Form 1120 2016

What is the Form 1120

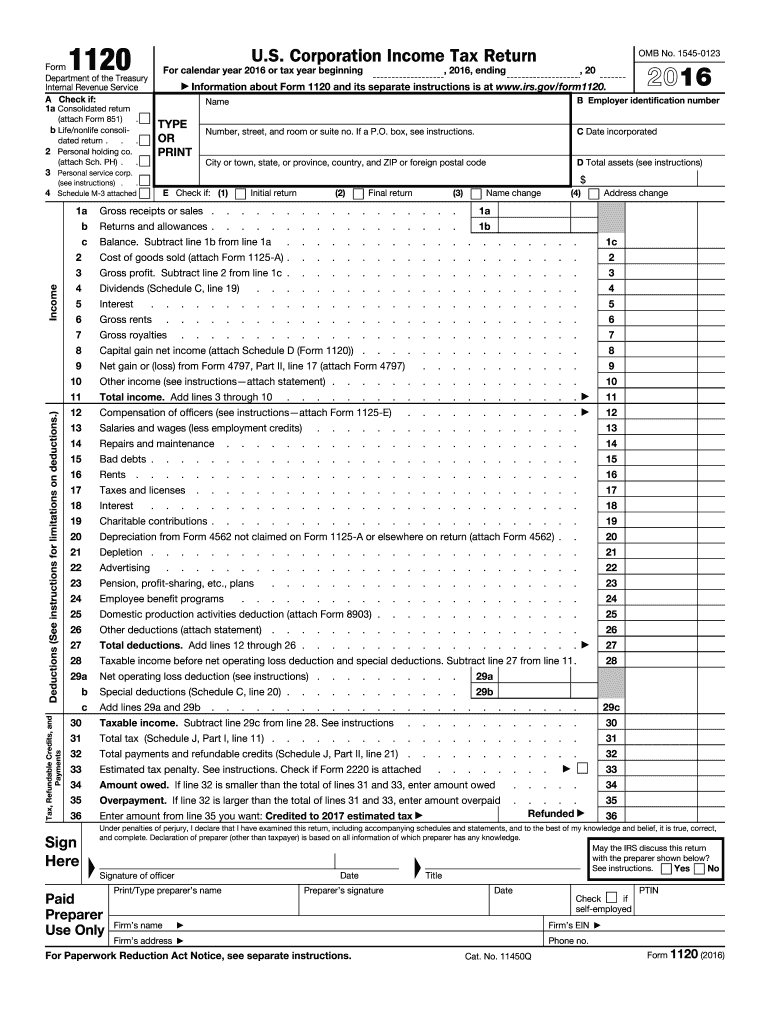

The Form 1120 is the U.S. Corporation Income Tax Return, a crucial document that corporations use to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is specifically designed for C corporations, which are separate legal entities from their owners. Completing the Form 1120 accurately is essential for ensuring compliance with federal tax laws and for determining the corporation's tax liability.

How to use the Form 1120

Using the Form 1120 involves several steps. First, corporations must gather all necessary financial information, including income statements and balance sheets. Next, they fill out the form, detailing their income, deductions, and credits. It's important to ensure that all figures are accurate and that the form is signed by an authorized officer of the corporation. Once completed, the form must be submitted to the IRS by the required deadline to avoid penalties.

Steps to complete the Form 1120

Completing the Form 1120 requires careful attention to detail. Here are the essential steps:

- Gather financial records, including income, expenses, and tax documents.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income in the appropriate sections, including gross receipts and other income sources.

- Detail deductions, including operating expenses, salaries, and benefits.

- Calculate taxable income by subtracting total deductions from total income.

- Complete the tax computation section to determine the total tax owed.

- Review the form for accuracy and ensure it is signed by an authorized individual.

Legal use of the Form 1120

The legal use of the Form 1120 is governed by IRS regulations. Corporations must file this form annually to report their income and pay taxes accordingly. Failure to file or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes. It is essential for corporations to maintain accurate records and ensure compliance with all applicable tax laws to avoid legal issues.

Filing Deadlines / Important Dates

The filing deadline for Form 1120 is typically the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations can also request a six-month extension to file, but this does not extend the time to pay any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Corporations can submit the Form 1120 through various methods. The IRS allows electronic filing, which is often the quickest and most efficient way to submit the form. Alternatively, corporations can mail a paper copy of the form to the appropriate IRS address based on their location. In-person submission is generally not available, as the IRS encourages electronic filing for faster processing.

Quick guide on how to complete 2016 form 1120 395033455

Effortlessly Prepare Form 1120 on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and electronically sign your documents quickly without delays. Manage Form 1120 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign Form 1120 with Ease

- Locate Form 1120 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1120 and ensure effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1120 395033455

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1120 395033455

How to generate an electronic signature for your 2016 Form 1120 395033455 in the online mode

How to create an eSignature for your 2016 Form 1120 395033455 in Google Chrome

How to make an electronic signature for putting it on the 2016 Form 1120 395033455 in Gmail

How to generate an eSignature for the 2016 Form 1120 395033455 from your smartphone

How to generate an electronic signature for the 2016 Form 1120 395033455 on iOS devices

How to generate an eSignature for the 2016 Form 1120 395033455 on Android

People also ask

-

What is Form 1120 and who needs it?

Form 1120 is the U.S. Corporation Income Tax Return that corporations must file to report their income, gains, losses, deductions, and credits. Businesses that operate as C Corporations are required to complete this form annually. Understanding how to accurately fill out Form 1120 is essential for compliance with IRS regulations.

-

How can airSlate SignNow help with Form 1120 submissions?

airSlate SignNow simplifies the process of preparing and submitting Form 1120 by allowing businesses to digitally eSign and send documents securely. This cost-effective solution enhances workflow efficiency and ensures that all necessary signatures are obtained quickly. By using airSlate SignNow for Form 1120, you can streamline your document management process.

-

What features does airSlate SignNow offer for handling Form 1120?

airSlate SignNow offers a range of features tailored for Form 1120 management, including eSignature capabilities, secure cloud storage, and customizable templates. These features make it easy to manage your corporate tax documents efficiently. With airSlate SignNow, you can ensure your Form 1120 is handled with precision and speed.

-

Is airSlate SignNow affordable for small businesses needing to file Form 1120?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to file Form 1120. Our pricing plans are designed to fit various budgets while offering comprehensive features that simplify the eSigning process. This makes it accessible for any business, regardless of size.

-

Can I integrate airSlate SignNow with other software for Form 1120 processing?

Absolutely! airSlate SignNow integrates seamlessly with a variety of accounting and tax software to help streamline the Form 1120 preparation process. These integrations allow for automatic data import and management, enhancing your overall productivity and ensuring accuracy in your tax filings.

-

What are the benefits of using airSlate SignNow for eSigning Form 1120?

Using airSlate SignNow for eSigning Form 1120 provides numerous benefits including faster turnaround times, enhanced security for sensitive documents, and improved tracking of signatures. This allows businesses to focus on their core operations while ensuring compliance with tax regulations. Moreover, it reduces the need for paper, contributing to a greener environment.

-

Can I track the status of my Form 1120 submissions in airSlate SignNow?

Yes, airSlate SignNow offers tracking capabilities that allow you to monitor the status of your Form 1120 submissions in real-time. You will receive notifications when documents are viewed, signed, or completed, providing you with peace of mind and ensuring you never miss a deadline. This feature enhances transparency in your document workflow.

Get more for Form 1120

Find out other Form 1120

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT