Form 1120 2013

What is the Form 1120

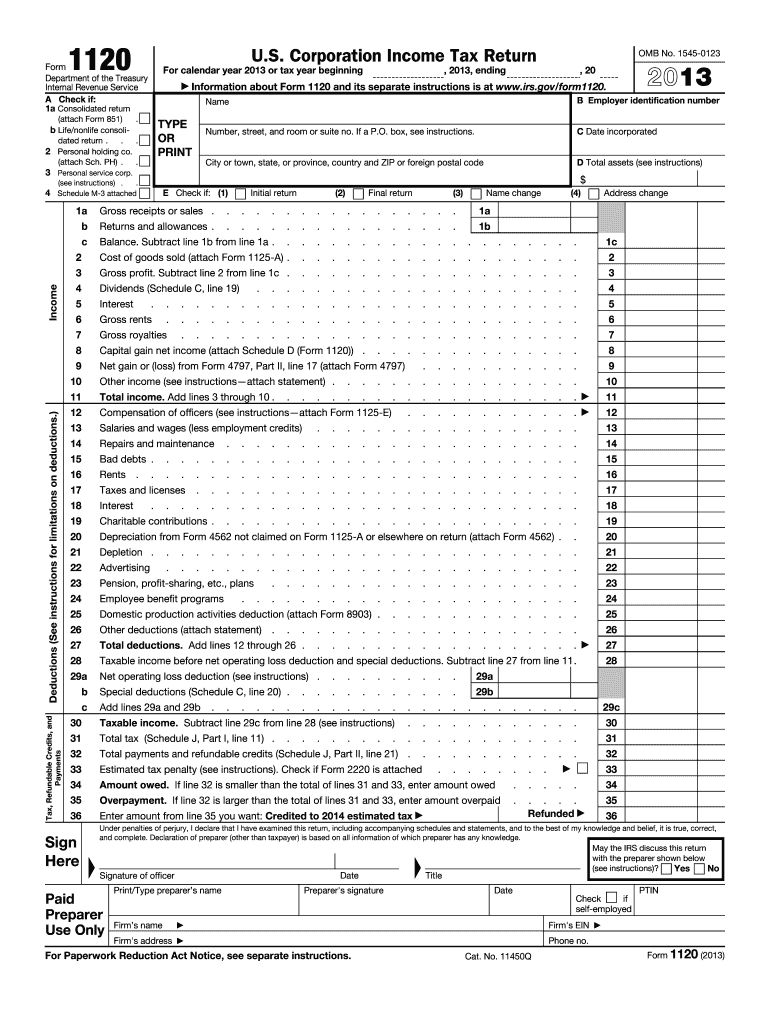

The Form 1120, officially known as the U.S. Corporation Income Tax Return, is a federal tax form used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations in the United States, as it determines the corporation's tax liability. The IRS requires this form to be filed annually, and it must accurately reflect the financial activities of the corporation for the tax year. Understanding the Form 1120 is crucial for compliance with federal tax regulations.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by providing details such as the corporation's name, address, and Employer Identification Number (EIN). Report all sources of income, including sales and interest earned. Then, list allowable deductions, such as salaries, rent, and utilities. After completing the form, review it for accuracy and ensure all calculations are correct before submitting it to the IRS.

Legal use of the Form 1120

The legal use of the Form 1120 is governed by IRS regulations, which stipulate that corporations must file this form to report their income accurately. Filing the Form 1120 is a legal obligation for C corporations, and failure to do so can result in penalties and interest charges. Additionally, the form must be signed by an authorized officer of the corporation, affirming that the information provided is true and correct. Compliance with these legal requirements ensures that the corporation meets its tax obligations and avoids potential legal issues.

Filing Deadlines / Important Dates

The filing deadline for the Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations may also request an automatic six-month extension to file, but this does not extend the time to pay any taxes owed, which must be paid by the original due date to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 can be submitted to the IRS through various methods. Corporations can file electronically using IRS-approved e-filing software, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location and whether it includes a payment. In-person submissions are generally not accepted, as the IRS encourages electronic filing for quicker processing. It is important to keep a copy of the submitted form for the corporation's records.

Penalties for Non-Compliance

Corporations that fail to file the Form 1120 on time or provide inaccurate information may face significant penalties. The IRS imposes a penalty for late filing, which can accumulate daily until the form is submitted. Additionally, if a corporation underreports its income or fails to pay the taxes owed, it may incur interest charges and further penalties. Understanding these consequences emphasizes the importance of timely and accurate filing of the Form 1120 to avoid financial repercussions.

Quick guide on how to complete form 1120 2013

Complete Form 1120 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a fantastic environmentally friendly option to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly and without interruptions. Manage Form 1120 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form 1120 effortlessly

- Locate Form 1120 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Produce your signature using the Sign tool, which only takes seconds and carries the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your preference. Modify and eSign Form 1120 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 2013

Create this form in 5 minutes!

How to create an eSignature for the form 1120 2013

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is Form 1120 and how is it used in business?

Form 1120 is the U.S. Corporation Income Tax Return used by C corporations to report their income, gains, losses, and deductions. Businesses must file Form 1120 annually to determine their tax obligations to the IRS. Properly managing your Form 1120 can help ensure compliance and optimize tax savings.

-

How can airSlate SignNow help with signing Form 1120?

airSlate SignNow provides a streamlined solution for electronically signing Form 1120, making it easy for business owners and accountants to get necessary signatures quickly. With its user-friendly interface, you can send, sign, and manage Form 1120 from any device, simplifying the tax filing process.

-

What features does airSlate SignNow offer for managing Form 1120?

airSlate SignNow offers features such as document templates, in-app signing, and real-time tracking for Form 1120. These tools help businesses save time and reduce errors when preparing and submitting tax documents. Additionally, the ability to collaborate with multiple signers ensures that your Form 1120 is completed accurately.

-

Is airSlate SignNow suitable for small businesses filing Form 1120?

Yes, airSlate SignNow is an excellent choice for small businesses filing Form 1120. Its cost-effective pricing plans make it accessible for companies of all sizes, while its intuitive design allows small business owners to manage their tax documentation without needing extensive technical knowledge.

-

What integrations does airSlate SignNow offer for tax preparation and Form 1120?

airSlate SignNow integrates seamlessly with various accounting and tax preparation software that can assist in filing Form 1120. This integration allows for smooth data transfer and ensures that all necessary information is accurately reflected in your tax documents, enhancing efficiency and accuracy.

-

How secure is airSlate SignNow for signing sensitive documents like Form 1120?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your Form 1120 and other sensitive documents. With features like password protection and audit trails, you can trust that your data remains confidential and secure throughout the signing process.

-

Can I store my completed Form 1120 on airSlate SignNow?

Yes, with airSlate SignNow, you can securely store your completed Form 1120 and access it anytime. The platform offers cloud storage solutions, making it easy to manage and retrieve your tax documents whenever needed, ensuring that you have all your records organized for future reference.

Get more for Form 1120

- Robert f smith school dedicated in inspiring ceremony form

- Letter of last instruction template form

- Rntcp request form for examination of biological specimen for tb

- Samordnet registermelding del 1 hovedblankett form

- Baggage delayloss claims travelex insurance form

- Karate kid worksheet form

- Assignment of interest in estate form

- Panama medical form

Find out other Form 1120

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself