Form 1120 U S Corporation Income Tax Return 2023

What is the Form 1120 U S Corporation Income Tax Return

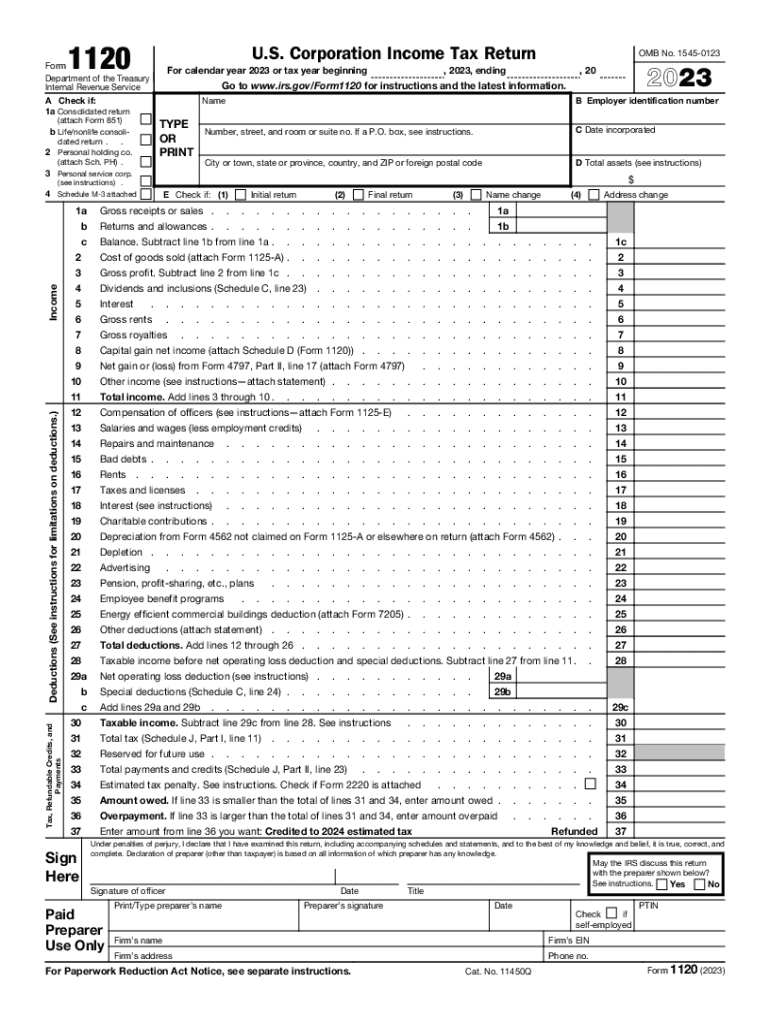

The Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations operating in the United States, as it determines the tax liability of the corporation. Corporations must file Form 1120 annually, regardless of whether they owe taxes or not. It is important to note that the form is specifically designed for C corporations, which are taxed separately from their owners.

Steps to complete the Form 1120 U S Corporation Income Tax Return

Completing Form 1120 involves several key steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements, balance sheets, and previous tax returns.

- Fill Out Basic Information: Enter the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report Income: Complete the income section by detailing gross receipts, dividends, and any other income sources.

- Calculate Deductions: List allowable deductions, such as salaries, rent, and interest expenses, to reduce taxable income.

- Determine Tax Liability: Use the tax tables provided by the IRS to calculate the corporation's tax based on the taxable income.

- Sign and Date the Form: Ensure that the form is signed by an authorized officer of the corporation.

How to obtain the Form 1120 U S Corporation Income Tax Return

The Form 1120 can be obtained directly from the IRS website or through a tax professional. It is available in a printable format, allowing businesses to fill it out manually. Additionally, many tax software programs also include the Form 1120, making it easier for corporations to complete and file electronically. For those who prefer a fillable version, the IRS provides an interactive PDF that can be filled out digitally before printing.

Filing Deadlines / Important Dates

Corporations must file Form 1120 by the 15th day of the fourth month following the end of their tax year. For most corporations with a calendar year-end, this means the deadline is April 15. If the corporation requires additional time, it can file for an automatic six-month extension using Form 7004, which must be submitted by the original due date of Form 1120. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting Form 1120. They can file electronically through the IRS e-file system, which is the preferred method as it speeds up processing times and provides immediate confirmation of receipt. Alternatively, corporations may choose to mail the completed form to the appropriate IRS address based on their location. In-person submission is generally not available for Form 1120, as the IRS encourages electronic filing for efficiency.

Key elements of the Form 1120 U S Corporation Income Tax Return

Form 1120 consists of several key sections that must be completed accurately:

- Income Section: Reports total income and any adjustments.

- Deductions Section: Lists all allowable deductions to determine taxable income.

- Tax Computation: Calculates the tax owed based on taxable income.

- Payments Section: Details any estimated tax payments made during the year.

- Signature Section: Requires the signature of an authorized corporate officer.

Quick guide on how to complete form 1120 u s corporation income tax return 705460544

Complete Form 1120 U S Corporation Income Tax Return effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Form 1120 U S Corporation Income Tax Return on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 1120 U S Corporation Income Tax Return with ease

- Locate Form 1120 U S Corporation Income Tax Return and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight signNow portions of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Verify the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow efficiently addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1120 U S Corporation Income Tax Return and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 u s corporation income tax return 705460544

Create this form in 5 minutes!

How to create an eSignature for the form 1120 u s corporation income tax return 705460544

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1120 and why is it important for businesses?

Form 1120 is the U.S. Corporation Income Tax Return that corporations must file with the IRS. It is important because it reports a corporation's income, gains, losses, deductions, and credits, ensuring compliance with tax regulations. Using airSlate SignNow can streamline the process of preparing and submitting your form 1120, making it simpler and more efficient.

-

How can airSlate SignNow assist in filling out form 1120?

airSlate SignNow provides an easy-to-use platform for electronically managing form 1120. With features like templates and automated workflows, users can fill out the form accurately and efficiently. This can reduce errors and help ensure that all required information is included before submission.

-

Are there any costs associated with using airSlate SignNow for form 1120?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including support for filling out form 1120. The cost-effective solutions provided can save businesses time and resources when managing their documentation processes, including tax forms.

-

What features does airSlate SignNow offer for document management related to form 1120?

airSlate SignNow includes features such as electronic signatures, document templates, and collaboration tools, which are beneficial for preparing form 1120. These features allow for faster approvals and ensure that all parties involved can easily contribute to the document efficiently.

-

Can I integrate airSlate SignNow with my accounting software for form 1120?

Absolutely! airSlate SignNow offers integrations with popular accounting software, which can help streamline the process of preparing form 1120. By syncing data between your accounting system and airSlate SignNow, you can reduce data entry errors and save valuable time.

-

Is airSlate SignNow secure for handling sensitive information on form 1120?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that sensitive information on form 1120 is protected. The platform complies with industry standards and uses encryption to ensure that your documents remain safe throughout the signing process.

-

Can I track the status of my form 1120 using airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities that allow you to monitor the status of your form 1120 in real-time. You'll be able to see who has signed the document and ensure that all necessary approvals are obtained promptly.

Get more for Form 1120 U S Corporation Income Tax Return

- Final notice of forfeiture and request to vacate property under contract for deed michigan form

- Buyers request for accounting from seller under contract for deed michigan form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed michigan form

- General notice of default for contract for deed michigan form

- Michigan seller form

- Michigan disclosure form

- Contract for deed sellers annual accounting statement michigan form

- Notice of default for past due payments in connection with contract for deed michigan form

Find out other Form 1120 U S Corporation Income Tax Return

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple