Form 1120 1996

What is Form 1120

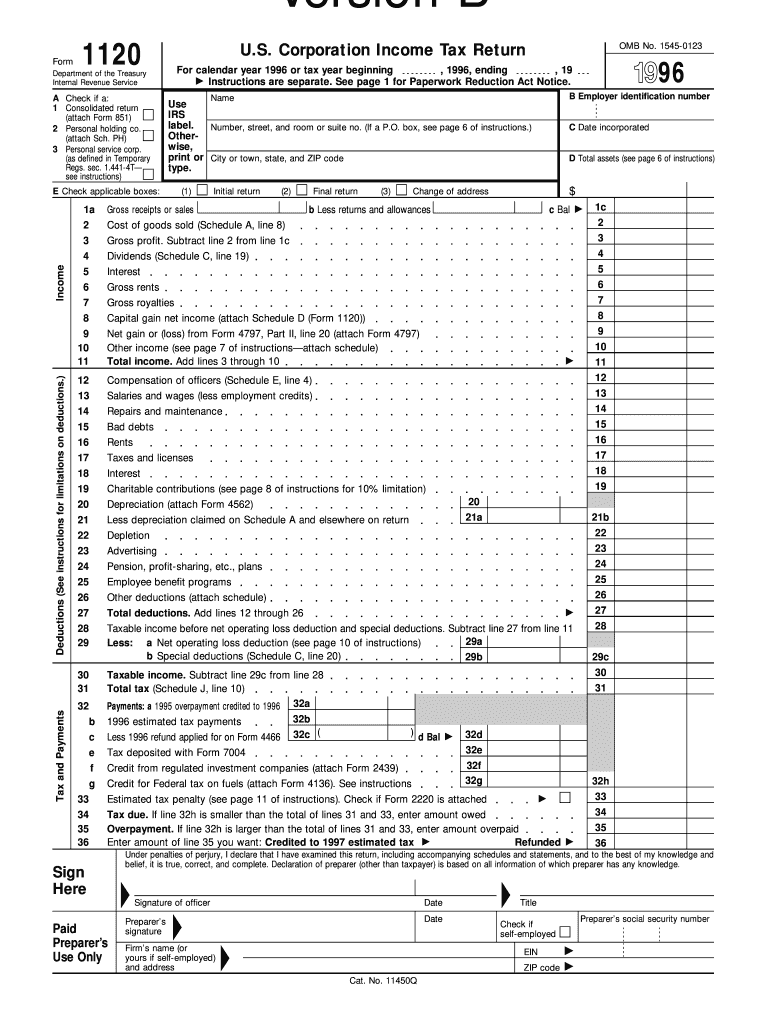

Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, as it determines the corporation's tax liability for the year. Corporations must file Form 1120 annually, regardless of whether they have taxable income or not. The information provided on this form allows the Internal Revenue Service (IRS) to assess the corporation's financial status and ensure compliance with federal tax laws.

How to use Form 1120

Using Form 1120 involves several steps to ensure accurate reporting of corporate income and expenses. Corporations must gather financial records, including income statements and balance sheets, to complete the form. Each section of Form 1120 requires specific information, such as total income, cost of goods sold, and deductions. After filling out the form, corporations should review it for accuracy before submission. Utilizing digital tools can simplify this process, allowing for easy editing and electronic filing.

Steps to complete Form 1120

Completing Form 1120 requires careful attention to detail. Here are the main steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including sales and other income sources.

- Calculate the cost of goods sold, if applicable, and report deductions for business expenses.

- Complete the tax computation section to determine the corporation's tax liability.

- Review the form for accuracy and completeness before submission.

Legal use of Form 1120

Form 1120 is legally binding when completed accurately and submitted on time. The IRS requires corporations to file this form to comply with federal tax laws. Failure to file or inaccuracies can result in penalties or audits. It is crucial for corporations to understand the legal implications of the information reported on this form. Utilizing electronic signature solutions can enhance the legal validity of the submission, ensuring that all signatures are verified and compliant with eSignature laws.

Filing Deadlines / Important Dates

The filing deadline for Form 1120 is typically the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations can request a six-month extension to file, but any taxes owed must still be paid by the original due date to avoid penalties and interest.

Form Submission Methods

Corporations have multiple options for submitting Form 1120. The form can be filed electronically through the IRS e-file system, which is often the fastest and most efficient method. Alternatively, corporations can submit Form 1120 by mail, sending it to the appropriate address based on their location. In-person submission is generally not available for this form. Choosing the right submission method can help ensure timely processing and compliance with IRS regulations.

Quick guide on how to complete 1996 form 1120

Effortlessly Complete Form 1120 on Any Device

Managing documents online has gained traction among organizations and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 1120 on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented procedure today.

How to Edit and Electronically Sign Form 1120 with Ease

- Find Form 1120 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, an action that takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your edits.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, and mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 1120 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1996 form 1120

Create this form in 5 minutes!

How to create an eSignature for the 1996 form 1120

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form 1120 and why do I need it?

Form 1120 is a tax return form used by C corporations to report their income, gains, losses, deductions, and tax liability. It is essential for compliance with IRS regulations, allowing businesses to accurately report their financial status and pay taxes owed.

-

How can airSlate SignNow help with Form 1120?

airSlate SignNow streamlines the process of preparing and submitting Form 1120 by allowing you to electronically sign and send documents securely. This not only expedites the filing process but also ensures that your documents are more organized and easily accessible.

-

What features does airSlate SignNow offer for creating Form 1120?

airSlate SignNow provides features such as customizable templates, document merging, and eSignature capabilities, which are particularly useful when preparing Form 1120. These tools simplify the creation and signing process, ensuring that you meet your deadlines effortlessly.

-

Is airSlate SignNow a cost-effective solution for managing Form 1120?

Yes, airSlate SignNow is known for its cost-effective pricing plans that cater to businesses of all sizes. By investing in this solution, you can save time and reduce the hassle of manual paperwork, making it a wise choice for managing Form 1120 efficiently.

-

Can I integrate airSlate SignNow with other accounting software for Form 1120?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software platforms, simplifying the data transfer process when preparing Form 1120. This integration helps ensure that all necessary data is accurately reflected in your submission.

-

How secure is airSlate SignNow when handling Form 1120 submissions?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures, ensuring that your Form 1120 and sensitive business information remain protected. Our solution adheres to industry standards to give you peace of mind during the filing process.

-

What benefits can I expect from using airSlate SignNow for Form 1120?

By using airSlate SignNow for Form 1120, you can expect increased efficiency, reduced processing times, and improved accuracy in your submissions. The platform allows you to track the signing process, ensuring that all signatures are obtained promptly.

Get more for Form 1120

Find out other Form 1120

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement