration enhances workflow efficiency and ensures that all your data stays synchronized and up-to-date.

-

What features does airSlate SignNow offer to streamline the signing of the 1120s K 1 IRS Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated reminders, all aimed at simplifying how you handle the 1120s K 1 IRS Form. These tools help ensure that signatures are collected efficiently, reducing turnaround time and improving overall productivity. You can focus on your business while we take care of the paperwork.

-

Is airSlate SignNow secure for sending sensitive documents like the 1120s K 1 IRS Form?

Yes, security is a top priority for airSlate SignNow. We implement industry-standard encryption, multi-factor authentication, and rigorous compliance measures to protect sensitive documents, including the 1120s K 1 IRS Form. You can confidently send and receive your tax documents without worrying about data bsignNowes.

-

How does airSlate SignNow improve collaboration on the 1120s K 1 IRS Form among team members?

airSlate SignNow provides collaborative tools that allow team members to work together on the 1120s K 1 IRS Form in real-time. Our platform enables you to share documents, provide feedback, and track changes easily, ensuring everyone is on the same page. This collaboration can lead to more accurate submissions and a smoother filing process.

Get more for 1120s K 1 Irs Form

- Catholic health care directive form

- Mn provider change form

- First report of injury mn form

- Client placement authorization cpa ccdtf dhs 2780 eng 6 08 hennepinhealth form

- Mn workman comp first report of injury form

- Bluerx physician drug authorization form alseib

- Prime therapeutics part d prior authorization form part d drug authorization request form

- Pca timesheet form

Find out other 1120s K 1 Irs Form

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract