Form 1120 2012

What is the Form 1120

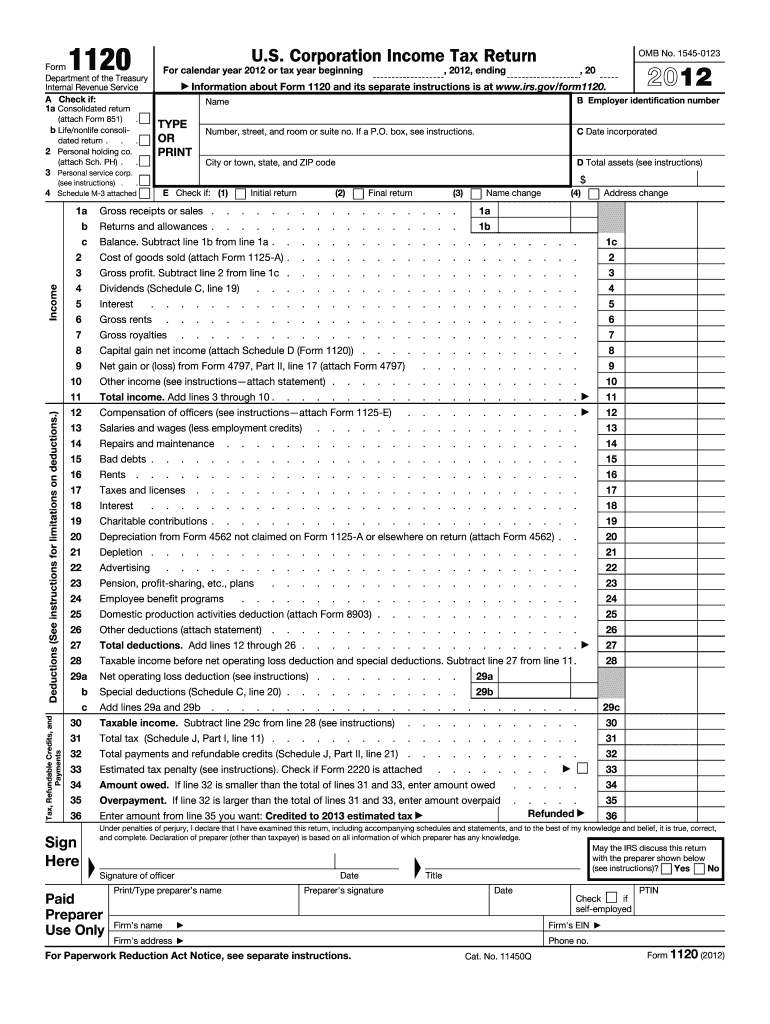

The Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners, and it allows them to calculate their tax liability based on their net income. The form must be filed annually with the Internal Revenue Service (IRS) and provides a comprehensive overview of a corporation's financial activities for the tax year.

How to use the Form 1120

To effectively use the Form 1120, a corporation must first gather all necessary financial records, including income statements, balance sheets, and any relevant documentation of deductions or credits. The form consists of various sections that require detailed information about the corporation's income and expenses. Each section must be completed accurately to ensure compliance with IRS regulations. After filling out the form, it should be reviewed for accuracy before submission.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps:

- Gather financial documents, including income statements and expense records.

- Fill out the identification section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including sales and other revenue sources.

- Deduct allowable expenses, such as salaries, rent, and utilities, to calculate taxable income.

- Claim any applicable tax credits.

- Sign and date the form, ensuring that it is submitted by the due date.

Legal use of the Form 1120

The Form 1120 is legally binding when filed correctly and on time. Corporations must adhere to IRS guidelines regarding the accuracy of the information provided. Failure to comply with these requirements can result in penalties, including fines or additional taxes owed. It is crucial for corporations to maintain proper records and ensure that all claims made on the form are substantiated by appropriate documentation.

Filing Deadlines / Important Dates

The filing deadline for Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also apply for an automatic six-month extension, but this does not extend the time to pay any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Corporations can submit the Form 1120 through various methods. The form can be filed electronically using IRS-approved e-filing software, which is often the fastest and most efficient method. Alternatively, corporations may choose to mail a paper copy of the completed form to the appropriate IRS address based on their location. In-person submissions are generally not available, but certain tax assistance centers may provide support for filing.

Penalties for Non-Compliance

Failure to file the Form 1120 on time or inaccuracies in reporting can lead to significant penalties. The IRS may impose a penalty for late filing, which is typically a percentage of the unpaid tax for each month the return is late. Additionally, inaccuracies can result in penalties for underpayment of taxes. It is essential for corporations to file accurately and on time to avoid these potential consequences.

Quick guide on how to complete 2012 form 1120

Effortlessly Prepare Form 1120 on Any Device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Form 1120 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to Modify and Electronically Sign Form 1120 with Ease

- Find Form 1120 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to preserve your edits.

- Select your preferred method to share your form, either via email, SMS, or link invitation, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your needs in document management in just a few clicks from your chosen device. Modify and electronically sign Form 1120 and guarantee effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 1120

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 1120

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is Form 1120 and why is it important for my business?

Form 1120 is the U.S. Corporation Income Tax Return, crucial for C corporations to report their income, gains, losses, and deductions. Filing this form accurately helps ensure compliance with tax regulations and avoid penalties. Understanding your tax responsibilities related to Form 1120 can lead to efficient tax management for your business.

-

How can airSlate SignNow simplify the process of signing Form 1120?

airSlate SignNow provides a seamless solution for electronically signing Form 1120, allowing your business to expedite the submission process. With easy document sharing and tracking features, you can ensure all necessary signatures are collected efficiently. This helps you stay compliant and meet tax deadlines without the hassle of traditional paper methods.

-

Is there a cost associated with using airSlate SignNow for Form 1120?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs, making it a cost-effective solution for handling Form 1120. Pricing depends on the number of users and features required, such as advanced integrations and additional storage. Overall, utilizing airSlate SignNow can save you time and expense in document management.

-

What features does airSlate SignNow offer for managing Form 1120 documents?

airSlate SignNow includes advanced features such as template creation, in-document chat, and automated reminders to streamline the Form 1120 signing process. You can customize workflows and set permissions to control document access, ensuring sensitive information remains secure. These features enhance collaboration and efficiency in completing your tax documentation.

-

Can I integrate airSlate SignNow with other tools for Form 1120 processing?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of business tools and applications, improving the workflow for processing Form 1120. Popular integrations include CRMs, cloud storage services, and project management tools, enabling you to bridge workflows and eliminate redundancy. This streamlines your entire documentation process.

-

How secure is airSlate SignNow when handling sensitive information like Form 1120?

Security is a top priority at airSlate SignNow; we employ advanced encryption methods to protect your Form 1120 documents. Additionally, compliant with industry standards, our platform offers features like two-factor authentication and audit trails. This ensures that your sensitive information is safeguarded against unauthorized access.

-

Can airSlate SignNow assist with tracking the submission status of Form 1120?

Yes, one of the beneficial features of airSlate SignNow is its ability to track the status of your Form 1120 submissions. You receive real-time notifications when documents are viewed and signed, allowing you to manage deadlines effectively. With this feature, you can keep all stakeholders informed about the submission process.

Get more for Form 1120

- Deus ex the fall cheat codesanynywuxazas scoopit form

- The collaborative for children and families health home ccf form

- Direct disbursements of 50000 and above will require a notary seal or signature guarantee form

- Prior authorization benefit form

- Laboratory suppy request bformb rochestergeneral

- Physical examination form oregongov

- Medical abstract form

- Nys form sny9457

Find out other Form 1120

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast