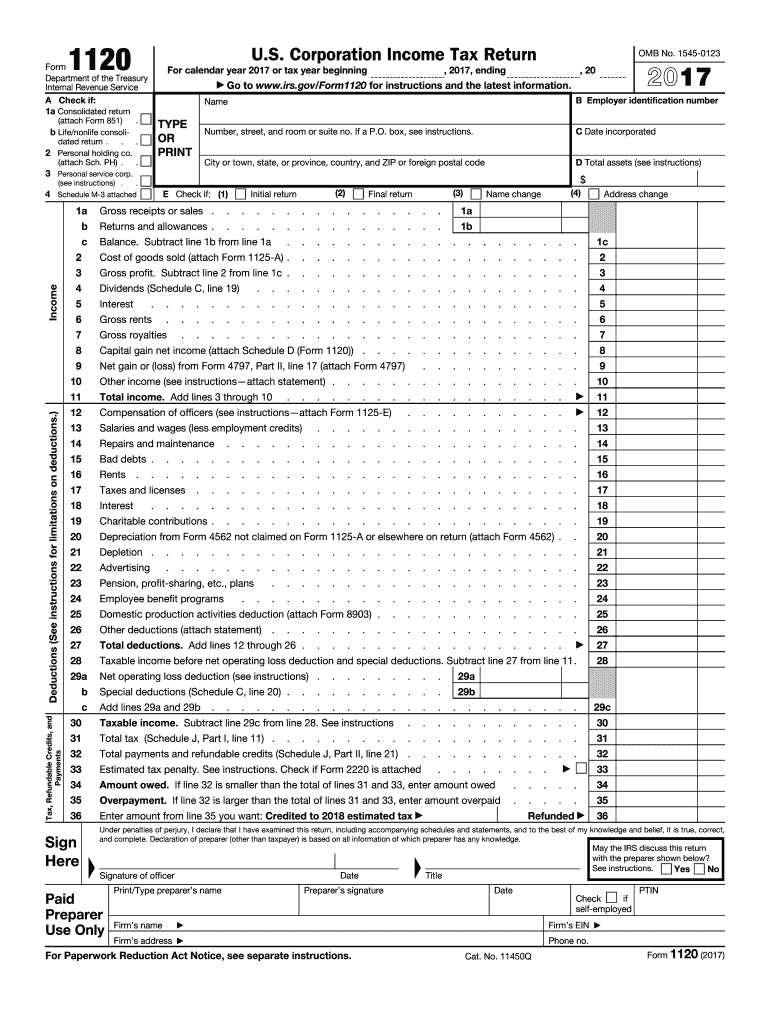

Irs Form 1120 2017

What is the IRS Form 1120

The IRS Form 1120, also known as the U.S. Corporation Income Tax Return, is a federal tax form that corporations in the United States use to report their income, gains, losses, deductions, and credits. This form is essential for any domestic corporation that is subject to income tax, regardless of whether it has taxable income or not. It provides a comprehensive overview of a corporation's financial activities and tax obligations for the year.

Steps to Complete the IRS Form 1120

Completing the IRS Form 1120 involves several key steps to ensure accuracy and compliance. Here’s a brief outline of the process:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including sales and other income sources.

- Detail allowable deductions, such as operating expenses, salaries, and interest paid.

- Calculate the corporation's tax liability based on the net income.

- Complete any additional schedules required for specific deductions or credits.

- Review the completed form for accuracy before submission.

How to Obtain the IRS Form 1120

The IRS Form 1120 can be obtained through several methods. Corporations can download the form directly from the IRS website, where it is available in PDF format. Additionally, many tax preparation software programs include the form, allowing for electronic completion and filing. Corporations may also request a paper copy by contacting the IRS directly.

Filing Deadlines / Important Dates

The filing deadline for the IRS Form 1120 is typically the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also apply for an automatic six-month extension to file, but any tax owed must still be paid by the original due date to avoid penalties.

Key Elements of the IRS Form 1120

The IRS Form 1120 consists of several key sections that must be completed accurately. These include:

- Identification information, such as the corporation's name and address.

- Income section, detailing total revenue and other income sources.

- Deductions section, where allowable expenses are reported.

- Tax computation, which calculates the amount of tax owed based on net income.

- Signature section, where an authorized officer of the corporation certifies the accuracy of the information provided.

Penalties for Non-Compliance

Failing to file the IRS Form 1120 on time or submitting an inaccurate form can result in significant penalties. The IRS may impose a failure-to-file penalty, which is based on the amount of unpaid tax and the length of time the return is late. Additionally, inaccuracies can trigger audits or further scrutiny from the IRS, leading to additional fines or interest on unpaid taxes. It is crucial for corporations to ensure timely and accurate filing to avoid these potential issues.

Quick guide on how to complete irs form 1120 2017 2018

Explore the simplest method to complete and endorse your Irs Form 1120

Are you still spending time generating your official documents on paper instead of online? airSlate SignNow offers a superior approach to fill and sign your Irs Form 1120 along with associated forms for public services. Our intelligent eSignature solution provides all that you require to handle documents efficiently while adhering to official standards - robust PDF editing, management, protection, signing, and sharing tools are readily available within a user-friendly interface.

There are just a few steps needed to fill out and endorse your Irs Form 1120:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to enter in your Irs Form 1120.

- Navigate between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill the fields with your information.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize what is truly important or Blackout sections that are no longer necessary.

- Click on Sign to generate a legally binding eSignature using any method you prefer.

- Add the Date next to your signature and finish your task with the Done button.

Store your completed Irs Form 1120 in the Documents folder in your profile, download it, or export it to your preferred cloud storage. Our solution also provides versatile file sharing options. There’s no necessity to print your forms when you’re ready to submit them to the appropriate public office - do it using email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 1120 2017 2018

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

Why can't I find the 2017 IRS form 1120?

Insufficient searching skills?Try this link. > https://www.irs.gov/pub/irs-prio...

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the irs form 1120 2017 2018

How to create an electronic signature for your Irs Form 1120 2017 2018 online

How to create an eSignature for the Irs Form 1120 2017 2018 in Google Chrome

How to make an eSignature for signing the Irs Form 1120 2017 2018 in Gmail

How to generate an eSignature for the Irs Form 1120 2017 2018 straight from your mobile device

How to create an electronic signature for the Irs Form 1120 2017 2018 on iOS devices

How to generate an electronic signature for the Irs Form 1120 2017 2018 on Android OS

People also ask

-

What is the purpose of IRS Form 1120?

IRS Form 1120 is the U.S. Corporation Income Tax Return that corporations must file annually to report income, gains, losses, deductions, and credits. This form is essential for corporations to comply with federal tax regulations and determine their tax liability. Understanding the details of IRS Form 1120 can help your business stay compliant and avoid penalties.

-

How can airSlate SignNow help with IRS Form 1120 submissions?

airSlate SignNow simplifies the process of completing and submitting IRS Form 1120 by allowing users to electronically sign and send documents seamlessly. This not only saves time but also reduces errors that can occur with paper forms. With airSlate SignNow, you can ensure that your IRS Form 1120 is filed accurately and on time.

-

Is airSlate SignNow suitable for small businesses filing IRS Form 1120?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses filing IRS Form 1120. Our solution is cost-effective and user-friendly, making it easier for small business owners to manage their documents without unnecessary complexities. With an intuitive interface, even those with minimal tech experience can navigate the signing process efficiently.

-

What features does airSlate SignNow offer for IRS Form 1120 preparation?

airSlate SignNow offers various features that enhance the preparation of IRS Form 1120, including customizable document templates, secure electronic signatures, and real-time tracking. These features ensure that all parties involved can collaborate effectively and monitor the status of the document. With airSlate SignNow, preparing your IRS Form 1120 is streamlined and secure.

-

Are there integrations available for IRS Form 1120 with airSlate SignNow?

Absolutely! airSlate SignNow integrates with popular tools like Google Drive, Microsoft Office, and CRM systems, making it easy to access and manage your IRS Form 1120 documents. These integrations enhance productivity by allowing you to work within your existing workflows while ensuring that your documents are secure and compliant. Simplifying document management for IRS Form 1120 has never been easier.

-

What are the pricing options for using airSlate SignNow for IRS Form 1120?

airSlate SignNow offers competitive pricing plans that cater to businesses with varying needs, including those focused on filing IRS Form 1120. Our plans are designed to be cost-effective, allowing you to choose the features that match your requirements. You can check our pricing page for detailed information on subscription options and any potential discounts for annual plans.

-

Can I store my IRS Form 1120 documents securely with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for your documents, including your completed IRS Form 1120. We prioritize data security with encryption and compliant storage, ensuring that your sensitive information remains protected. You can access your documents anytime, knowing that they are safe and secure.

Get more for Irs Form 1120

- 2017 m1 individual income tax return form

- Electronic wage reporting 2018 form

- Schedule ct 1040wh if 20170912indd form

- 2018 form card

- Your 2017 return and payment for the full amount of tax due must be mailed by the due date of your federal return form

- 2011 irs form 1041 schedule d 1

- Form 515 2017 2018

- Form 2210

Find out other Irs Form 1120

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free