Form1120 PDF 1120 U S Corporation Income Tax Return Form Department 2022

What is the Form 1120?

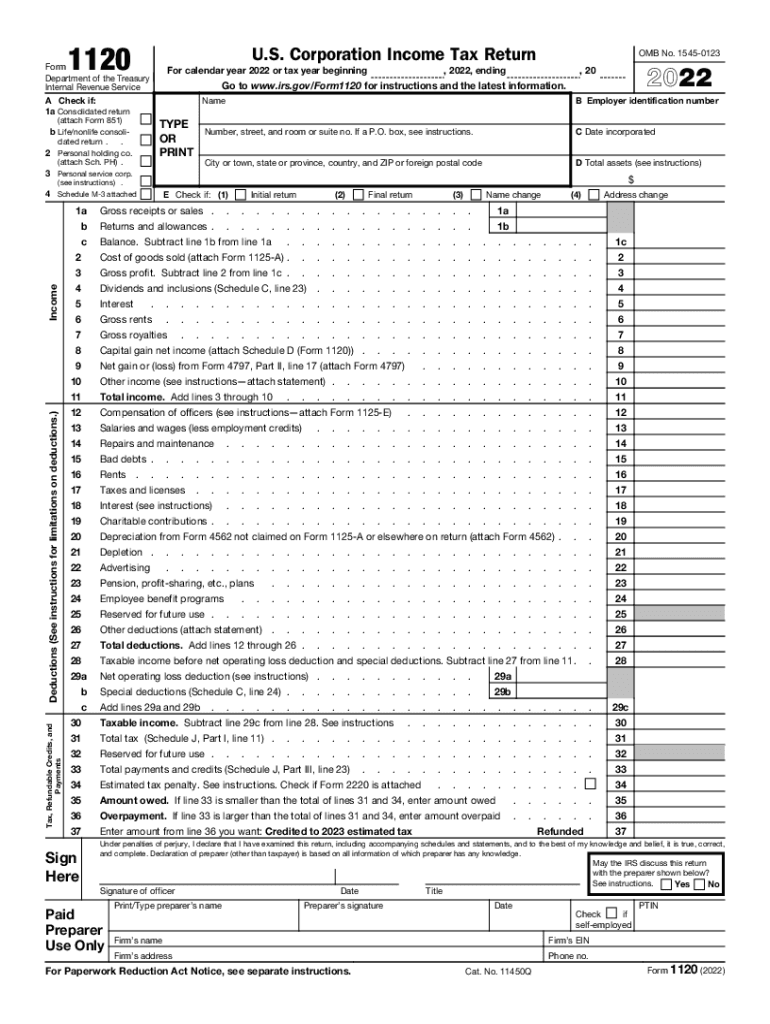

The Form 1120, officially known as the U.S. Corporation Income Tax Return, is a tax form used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for C corporations, which are separate legal entities from their owners and are subject to corporate income tax. The information provided on this form helps the IRS assess the corporation's tax liability for the year.

Steps to Complete the Form 1120

Completing the Form 1120 involves several key steps to ensure accuracy and compliance with IRS regulations. Here’s a general outline:

- Gather financial records, including income statements, balance sheets, and expense reports.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income in the appropriate sections, detailing gross receipts and other income sources.

- Deduct allowable expenses, such as salaries, rent, and utilities, to determine taxable income.

- Calculate tax liability based on the applicable corporate tax rate.

- Complete any additional schedules or forms required for specific deductions or credits.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

The deadline for filing Form 1120 typically falls on the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can request a six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Key Elements of the Form 1120

Understanding the key elements of Form 1120 is crucial for accurate completion. Important sections include:

- Income Section: Reports total income, including gross receipts and other income sources.

- Deductions Section: Lists business expenses that can be deducted from total income.

- Tax Computation: Calculates the corporation's tax liability based on taxable income.

- Signature Section: Requires an authorized person to sign and date the form, certifying its accuracy.

Legal Use of the Form 1120

Form 1120 is legally binding when completed correctly and submitted to the IRS. It must be signed by an authorized officer of the corporation. The information provided must be truthful and accurate, as any discrepancies can lead to audits or penalties. Corporations are encouraged to maintain records that support the figures reported on the form for at least three years, as the IRS may request documentation during an audit.

Digital vs. Paper Version

Corporations have the option to file Form 1120 either electronically or via paper submission. E-filing is generally faster, more secure, and allows for immediate confirmation of receipt by the IRS. The digital version often includes built-in error-checking features, reducing the likelihood of mistakes. However, some corporations may prefer to file a paper version for record-keeping purposes or due to specific preferences regarding document handling.

Quick guide on how to complete form1120pdf 1120 us corporation income tax return form department

Complete Form1120 pdf 1120 U S Corporation Income Tax Return Form Department effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents swiftly without obstacles. Manage Form1120 pdf 1120 U S Corporation Income Tax Return Form Department on any device using airSlate SignNow's Android or iOS applications and streamline any document-based workflow today.

How to change and eSign Form1120 pdf 1120 U S Corporation Income Tax Return Form Department with ease

- Obtain Form1120 pdf 1120 U S Corporation Income Tax Return Form Department and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this task.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form1120 pdf 1120 U S Corporation Income Tax Return Form Department and ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form1120pdf 1120 us corporation income tax return form department

Create this form in 5 minutes!

People also ask

-

What is form 1120 and why is it important for businesses?

Form 1120 is the U.S. Corporation Income Tax Return that corporations must file annually. It is crucial for businesses as it reports income, gains, losses, deductions, and credits, determining the tax liabilities of corporations. Completing form 1120 accurately can signNowly impact a business's financial standing and tax responsibilities.

-

How can airSlate SignNow help with filling out form 1120?

AirSlate SignNow offers a streamlined way to prepare and eSign form 1120 by providing templates and intuitive editing tools. With features that facilitate collaboration, users can easily gather necessary signatures and ensure compliance. This simplifies the process, saving time and reducing errors, leading to successful tax filing.

-

What features does airSlate SignNow provide for handling form 1120?

AirSlate SignNow includes features such as customizable templates, eSignature capabilities, document tracking, and integration with various applications. These features allow users to efficiently manage form 1120 and related documents. With a user-friendly interface, businesses can navigate the tax filing process effortlessly.

-

Is there a free trial available for airSlate SignNow's eSigning solution for form 1120?

Yes, airSlate SignNow offers a free trial that allows users to explore its features for managing form 1120 without any upfront cost. During this trial, businesses can test document preparation, eSigning, and collaboration tools. This offers a risk-free opportunity to see how airSlate SignNow can streamline their tax filing processes.

-

What are the pricing plans for using airSlate SignNow for form 1120?

AirSlate SignNow offers various pricing plans tailored to different business needs, enabling efficient handling of form 1120. Plans are designed to be budget-friendly while providing necessary features for intuitive document management. Prospective customers can choose from monthly or annual subscriptions based on their requirements.

-

Can form 1120 be integrated with other software using airSlate SignNow?

Absolutely, airSlate SignNow provides seamless integrations with popular business applications such as Google Drive, Salesforce, and others, aiding in the handling of form 1120. These integrations streamline workflows, allowing users to access and manage documents from different platforms effortlessly. Enhancing connectivity can signNowly improve productivity during tax preparation.

-

What are the benefits of using airSlate SignNow for form 1120 preparation?

Using airSlate SignNow for form 1120 preparation offers numerous benefits including increased efficiency, reduced paperwork, and enhanced security for sensitive information. The easy-to-use interface helps to minimize errors, and eSigning features expedite approval processes. This comprehensive solution ensures a worry-free tax filing experience for businesses.

Get more for Form1120 pdf 1120 U S Corporation Income Tax Return Form Department

- Roofing contract for contractor oklahoma form

- Electrical contract for contractor oklahoma form

- Sheetrock drywall contract for contractor oklahoma form

- Flooring contract for contractor oklahoma form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract oklahoma form

- Notice of intent to enforce forfeiture provisions of contact for deed oklahoma form

- Final notice of forfeiture and request to vacate property under contract for deed oklahoma form

- Buyers request for accounting from seller under contract for deed oklahoma form

Find out other Form1120 pdf 1120 U S Corporation Income Tax Return Form Department

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online