Form 1120 1993

What is the Form 1120

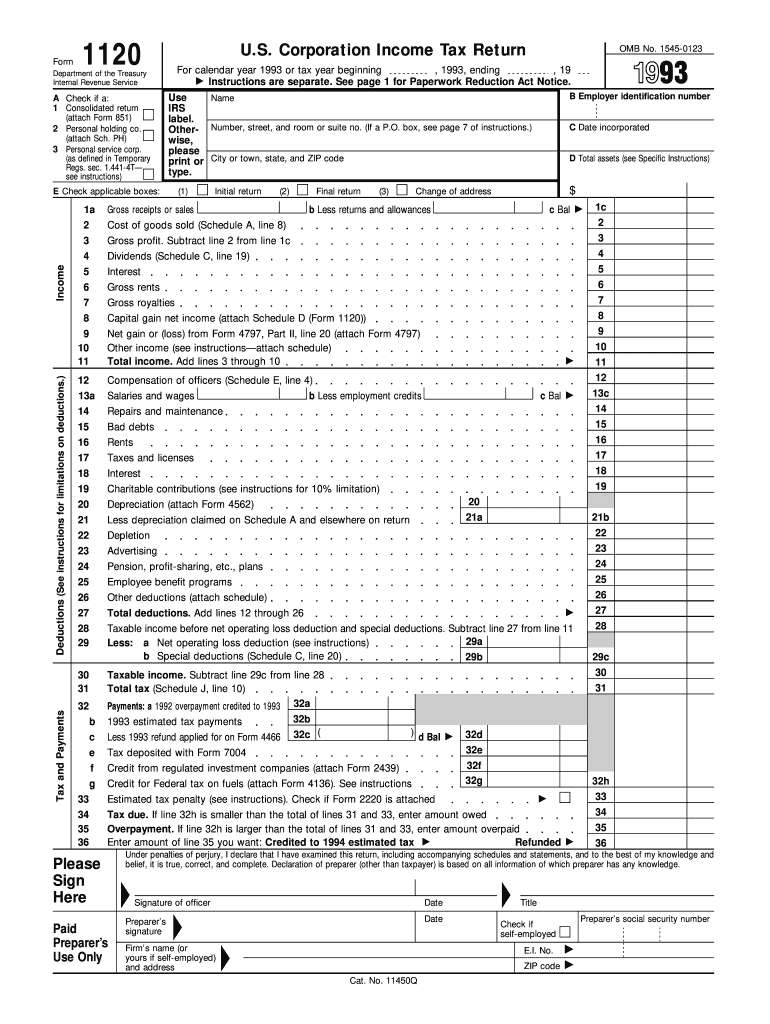

The Form 1120 is the U.S. Corporation Income Tax Return, which corporations use to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners. It allows the IRS to assess the tax liability of the corporation based on its financial activities over the fiscal year. The form requires detailed financial information, including revenue, expenses, and tax calculations.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps to ensure accuracy and compliance with IRS regulations:

- Gather financial records, including income statements, balance sheets, and receipts for expenses.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income by detailing gross receipts and any other income sources.

- Deduct allowable expenses, such as salaries, rent, and utilities, to determine taxable income.

- Calculate the corporation's tax liability using the appropriate tax rates.

- Review the completed form for accuracy before submission.

How to obtain the Form 1120

The Form 1120 can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, businesses can request a physical copy by contacting the IRS or visiting local IRS offices. It is advisable to ensure that the most current version of the form is used, as tax laws and forms may change annually.

Legal use of the Form 1120

The Form 1120 is legally binding when completed accurately and submitted to the IRS. It must be signed by an authorized officer of the corporation, affirming that the information provided is true and correct. Failure to file the form on time or providing false information can result in penalties, including fines and interest on unpaid taxes. Corporations must adhere to IRS guidelines to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

The deadline for filing Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can file for an automatic six-month extension, but this does not extend the time to pay any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Corporations can submit Form 1120 through various methods:

- Online: Many corporations choose to file electronically using IRS-approved tax software, which can streamline the process and reduce errors.

- Mail: The form can be printed and mailed to the appropriate IRS address, depending on the corporation's location and whether a payment is included.

- In-Person: Corporations may also deliver the form in person at designated IRS offices, although this method is less common.

Quick guide on how to complete 1993 form 1120

Effortlessly Prepare Form 1120 on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to produce, modify, and electronically sign your documents swiftly without interruptions. Manage Form 1120 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to Modify and eSign Form 1120 with Ease

- Obtain Form 1120 and then click Get Form to initiate the process.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information, then click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management requirements in just a few clicks from your chosen device. Modify and eSign Form 1120 to ensure clear communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1993 form 1120

Create this form in 5 minutes!

How to create an eSignature for the 1993 form 1120

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 1120 and who needs to file it?

Form 1120 is the U.S. Corporation Income Tax Return used by corporations to report their income, gains, losses, deductions, and credits. Any corporation that is subject to federal income tax must file Form 1120 annually. Understanding the requirements of Form 1120 is essential for compliance and accurate tax reporting.

-

How can airSlate SignNow help with filing Form 1120?

airSlate SignNow simplifies the process of gathering signatures and necessary documentation for Form 1120. With its user-friendly interface, you can easily send and eSign documents, ensuring that all required signatures are collected promptly. This streamlines the submission process and helps you meet your tax deadlines with ease.

-

Is there a cost associated with using airSlate SignNow for Form 1120?

Yes, airSlate SignNow offers several pricing plans to suit different business needs. The plans are designed to be cost-effective, especially for those who frequently deal with important documents like Form 1120. You can choose a plan that fits your budget while still gaining access to powerful eSigning features.

-

What features does airSlate SignNow offer for Form 1120 management?

airSlate SignNow provides features such as customizable templates, document tracking, and secure cloud storage that are particularly useful for managing Form 1120. These features help ensure that your documents are organized, easily accessible, and completed efficiently. Moreover, the platform's electronic signature capabilities enhance the legality and security of your filings.

-

Can I integrate airSlate SignNow with other software for Form 1120 processing?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, including accounting and tax preparation tools, to facilitate the processing of Form 1120. This integration allows you to streamline your workflow, ensuring that data flows smoothly between applications and reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for eSigning Form 1120?

Using airSlate SignNow for eSigning Form 1120 offers several benefits, including increased efficiency, enhanced security, and compliance with legal standards. The platform's electronic signatures are legally binding and help you save time by eliminating the need for physical document handling. This means you can focus on your business while ensuring your tax documents are handled correctly.

-

How secure is airSlate SignNow when handling Form 1120 documents?

airSlate SignNow prioritizes the security of your documents, including Form 1120, by employing advanced encryption protocols and compliance with industry standards. This ensures that all your sensitive information remains confidential and protected from unauthorized access. With airSlate SignNow, you can confidently manage your tax documents without compromising on security.

Get more for Form 1120

- Send completed form ampamp fees cash or chequesmoney eir

- San jose giants pups in the park liability release form

- Exchange form

- Attn grad students ampamp advisors annual soap student research form

- Educational events ampamp resources nccn annual congress form

- Window inspection template for measurements form

- District commissioner and assistant district commissioner form

- Webby pledge form

Find out other Form 1120

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form