Schedule K 1 Form 1120 S Shareholders Share of Income, Deductions, Credits, Etc 2024

What is the Schedule K-1 Form 1120-S?

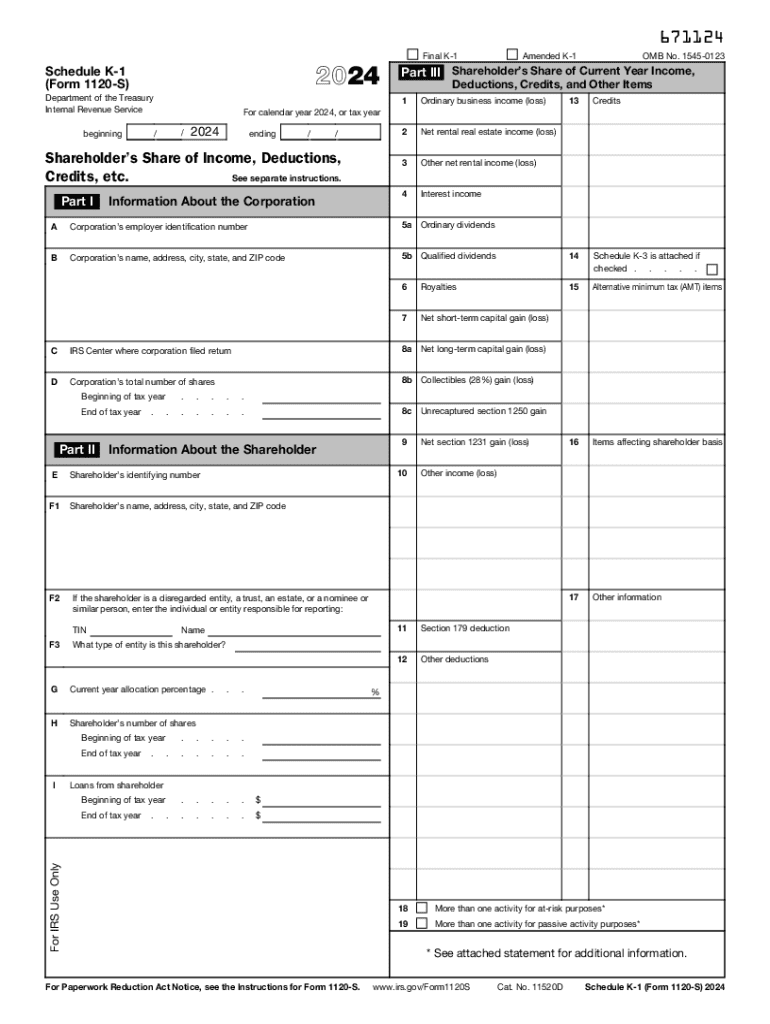

The Schedule K-1 Form 1120-S is a tax document used by S corporations to report each shareholder's share of income, deductions, credits, and other relevant tax information. This form plays a crucial role in ensuring that shareholders accurately report their earnings on their personal tax returns. Unlike traditional corporations, S corporations pass income directly to shareholders, allowing them to avoid double taxation. The K-1 form provides detailed information about each shareholder's portion of the corporation's income, which can include ordinary business income, rental income, and various tax credits.

Steps to Complete the Schedule K-1 Form 1120-S

Completing the Schedule K-1 Form 1120-S involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary financial information from the S corporation, including income statements and expense reports. Next, fill out the form by entering the shareholder's details, such as name, address, and taxpayer identification number. Then, report the shareholder's share of income, deductions, and credits in the appropriate sections of the form. It is important to review the completed form for any errors before submitting it to the IRS and providing a copy to the shareholder.

Key Elements of the Schedule K-1 Form 1120-S

The Schedule K-1 Form 1120-S contains several key elements that are essential for accurate reporting. These include:

- Shareholder Information: This section captures the shareholder's name, address, and taxpayer identification number.

- Income Reporting: The form details various types of income, including ordinary business income and capital gains.

- Deductions and Credits: Shareholders can also see their share of deductions and tax credits, which can reduce their overall tax liability.

- Other Information: Additional sections may include foreign transactions and other pertinent details that affect tax reporting.

IRS Guidelines for the Schedule K-1 Form 1120-S

The IRS provides specific guidelines for completing and filing the Schedule K-1 Form 1120-S. It is essential to follow these guidelines to avoid penalties and ensure compliance. The form must be filed with the S corporation's tax return, and copies should be distributed to all shareholders by the due date. Additionally, shareholders must include the information from the K-1 on their personal tax returns, typically on Form 1040. The IRS also emphasizes the importance of accuracy in reporting income and deductions to prevent audits or discrepancies.

Filing Deadlines for the Schedule K-1 Form 1120-S

The filing deadlines for the Schedule K-1 Form 1120-S align with the S corporation's tax return deadlines. Generally, S corporations must file their tax returns by March 15 for the previous calendar year. If the corporation requires an extension, the deadline can be extended to September 15. It is crucial for S corporations to provide K-1 forms to shareholders by the same deadlines to ensure timely reporting on their individual tax returns. Missing these deadlines can lead to penalties for both the corporation and the shareholders.

Examples of Using the Schedule K-1 Form 1120-S

Understanding how to utilize the Schedule K-1 Form 1120-S can be illustrated through various scenarios. For instance, if a shareholder receives a K-1 reporting $10,000 in ordinary business income, they must include this amount on their Form 1040 as part of their taxable income. Similarly, if the K-1 indicates $2,000 in tax credits, the shareholder can apply these credits to reduce their overall tax liability. Each K-1 form provides unique information that directly impacts the shareholder's tax situation, making it vital for accurate and timely filing.

Handy tips for filling out Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc online

Quick steps to complete and e-sign Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant solution for maximum efficiency. Use signNow to electronically sign and send out Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form 1120 s shareholders share of income deductions credits etc

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 1120 s shareholders share of income deductions credits etc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a K 1 form and why is it important?

A K 1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It is important because it provides essential information for individuals to accurately file their taxes. Understanding the K 1 form can help ensure compliance with tax regulations and optimize tax benefits.

-

How can airSlate SignNow help with K 1 form management?

airSlate SignNow simplifies the process of managing K 1 forms by allowing users to easily send, sign, and store these documents electronically. With its user-friendly interface, businesses can streamline their document workflows, ensuring that K 1 forms are processed efficiently and securely. This helps reduce errors and saves time during tax season.

-

What features does airSlate SignNow offer for K 1 forms?

airSlate SignNow offers features such as customizable templates, electronic signatures, and secure document storage specifically for K 1 forms. Users can create and send K 1 forms quickly, track their status, and ensure compliance with legal requirements. These features enhance productivity and improve the overall document management process.

-

Is airSlate SignNow cost-effective for handling K 1 forms?

Yes, airSlate SignNow is a cost-effective solution for handling K 1 forms, offering various pricing plans to fit different business needs. By reducing the time and resources spent on paper-based processes, businesses can save money while ensuring compliance and accuracy. The investment in airSlate SignNow pays off through increased efficiency and reduced operational costs.

-

Can I integrate airSlate SignNow with other software for K 1 forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to manage K 1 forms alongside your existing tools. This integration allows for a smoother workflow, ensuring that all necessary data is synchronized and accessible. Users can enhance their productivity by leveraging these integrations.

-

What are the benefits of using airSlate SignNow for K 1 forms?

Using airSlate SignNow for K 1 forms offers numerous benefits, including improved accuracy, faster processing times, and enhanced security. The electronic signature feature ensures that documents are signed quickly and securely, while the cloud storage keeps them safe and easily accessible. Overall, it simplifies the K 1 form management process for businesses.

-

How secure is airSlate SignNow when handling K 1 forms?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect K 1 forms and sensitive data. With features like secure document storage and audit trails, users can trust that their information is safe from unauthorized access. This commitment to security helps businesses maintain compliance and protect their clients' data.

Get more for Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc

Find out other Schedule K 1 Form 1120 S Shareholders Share Of Income, Deductions, Credits, Etc

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy