Form 1120 1995

What is the Form 1120

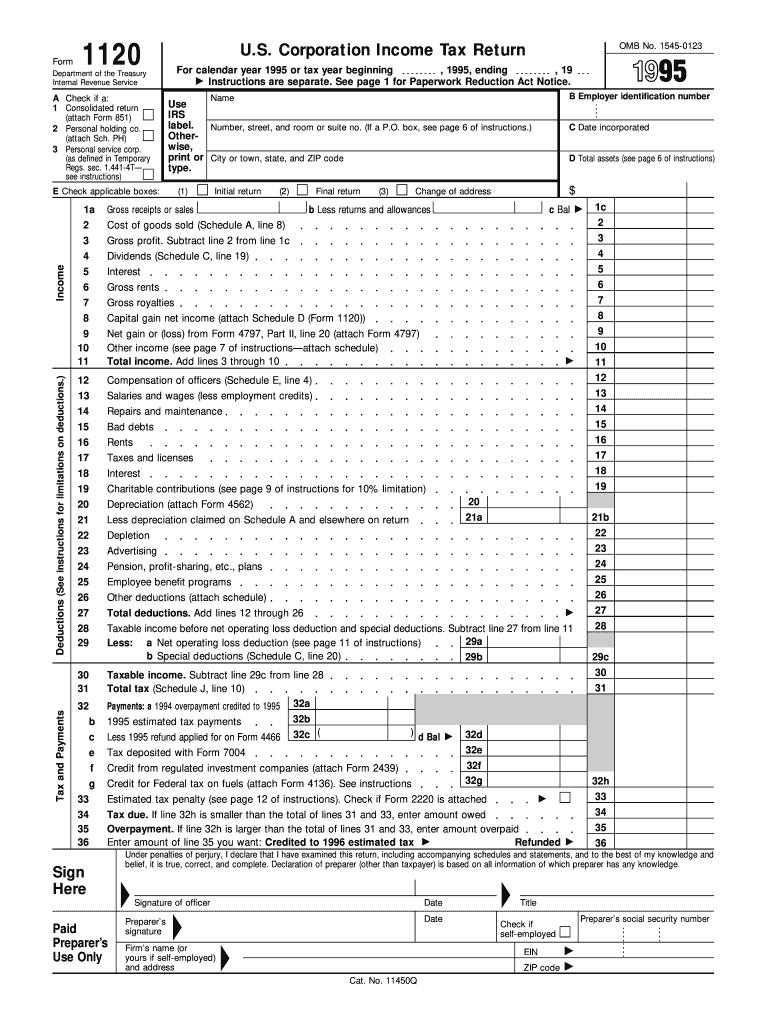

The Form 1120 is the U.S. Corporation Income Tax Return, which corporations use to report their income, gains, losses, deductions, and credits. This form is essential for C corporations that operate in the United States, as it provides the Internal Revenue Service (IRS) with a comprehensive overview of the corporation's financial activities for the tax year. The Form 1120 is typically due on the fifteenth day of the fourth month following the end of the corporation's tax year, and it is crucial for ensuring compliance with federal tax regulations.

How to use the Form 1120

To effectively use the Form 1120, corporations must gather all necessary financial information, including income statements, balance sheets, and any relevant deductions or credits. The form requires detailed reporting of various income sources and expenses, which helps determine the corporation's taxable income. It is important to accurately complete each section, as errors can lead to penalties or delays in processing. Corporations may choose to file the form electronically or by mail, depending on their preferences and the size of the business.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps:

- Gather all financial documents, including income statements and expense records.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including gross receipts and any other income sources.

- Detail allowable deductions, such as salaries, rent, and other business expenses.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the tax computation section to determine the amount of tax owed.

- Sign and date the form before submission.

Legal use of the Form 1120

The legal use of the Form 1120 is governed by IRS regulations, which require accurate reporting of a corporation's financial activities. To ensure compliance, corporations must adhere to the guidelines set forth by the IRS, including proper documentation of income and expenses. Filing the form correctly is essential to avoid potential audits or penalties. Additionally, electronic submissions must comply with the eSignature regulations to ensure that the form is legally binding.

Filing Deadlines / Important Dates

The filing deadline for the Form 1120 is the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations that operate on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations may also apply for an automatic six-month extension, allowing additional time to file, but any taxes owed must still be paid by the original due date to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the Form 1120. The form can be filed electronically through the IRS e-file system, which is often the fastest method for processing. Alternatively, corporations may choose to mail a paper version of the form to the appropriate IRS address based on their location. In-person submissions are generally not available for tax forms. It is important to retain a copy of the submitted form and any supporting documents for record-keeping purposes.

Quick guide on how to complete 1995 form 1120

Effortlessly Complete Form 1120 on Any Device

Digital document organization has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to generate, modify, and electronically sign your documents quickly and efficiently. Manage Form 1120 seamlessly across any platform with airSlate SignNow's Android or iOS applications, and enhance any document-centric process today.

How to Edit and Electronically Sign Form 1120 with Ease

- Locate Form 1120 and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1120 while ensuring superior communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1995 form 1120

Create this form in 5 minutes!

How to create an eSignature for the 1995 form 1120

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is Form 1120 and why is it important for businesses?

Form 1120 is the U.S. Corporation Income Tax Return that corporate taxpayers must file with the IRS. It is crucial for businesses as it reports income, deductions, and tax liability. Properly managing Form 1120 ensures compliance with tax regulations and helps avoid penalties.

-

How can airSlate SignNow help with eSigning Form 1120?

airSlate SignNow allows businesses to easily eSign Form 1120, streamlining the filing process. With its user-friendly interface, you can quickly add signatures, dates, and necessary annotations. This feature ensures that your Form 1120 is completed accurately and submitted on time.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans to suit different business needs, including options for solo entrepreneurs and large enterprises. Each plan includes essential features for managing documents like Form 1120, allowing you to select the best value for your requirements. Visit the pricing page to explore all available options.

-

What features does airSlate SignNow offer for Form 1120 management?

AirSlate SignNow provides features such as document templates, real-time collaboration, and a secure eSignature process for Form 1120. These tools enhance efficiency and accuracy, allowing multiple team members to contribute seamlessly. Additionally, tracking and storage options ensure your completed forms are accessible when needed.

-

Is airSlate SignNow compliant with IRS requirements for Form 1120?

Yes, airSlate SignNow ensures compliance with IRS eSignature standards, meeting the requirements for filing Form 1120 electronically. This guarantees that your submitted documents are legally recognized, reducing the risk of disputes with regulatory bodies. Using airSlate SignNow gives you peace of mind regarding compliance.

-

Can I integrate airSlate SignNow with other software for Form 1120 preparation?

Absolutely, airSlate SignNow integrates seamlessly with various accounting and document management tools to facilitate Form 1120 preparation. This flexibility allows you to import necessary data easily, manage workflows, and enhance productivity. Integration saves time and helps maintain accuracy in your filing process.

-

What are the benefits of using airSlate SignNow for filing Form 1120?

Utilizing airSlate SignNow for filing Form 1120 offers numerous benefits, such as increased efficiency, streamlined workflows, and reduced paperwork. The platform's automation features minimize errors and speed up the signing process. This ultimately allows businesses to focus on core operations rather than administrative tasks.

Get more for Form 1120

- Fax cover sheet greenwood physical therapy form

- The new postacute care payment systems 5 tips to help form

- Send copy of form to the person who fill out the form jotform

- To a third year student cu anschutz form

- Co prescription drug rior authorization request form

- Blood therapeutic phlebotomy form

- Critical claim form

- Calgary lab services form

Find out other Form 1120

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT