1120 Form 2014

What is the 1120 Form

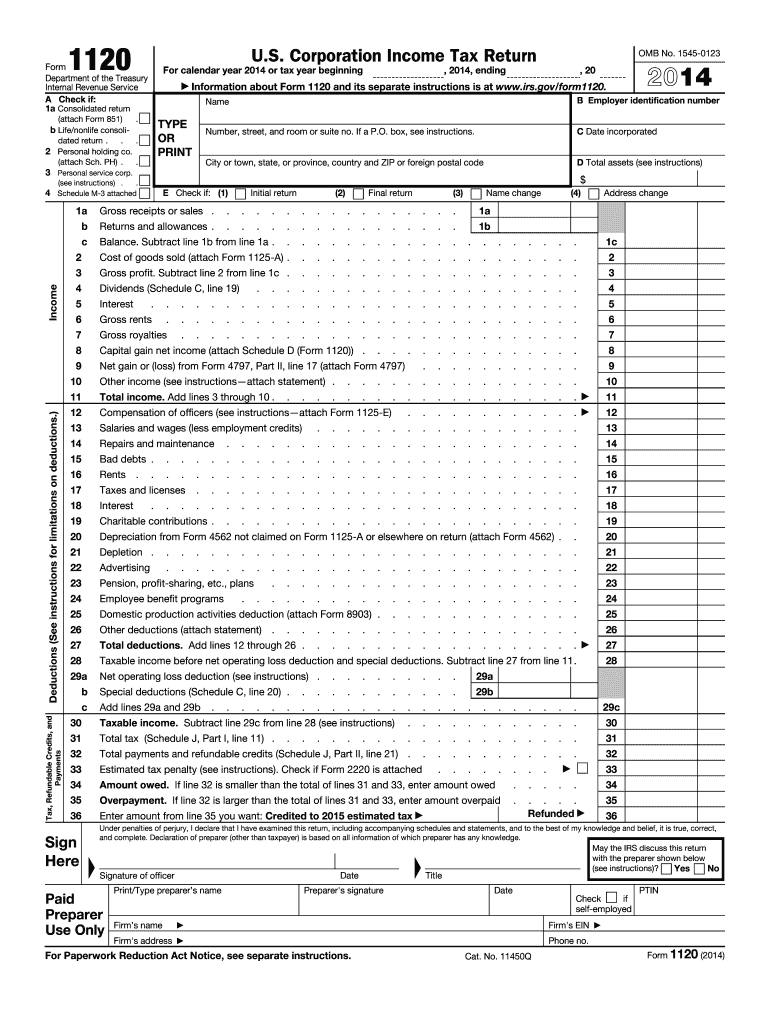

The 1120 Form is the U.S. corporate income tax return used by C corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their tax liability and ensure compliance with federal tax regulations. It provides the Internal Revenue Service (IRS) with a comprehensive overview of a corporation's financial activities during the tax year.

Steps to complete the 1120 Form

Completing the 1120 Form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by entering details such as total income, cost of goods sold, and various deductions. Pay close attention to the specific schedules required for different types of income and deductions. After completing the form, review it for any errors or omissions before submitting it to the IRS.

How to obtain the 1120 Form

The 1120 Form can be obtained directly from the IRS website or through authorized tax preparation software. The IRS provides the form in downloadable PDF format, allowing businesses to print and complete it manually. Additionally, many tax professionals and accounting firms can assist in obtaining and filing the form, ensuring that all requirements are met.

Legal use of the 1120 Form

The legal use of the 1120 Form is crucial for corporations to maintain compliance with federal tax laws. The form must be filed annually, and accurate reporting is essential to avoid penalties. E-filing is recognized as a valid method of submission, provided that the corporation adheres to the IRS guidelines for electronic filing. Ensuring that the form is completed correctly and submitted on time helps protect the corporation from legal issues related to tax compliance.

Filing Deadlines / Important Dates

The deadline for filing the 1120 Form is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations may request an automatic six-month extension, but this does not extend the time to pay any taxes owed.

Penalties for Non-Compliance

Failure to file the 1120 Form on time can result in significant penalties. The IRS imposes a late filing penalty, which is typically calculated based on the number of months the return is late and the amount of tax owed. Additionally, inaccuracies in the form can lead to further penalties and interest charges. It is essential for corporations to file accurately and on time to avoid these financial repercussions.

Quick guide on how to complete 1120 form 2014

Complete 1120 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct version and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage 1120 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign 1120 Form with ease

- Find 1120 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign 1120 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 form 2014

Create this form in 5 minutes!

How to create an eSignature for the 1120 form 2014

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is the 1120 Form and why is it important?

The 1120 Form is a crucial document used by corporations to report income, gains, losses, and other deductions to the IRS. Completing the 1120 Form accurately is essential for maintaining compliance with tax regulations. Proper filing ensures a company's tax obligations are met, helping to avoid penalties and interest.

-

How can airSlate SignNow assist with the 1120 Form?

airSlate SignNow offers a streamlined platform for signing and managing the 1120 Form electronically. With its intuitive interface, you can easily upload, edit, and send the 1120 Form for signatures, making the process efficient and hassle-free. This helps save time and ensures timely submission.

-

Is there a cost associated with using airSlate SignNow for the 1120 Form?

airSlate SignNow provides a cost-effective solution for handling the 1120 Form, with various pricing plans to suit different business needs. Whether you're a small business or a larger corporation, you can choose a plan that fits your budget. This allows you to manage your documents without breaking the bank.

-

What are the benefits of using airSlate SignNow for the 1120 Form?

Using airSlate SignNow for the 1120 Form offers numerous benefits, including increased efficiency and reduced paper usage. The platform provides secure electronic signatures, which help expedite the signing process. Additionally, it facilitates tracking and storage, ensuring that your documents are well organized and easily accessible.

-

Can I integrate airSlate SignNow with other software for my 1120 Form needs?

Yes, airSlate SignNow seamlessly integrates with various software and tools, enhancing your workflow related to the 1120 Form. Whether you're using accounting software or document management systems, you can sync your data effortlessly. This integration capability streamlines your process and reduces the need for manual data entry.

-

How secure is airSlate SignNow when handling the 1120 Form?

airSlate SignNow prioritizes the security of your documents, including the 1120 Form, by employing advanced encryption and security protocols. This ensures that your sensitive financial information is safe from unauthorized access. You can have peace of mind knowing that your data is protected during the entire signing process.

-

Can I track the status of my 1120 Form with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your 1120 Form throughout the signing process. You'll receive notifications when the document is viewed and signed, ensuring you stay informed every step of the way. This transparency helps facilitate timely filing and compliance.

Get more for 1120 Form

- Residence on december 31 form

- Azumio inc app check form

- Form 4669 abandoned property report

- Form 385 dealers sales report mogov

- To calculate the amount needed divide the amount of the expected tax by the number of pay periods in a form

- R the motor vehicle described on the attached application has not been operated on public roads or the highways of missouri by form

- Total loss auto claims state farm form

- City tax formskcmogov city of kansas city mo

Find out other 1120 Form

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer